What's been the most meaningful trend in real estate over the last 10+ years?

It could be multifamily's emergence as *the* primary real estate supersector.

[Sidenote: Yes, industrial has had an amazing run too. But we estimate that the overall value of U.S. multifamily outweighs all other subsectors by a multiple.]

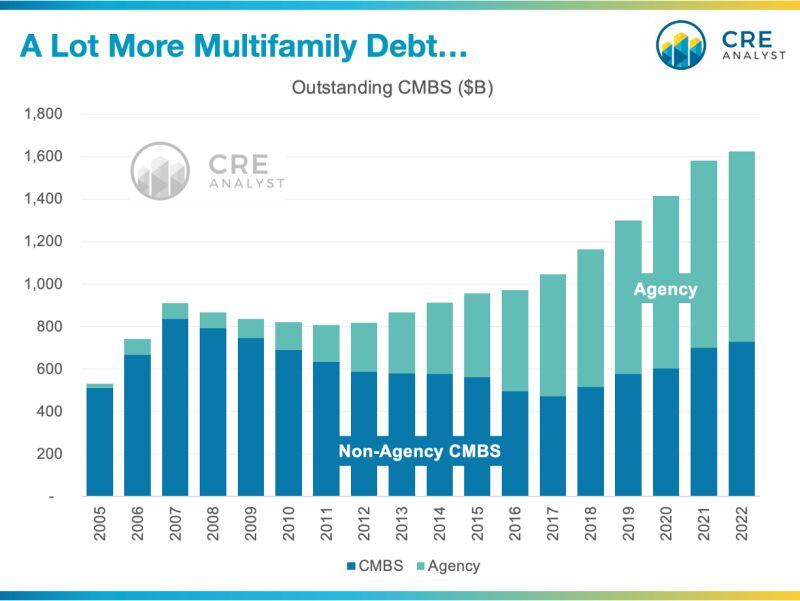

This chart summarizes outstanding CMBS (non-agency vs. agency). "Agency" represents Fannie and Freddie multifamily originations.

A FEW TAKEAWAYS

1. CMBS was the primary culprit during the financial crisis, but the overall amount of Non-Agency CMBS outstanding has fallen since the financial crisis. In other words, there's been a significant deleveraging of CMBS debt secured by office buildings, warehouses, and retail.

2. Agency CMBS has exploded over the last 5-10 years.

3. The increase in multifamily debt could be bad. More leverage increases debt service requirements and volatility.

4. But it could be good for the industry's overall stability. Apartment rents surged during and after Covid, which led to significant NOI growth. Borrowers rarely default as long as property incomes cover debt service.

Also, note that securitized debt (agency and non-agency) makes up only about 25% of the total debt market, so there may not be as much of a multifamily increase in total debt (or as meaningful of a non-multifamily decrease) since other lenders could be gaining/losing market share within subsectors. However, the significant emergence of agency debt is too meaningful to ignore.

KEEP AN EYE ON RECENT TRADES (20% OF THE MARKET)

We think higher multifamily rents and incomes will probably offset cap rate expansion and higher borrowing rates. However, about 20% of the multifamily market traded hands over the last two years, and many of these properties were transitional. i.e., sponsors were buying, moderately improving, and flipping properties (often to other sponsors who would buy, moderately improve, and flip again). Given their short-term hold periods, these sponsors almost always tapped the floating rate debt markets since floating rate loans are more easily pre-paid vs. fixed-rate loans.

IN SUM

There were $650B of multifamily acquisitions over the last two years, much of which depended on rising rents, low cap rates, and floating rate debt. All of these factors have degraded substantially in recent months, affecting the entire subsector. But we think the vast majority of problems will stem from a relatively small pocket: The 2021-22 trades financed with floating rate debt.

COMMENTS