Blackstone's troubled $1.3B floater that we profiled yesterday might sound like an outlier, but it may be an early indicator of an ice bath coming for CMBS bondholders...

CASE STUDY: Blackstone borrowed $1.3 billion against a 20-year-old portfolio of 6,700 units in 2021. The original LTV was 81% with 2.0x DSCR at a 2.4% floating rate. Rising rates pushed the coupon to 7.4%, tripling the amount of debt service due every month. Value declines and asset sales leave BX with $970 million of debt on a portfolio worth $920 million. The loan matures in four months, but BX can extend by renewing a cap for about $30M. Ouch.

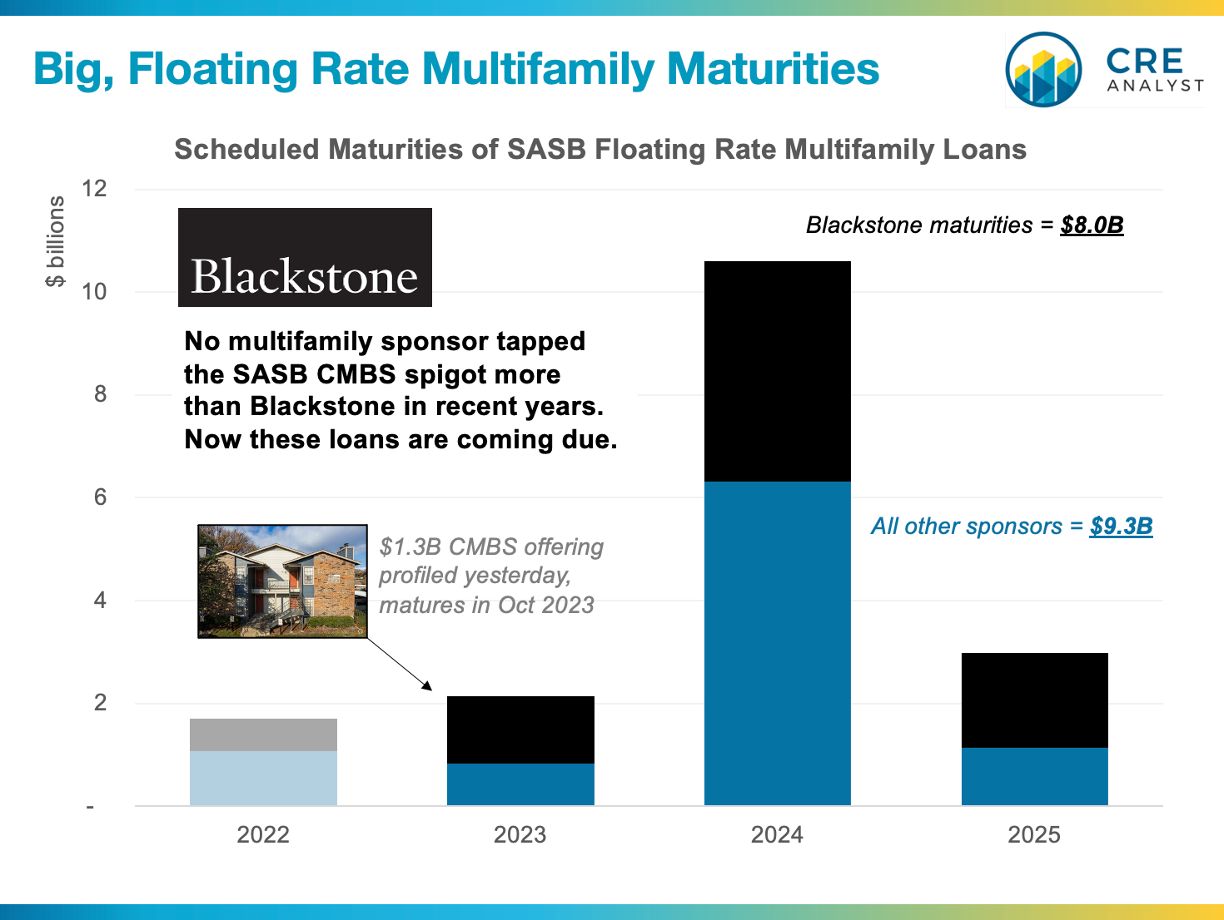

SCRATCHING THE SURFACE? It turns out that this loan shares several characteristics with other multifamily loans originated over the last few years. In the SASB market, $17+ billion of floating rate multifamily debt was issued since 2019, and this corner of the market (with $600 million avg loans) heated up substantially as interest rates fell.

800 LB GORILLA: Blackstone tapped this market more than any other multifamily sponsor, accounting for 47% of the floating rate SASB multifamily loans. Surely, even Blackstone can't escape the new reality of higher rates. ...or can it?

WINNERS AND LOSERS: Blackstone may hand over the keys on a few (or a few dozen) properties. Does this make Blackstone a loser? Not necessarily. They borrowed extensively at historically low rates. Worst case, Blackstone's BREP IX investors, despite a projected IRR of 27%, might take a hit since the fund is only about 40% realized. Either way, equity losses in opportunistic real estate funds don't generally rile markets. Equity investors know what they're getting into; they take risk in exchange for the chance of getting higher returns. But what about debt investors?

WHAT COULD RILE MARKETS? Panic almost always comes when lenders get surprised by losses. Fixed-income investors are notoriously risk averse, but they take losses in every downturn. How? Competition for loan production leads to relaxed lending standards until a blowup or two heightens risk awareness. Then lenders panic, liquidity dries up, spreads gap out, losses mount, and sometimes the government has to step in to help. It often takes a few years for confidence to establish a new foundation.

WHO WILL BE MORE SURPRISED? Blackstone and other multifamily sponsors are leveraged opportunistic investors. Yes, many of their loans are underwater with no coverage, expensive caps, and pending maturities. Trouble seems to be mounting, but who is more aware of these problems?

Most multifamily SASB bonds, which are held by pension funds and insurance companies, are still investment-grade rated and currently trade at about 99.7% of par.

COMMENTS