The CRE capital markets set several industry records over the last three years:

- Lowest borrowing rates in history

- Lowest cap rates in history

- Lowest debt yields in history

- Most transactions in history

- Highest property values in history

POST COVID WINNERS

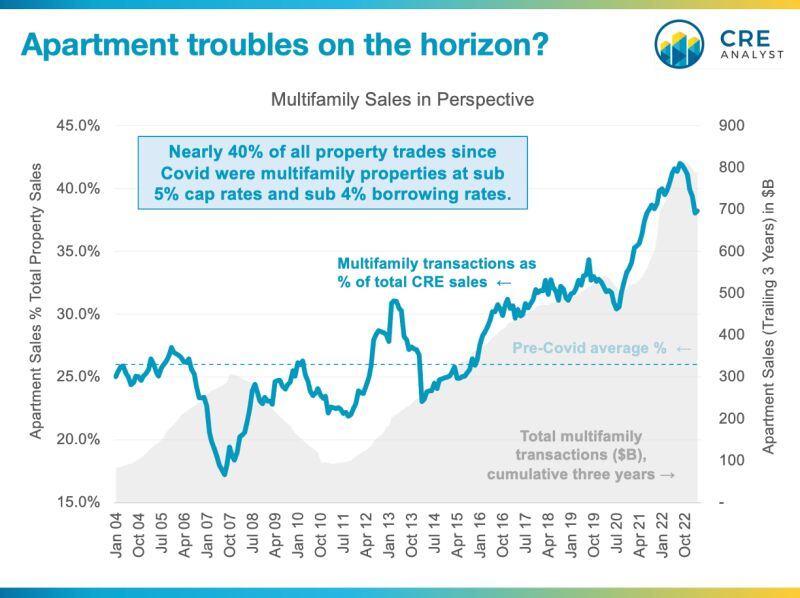

The primary beneficiaries of favorable post-Covid capital markets conditions were industrial properties and multifamily properties, but these two subsectors have diverged over the last year. Industrial's outperformance seems to have been driven largely by fundamental strength, but multifamily was driven by a capital markets surge that has since abated, which could expose thousands of borrowers.

INDUSTRIAL CONTINUES ITS MARCH

Industrial properties continue to outperform the broader market. ProLogis, the world's largest industrial property owner, recently reported that its NOI growth accelerated over the last year to 10-11% and it's massive portfolio remains 98% leased

MULTIFAMILY CHALLENGES

- Valuation declines: Apartment values are down 25%+ from post-Covid peaks (largest decline of all major sectors except for office.)

- Moderating revenues: Rent and revenue growth peaked post-Covid around 20% but has since flattened with the large REITs recently reporting 3-5% growth and mid 90% occupancy, down about 200 bps over the last 12 months.

- Pockets of supply: With nearly one million units under construction, the apartment stock is growing faster (by about 2% per year) than it has in the last 20 years.

- Higher operating expenses: With no net leases, residential property types are uniquely exposed to expense growth. More specifically, property taxes and insurance (both increasing by 10-20% annually) could meaningfully slow NOI growth in 2023-24.

- More restrictive debt markets: $370B of agency CMBS was issued since 2020, which accounted for about 50% of all CMBS originations. But agency originations are down by 90%, bank lending is sidelined, and borrowing rates are up by 50-100%, which creates a significant gap between in-place debt loads and amounts lenders are willing to refinance. This gap will challenge borrowers, (particularly those with floating rates) looking to refinance in the next few years. We estimate that about $100B of multifamily CMBS debt is scheduled to mature over the next 30 months.

TAKEAWAYS

Multifamily is generally a solid asset class and could easily outperform other sectors over the long run, but there's been a steady chorus saying that industrial and multifamily are generally immune to the pending real estate downturn. We find this chorus problematic in the face of the multifamily headwinds outlined above. We think the near-term could be dicier than expected for multifamily investors and wouldn't be surprised to see a spike in special servicing, loan modifications, and foreclosures, especially on older vintage properties (15+ years old).

COMMENTS