Joint ventures and waterfalls...

Of the four types of real estate transactions, we find joint ventures (aka partnerships) to be the most widely misunderstood or not understood at all. Real estate is an industry defined by partnerships, so we spend a lot of time in FastTrack covering JVs.

FIVE DEFINING TRAITS OF JVS

1. Contributions: How partners agree to fund the partnership's resources upfront and over the course of the venture, including capital required to cover surprises, support recourse obligations, etc.

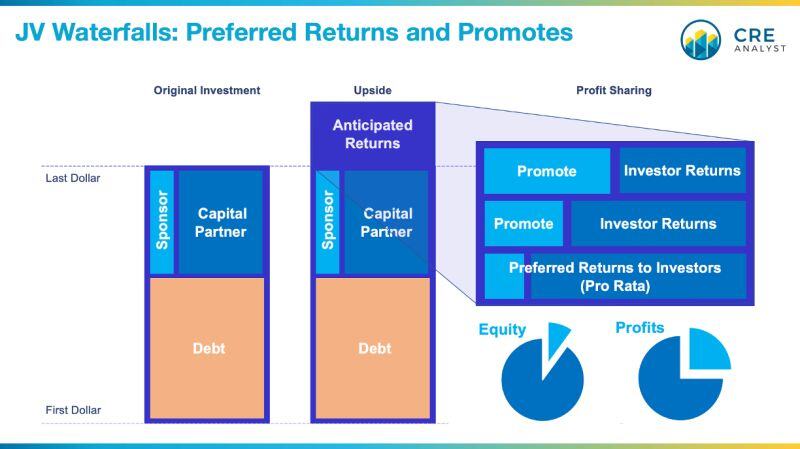

2. Distributions: How partners agree to share in anticipated profits. The go-to distribution model for value-add/opportunistic real estate deals is the waterfall model, where sponsors get disproportionate upside to incentivize performance.

3. Management: How partners agree to tackle the partnership's oversight and associated fees.

4. Major decisions: How partners handle key decisions. Since one partner is typically designated the manager of the partnership, the other partner takes a back seat but will want to clarify which decisions require approval. E.g., financing, sales, etc.

5. Exits: How partners dissolve the partnership and/or get out. We believe this is arguably the most important and least discussed necessary feature of partnerships. We spend time in class talking about the four rights that partners typically define in partnership agreements related to exits and how they are valued (sell to a third party, put rights, call rights, buy-sell provisions).

MODELING VS. DECISION MAKING

We often see young professionals spending a lot of time trying to work through the modeling of preferred returns and promotes before they understand the conceptual structural components of waterfalls, which leads to a lot of confusion and frustration. In our opinion, modeling/processing skills are important, but thinking skills are more important. We know hundreds of industry leaders who are great thinkers and "ehh" modelers, but we don't know a single industry leader who is a great modeler but an "ehh" thinker.

Additionally, how partnerships distribute capital (waterfalls) is only one feature of the five that define partnerships. And it's the feature that is most narrowly defined by the market (e.g., prefs typically range from 8-10%) and the overall share of profits allocated to sponsors typically ranges from 15-30%. Where the terms of waterfall distributions end up in a partnership negotiation ("splits") typically has more to do with market forces than modeling acumen.

TAKEAWAYS

Waterfalls deservedly get a lot of attention, but in our view: (i) it's important to understand the conceptual structure of the common real estate waterfall before writing formulas in Excel, and (ii) it's more important to understand all of the critical features that define real estate partnerships.

COMMENTS