Category

Debt

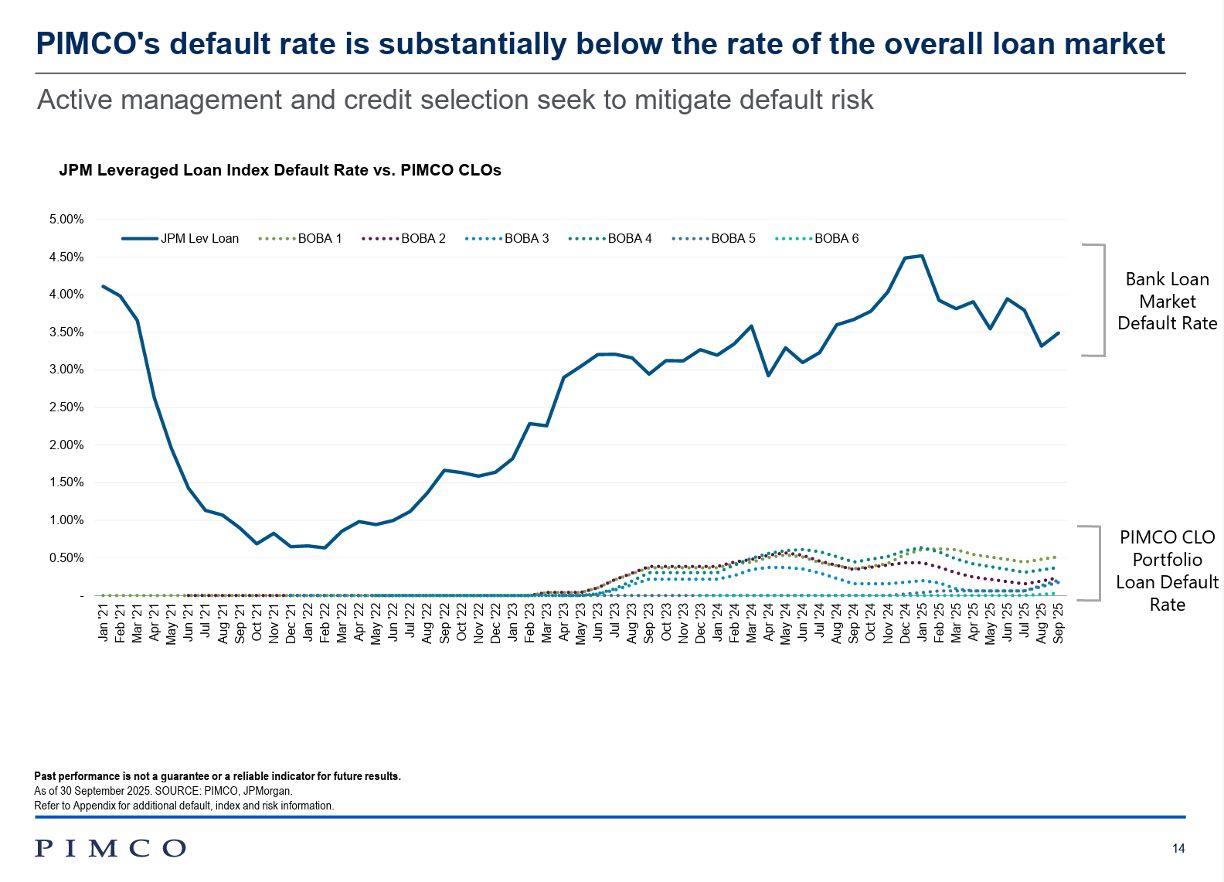

How CLO Managers Claim 15%+ Returns—and the Catch Behind It

How CLO Managers Claim 15%+ Returns—and the Catch Behind It

By CRE Analyst

December 11, 2025

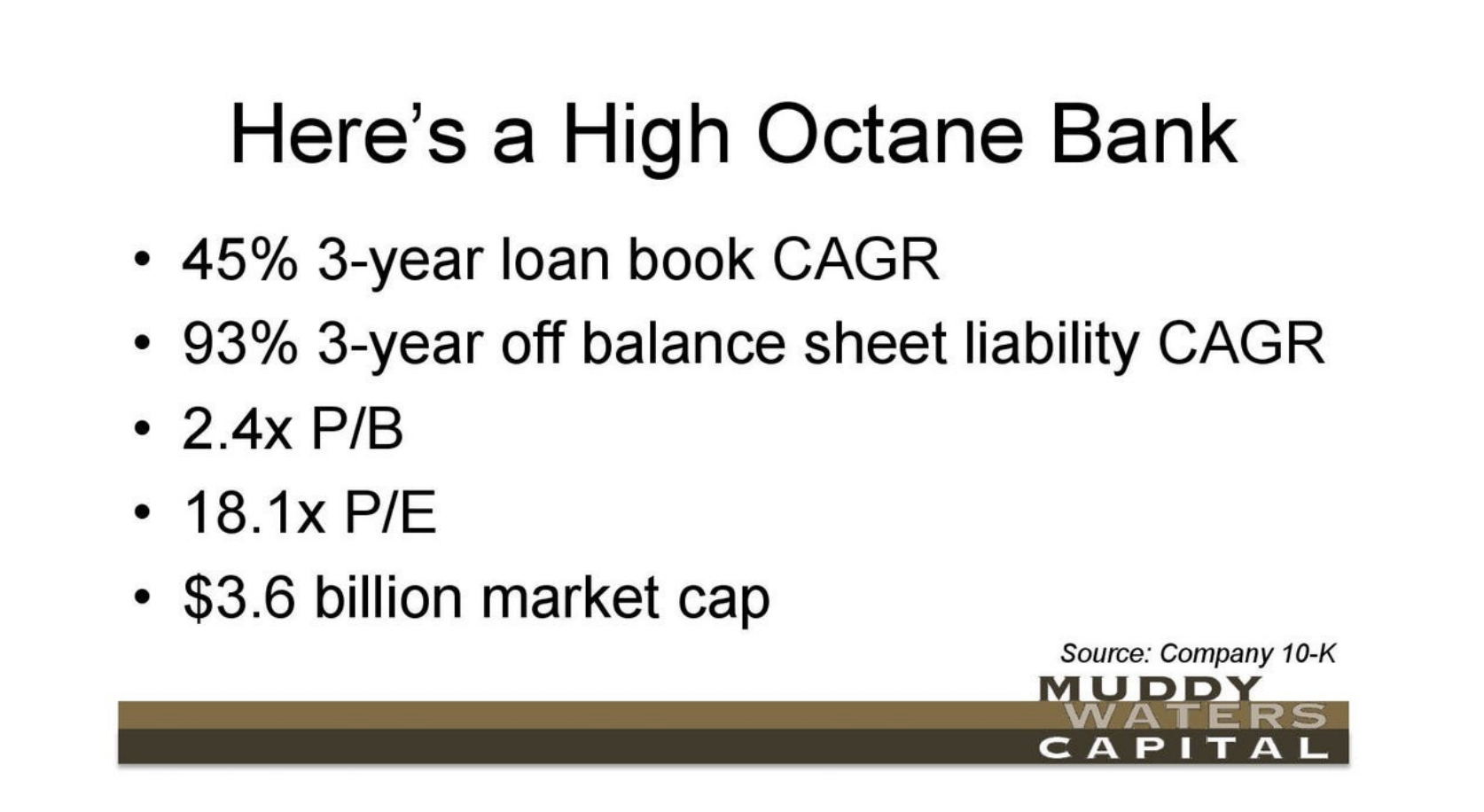

