A loaded case study: Blackstone, class B office, core plus questions...

Blackstone launched an open-end predecessor to BREIT about 10 years ago, focused on giving institutional investors long-term, goldilocks returns. ...not too low like core funds but not too aggressive like closed-end funds.

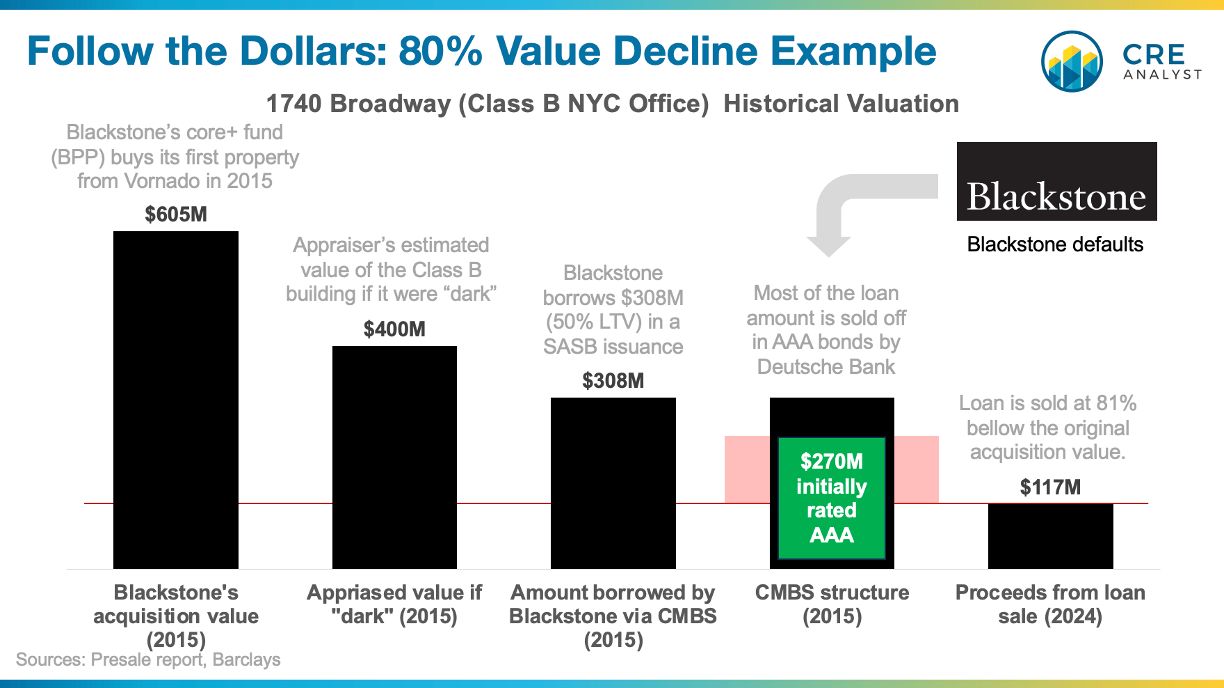

One of Blackstone Property Partners' early acquisitions was 1740 Broadway, a class B office building in NYC. BPP purchased the asset from Vornado for $605M, and VNO reported a $500M gain.

Blackstone borrowed about 50% of the purchase price via a SASB execution. i.e., Deutsche Bank had the loan cut up into slices, which it sold to investors. Most of those slices were rated AAA by rating agencies.

2024 update: Blackstone defaulted, and the servicer sold the loan 81% below Blackstone's original acquisition value, implying a 263% LTV (a 62% loss severity on the loan).

---- Deal strengths (per rating agency presale report) ----

1. Blackstone has $300M+ cash in the deal:

"This high level of cash investment heavily incentivizes the loan sponsor to carry the property should there be any debt service shortfalls once both tenants have expired."

2. Blackstone is a strong sponsor:

"The Blackstone subsidiary guarantor for the loan secured substantial equity commitments in Q4 2014, and the subject represents the first property within its fund. Blackstone is an experienced commercial real estate operator with deep knowledge of the Manhattan market."

3. The property has been full for 20+ years:

"The property has maintained a stable occupancy historically, averaging a reported 6.0% direct vacancy rate since 1994."

---- Deal challenges (per presale report) ----

1. 97% of the leases expire during the ten-year loan term:

"While the subject has substantial tenant rollover... both of these tenants have established critical operations for their respective companies at the subject and have been actively expanding their presence at the property since moving in."

2. The loan psf is high at $510.

"Blackstone’s all-in cost basis in the property is $619.2 million ($1,025 psf) and the dark value based on the appraisal is $400.0 million ($663 psf). Furthermore, the subject is considered a highly liquid asset in a desirable location."

3. Blackstone's guaranty is limited to carveouts capped at 10%.

"The sponsor is an institutional entity, and the leverage is considered moderate."

---- Our takeaways ----

-- Likely not an accurate bellwether: Old building, 8-9' ceilings, concentrated tenancy/vacancy, and in a submarket that was hit hard by COVID.

-- Core plus? Blackstone's track record has been remarkably consistent across its funds, except for BPP, which has returned about 6% to investors since inception. Walking away from $300M+ leaves a mark and perhaps highlights the challenges with a 'goldilocks' strategy.

PS - How would you feel if you were the AAA bondholders taking losses?

COMMENTS