"So you're the biggest bond investor in the world, pitching my pension fund on a credit play that generates 15%+ returns. How are you able to manufacture those yields? Please explain it to me like I'm seven."

---------

1. No forced selling:

Our CLOs use long-term, non-mark-to-market financing, so volatility doesn’t push us out of positions.

2. Discounted purchasing:

When the market sells off, we buy loans at discounts and build par, which strengthens the portfolio instead of hurting it.

3. Active management:

We move early when credit weakens.

4. Big team of experts:

We have a large analyst team and deep credit platform that help us spot risks before others do.

5. Diversification:

Our portfolios are diversified and built with structural protections that limit exposure to weaker credits.

6. Alignment:

We invest significant equity alongside our partners, so we manage risk the same way we would with our own capital.

7. Floating vs. floating:

Our assets and liabilities both float, which reduces interest-rate risk and helps keep performance stable.

---------

"So you're basically better at dodging credit problems than others?"

---------

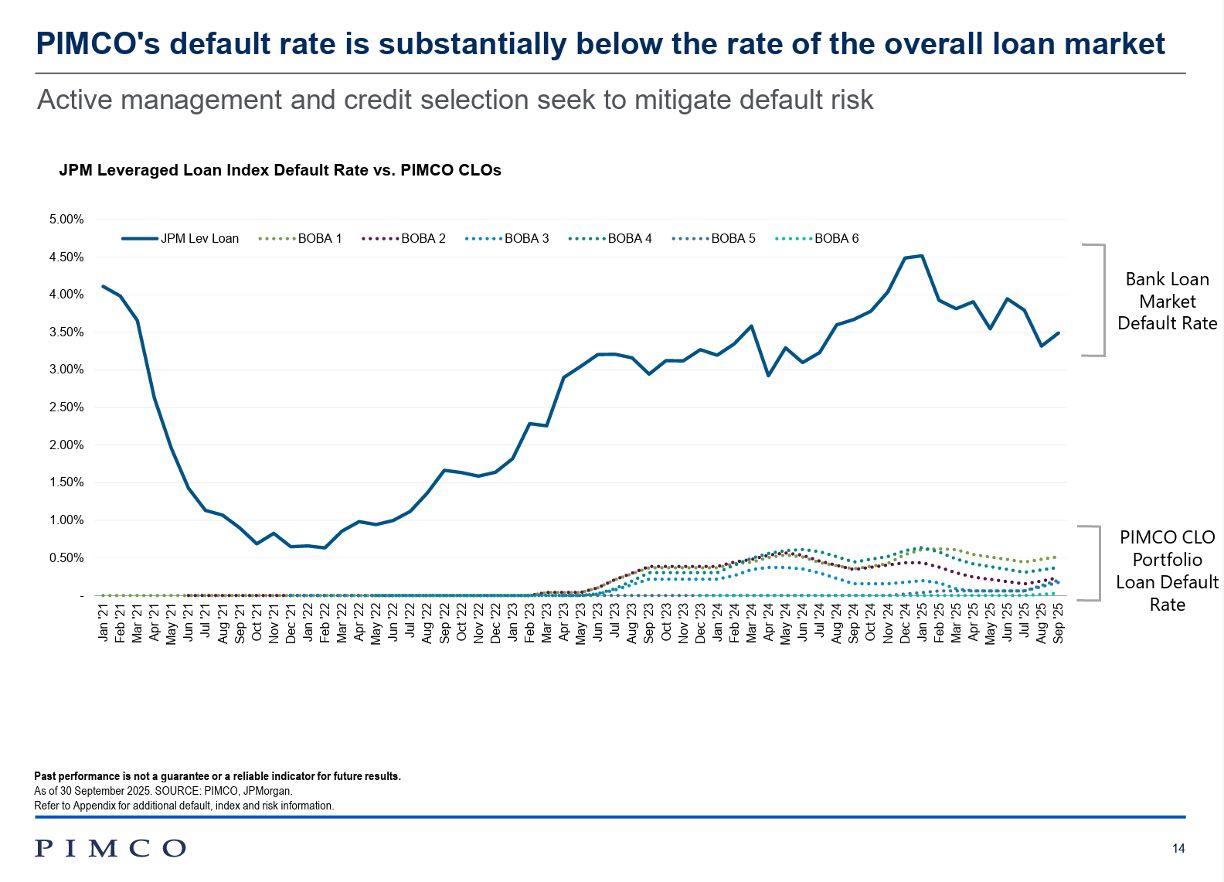

I'm so glad you asked. As this chart shows, we've far outperformed credit loss benchmarks.

---------

"But the chart only goes back to 2021."

---------

[crickets]

COMMENTS