Bank OZK’s Decade of Defying CRE Doom Predictions

Bank OZK’s Decade of Defying CRE Doom Predictions

By CRE Analyst

December 8, 2025

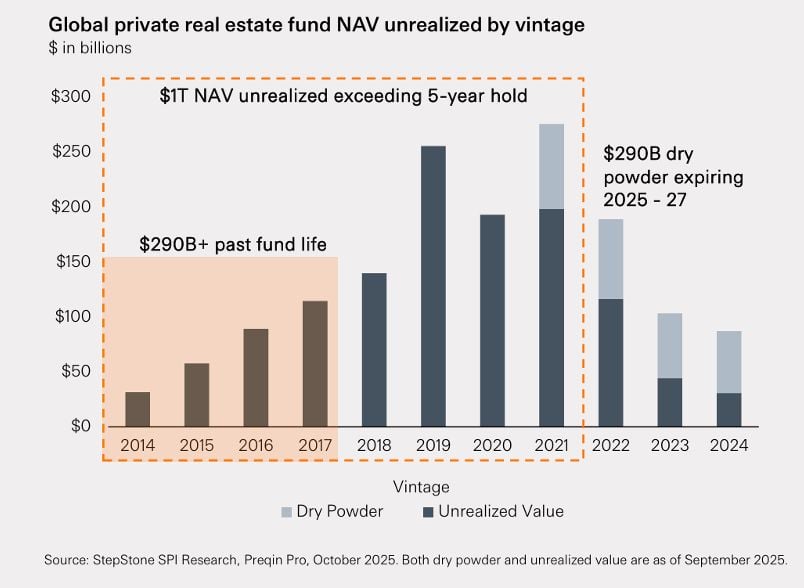

Are Closed-End Funds the Real Maturity Wall in CRE?

Are Closed-End Funds the Real Maturity Wall in CRE?

