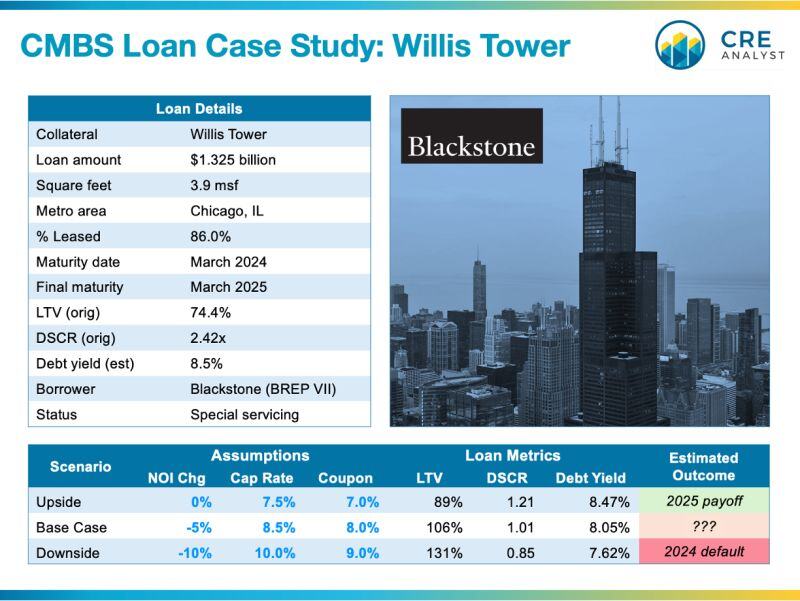

Blackstone borrowed $1.3B to refinance one of the most recognizable office buildings in the world. The floating rate loan matured this month, and it's a decent barometer for the office market...

BACKGROUND: Blackstone bought Willis Tower (previously known as Sears Tower) in 2015 for $1.3B, the highest price paid for a building outside of NYC. Goldman organized a $1B loan financing for the project in 2017, then Barclays refinanced that loan with a floating-rate, $1.325B CMBS securitization in 2018, which allowed Blackstone to finance a $500M renovation and cash out $240M.

BLACKSTONE: Willis Tower is in BREP VII, a closed-end opportunistic fund that started investing in 2010. The fund is nearing the end of its life (90% realized) with an overall return of 15% (per pension fund filings). When Blackstone purchased Willis Tower it announced, "We are bullish on Chicago as companies expand within and move into the city and look for first-class office space," but that was before Covid and WFH.

LOAN EXTENSIONS: Blackstone just extended the loan for another year, so the updated maturity is March 2024. It has one final maturity extension that could extend the loan to 2025, but BX would have to renew the interest cap, which would likely cost $10-15M.

CURRENT CREDIT CONDITIONS: Who knows what the property is worth in this market. Selling a billion-dollar office building wouldn't likely fetch many bidders without a deep discount, which could play into BX's hand. The loan likely sits at 90-100% LTV. But--silver lining--the asset's income profile has improved meaningfully in recent years thanks to a big renovation and a high-margin observation deck. In-place DSCR is currently above 4x but would likely be around 2x at today's levels. The loan has a relatively sturdy rent roll and could limp along for several years, but holding up the liquidation of BREP VII (and its promote) for 2-3% of its assets seems unlikely.

SCENARIOS:

1. Upside: NOI treads water, but cap rates hover in the mid 7s, allowing BX to sell in 2024 or 2025 for a little more than the loan balance.

2. Base case (breakeven): Continued pressure in the office market pushes NOI down by 5% and cap rates gap out to 8.5%, putting the loan on the bubble. Would BX pay $10-15M to extend the loan at the end of its fund? Maybe, maybe not.

3. Downside: Further pressure on rents and occupancy push NOI down by 10%. Office REIT pricing proves to be indicative of private assets (10% cap rate), forcing bondholders to eat about $300M of losses. Conspiratorial twist: BX could signal its intent to default and then buy the SASB CMBS bonds at a big discount (seems unlikely but not totally unlike its Hilton play in 2010).

Regardless of how the Willis Tower mortgage plays out, it might be a decent barometer for the rest of the office market: lower values with more income than you think, which leads to murky outcomes that play out over many years.

COMMENTS