Beneath the headlines...

RECENT HEADLINES:

"After SVB: Commercial real estate threatens banking" (Bloomberg) // "Commercial property debt creates more bank worries" (WSJ) // "Concerns grow as tighter lending threatens commercial real estate" (NYT) // "Banking's next threat? It might be commercial real estate" (Bloomberg) // "Office vacancies send real estate investors to the exits" (WSJ)

BACKGROUND:

$10-11 trillion of commercial real estate

$5 trillion of outstanding commercial mortgages (all types)

$1 trillion of outstanding mortgages secured by office buildings

TAKEAWAYS:

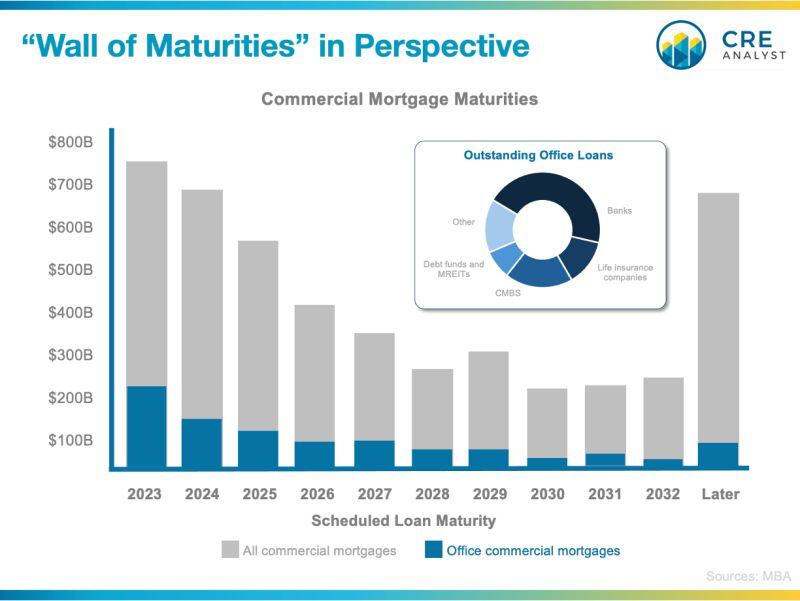

- Wall of maturities: Approximately $600B of commercial mortgages (per year) are scheduled to mature annually over the next three years. With higher interest rates, lower values, and pressure on office property incomes, refinancing many of these loans will almost certainly be challenging.

- A semi-flexible "wall": The $600B of annual maturities could come down by $100-200B per year since many of the loans have extension options, although most of these tests are subject to property income tests.

- Office challenges: $100B to $200B of upcoming annual maturities are secured by office buildings, and many of these buildings are struggling in a post-Covid world. The credit conditions of these loans at origination were relatively strong (i.e., better LTVs and DSCRs vs. GFC loans), but office loans will likely underperform in the coming years.

- Largest holders of office loans: Banks are the largest holders ($450B), but many of these mortgages are construction loans and owner-occupied properties, which are relatively favorable. CMBS accounts for about $200B of office loans and will likely underperform. Life insurance companies hold about $130B of office loans, mostly low leverage.

- Slow burn: Recent default announcements (triggered by expiring floating-rate loans) are likely the first wave of office problems. Keep an eye on the $25B of floating-rate CMBS office loans maturing in 2023. Many can be extended but wouldn't be surprised to see $5-10B of problem loans from this cohort. Expect more 1990s-like workouts, but falling office values and a meaningful debt overhang could take 5 to 6 years to work through with problems likely peaking in 2025-26.

- Silver lining: No subsector is immune to rising interest rates, but office is uniquely challenged. Our stressed loss scenarios (akin to GFC-like losses in the office sector) suggest $100B of losses over the next 7 years (10% of office mortgages), but this only represents about 2% of the total commercial mortgage market, which is significantly lower than GFC mortgage losses (10-14% across all sectors).

#beneaththeheadlines #commercialrealestate #cre #realestatefinance #realestateinvesting #mortgagedefaults #officeapocalypse

COMMENTS