By CRE Analyst

December 5, 2025

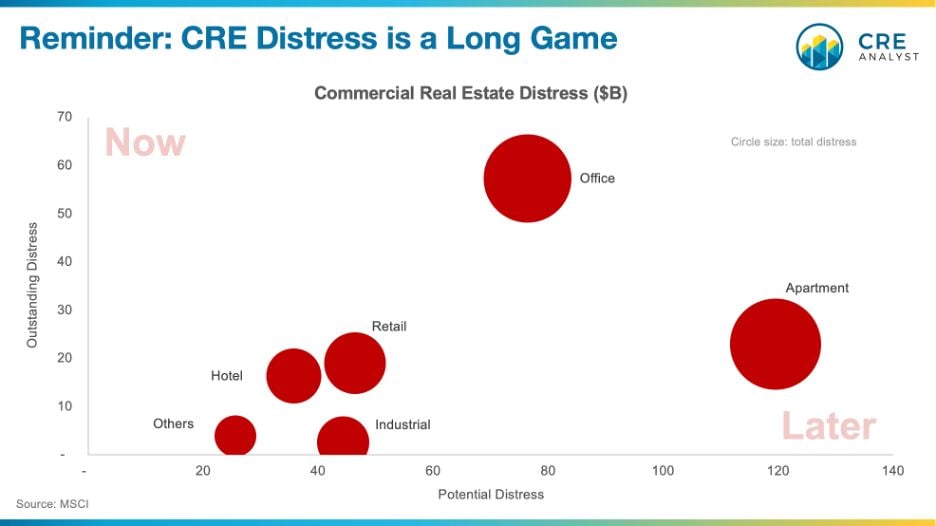

Office or Apartments: Where CRE Distress Runs Deeper

Office or Apartments: Where CRE Distress Runs Deeper

By CRE Analyst

October 14, 2025

High-Leverage Syndications: The Canary in Today’s CRE Market

High-Leverage Syndications: The Canary in Today’s CRE Market

By CRE Analyst

October 9, 2025

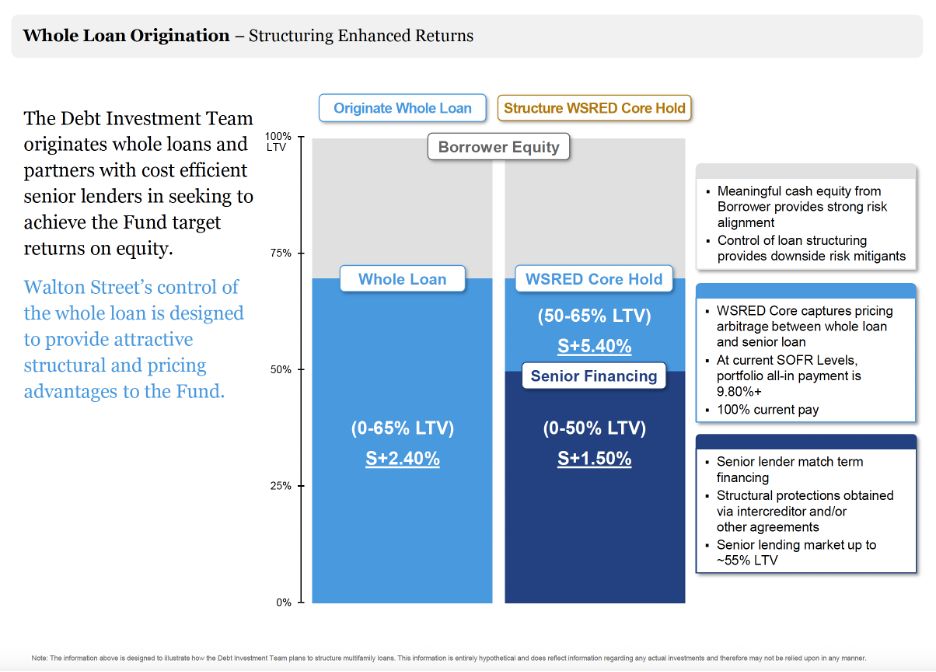

Manufacturing 10% Returns in a 4% Debt Market

Manufacturing 10% Returns in a 4% Debt Market

By CRE Analyst

October 8, 2025

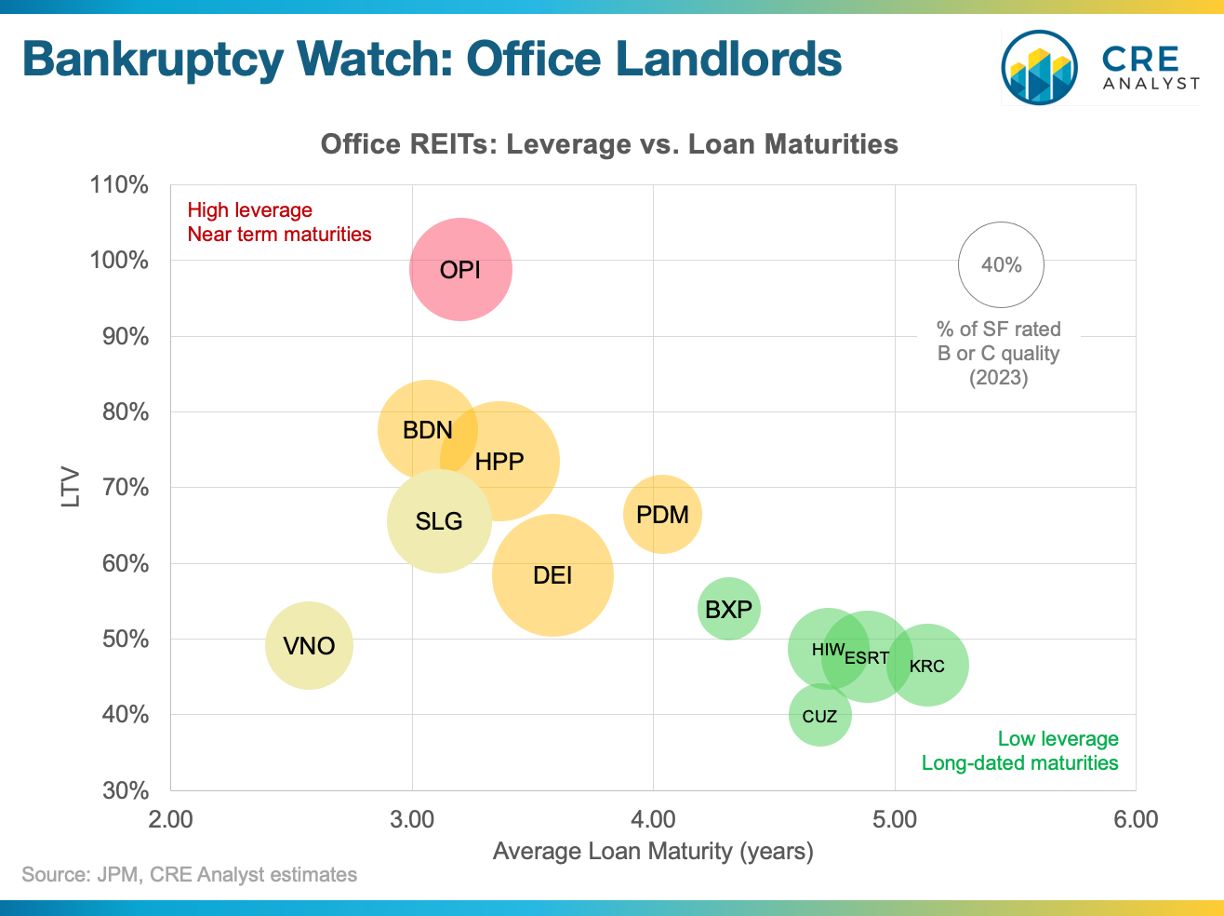

The REIT Bankruptcy Trifecta: Why Office Owners Face Rising Risk

The REIT Bankruptcy Trifecta: Why Office Owners Face Rising Risk

By CRE Analyst

September 30, 2025

Private Credit: Generational Opportunity or Looming Implosion?

Private Credit: Generational Opportunity or Looming Implosion?

By CRE Analyst

September 24, 2025

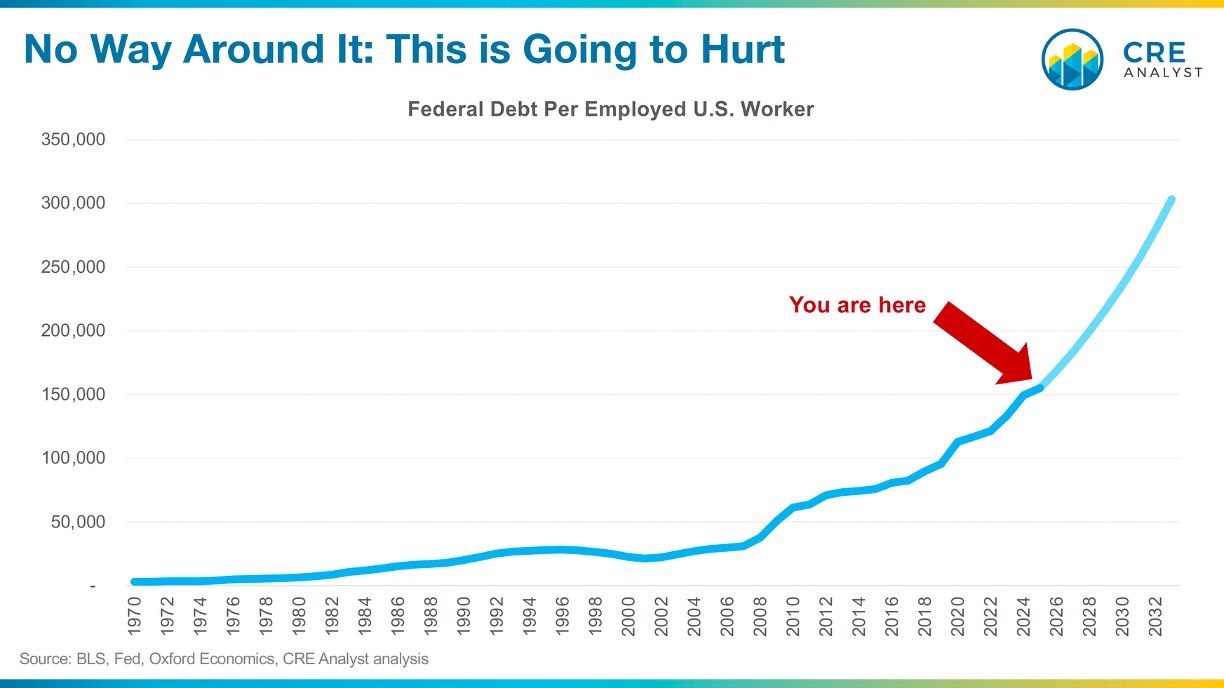

Debt Pressures, Dollar Doubts: CRE and the Reserve Currency Question

Debt Pressures, Dollar Doubts: CRE and the Reserve Currency Question

By CRE Analyst

September 24, 2025

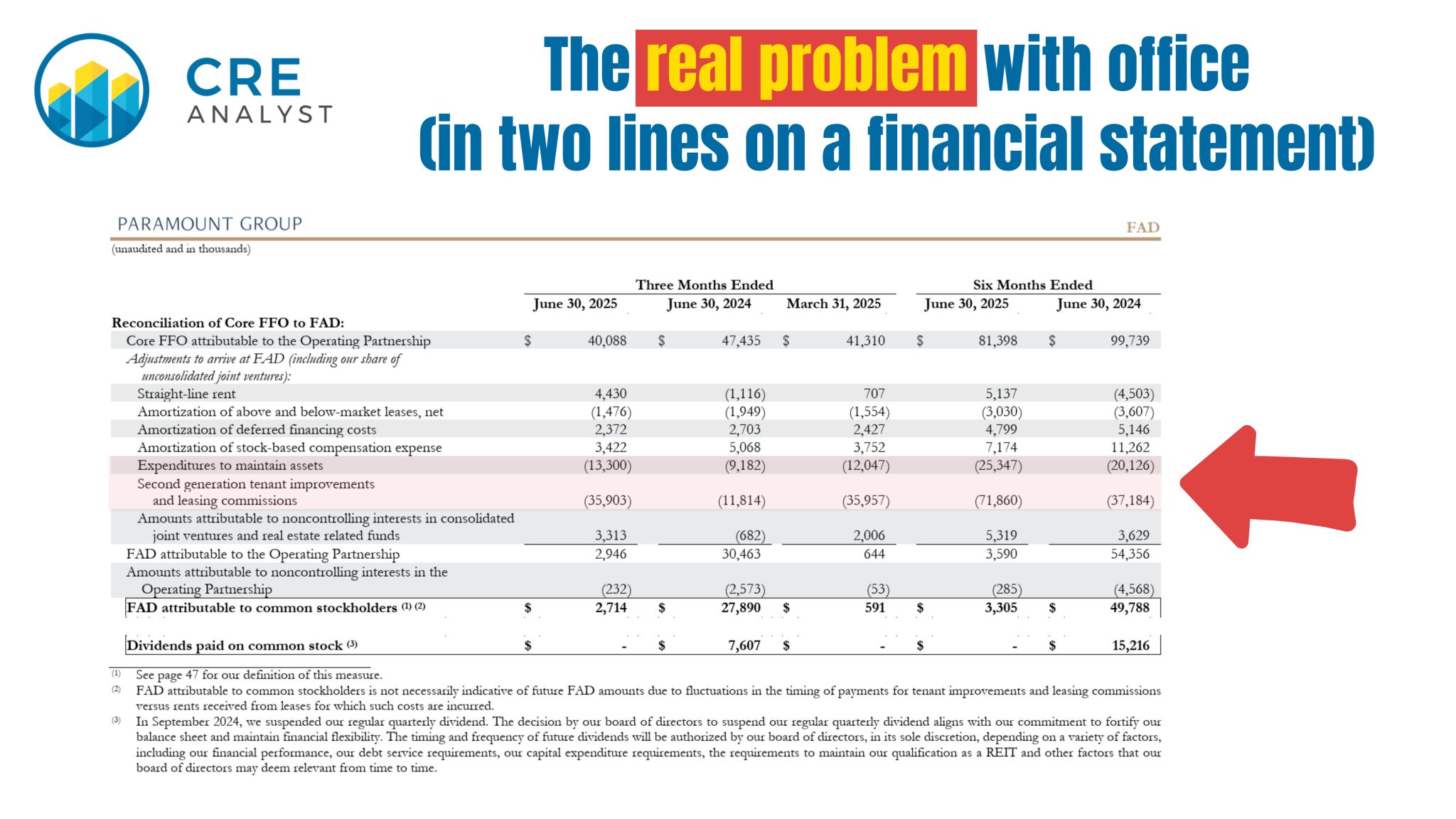

Office Real Estate’s Biggest Problem: It’s Not Occupancy, It’s Capex

Office Real Estate’s Biggest Problem: It’s Not Occupancy, It’s Capex

By CRE Analyst

September 2, 2025

Midyear CRE Update: Debt Wall, Private Credit & Multifamily Surge

Midyear CRE Update: Debt Wall, Private Credit & Multifamily Surge

By CRE Analyst

August 29, 2025

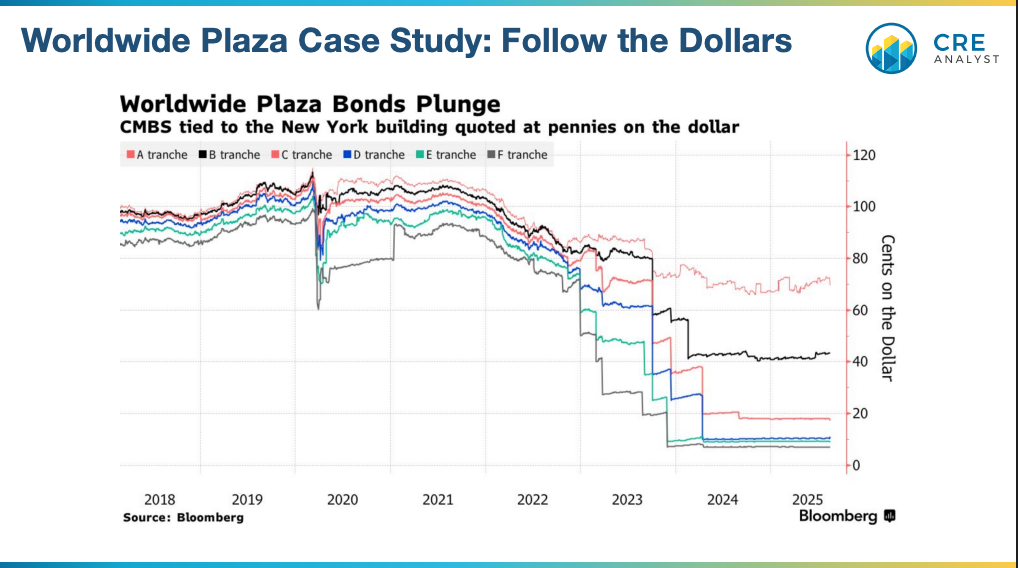

Worldwide Plaza: How a Manhattan Office Lost $1B in Value

Worldwide Plaza: How a Manhattan Office Lost $1B in Value

By CRE Analyst

August 25, 2025