Seller: "Why aren't we getting more bids? Interest rates have normalized."

Broker: "There's just not as much capital chasing this product type."

Seller: "Ouch"

Broker: "Tell me about it."

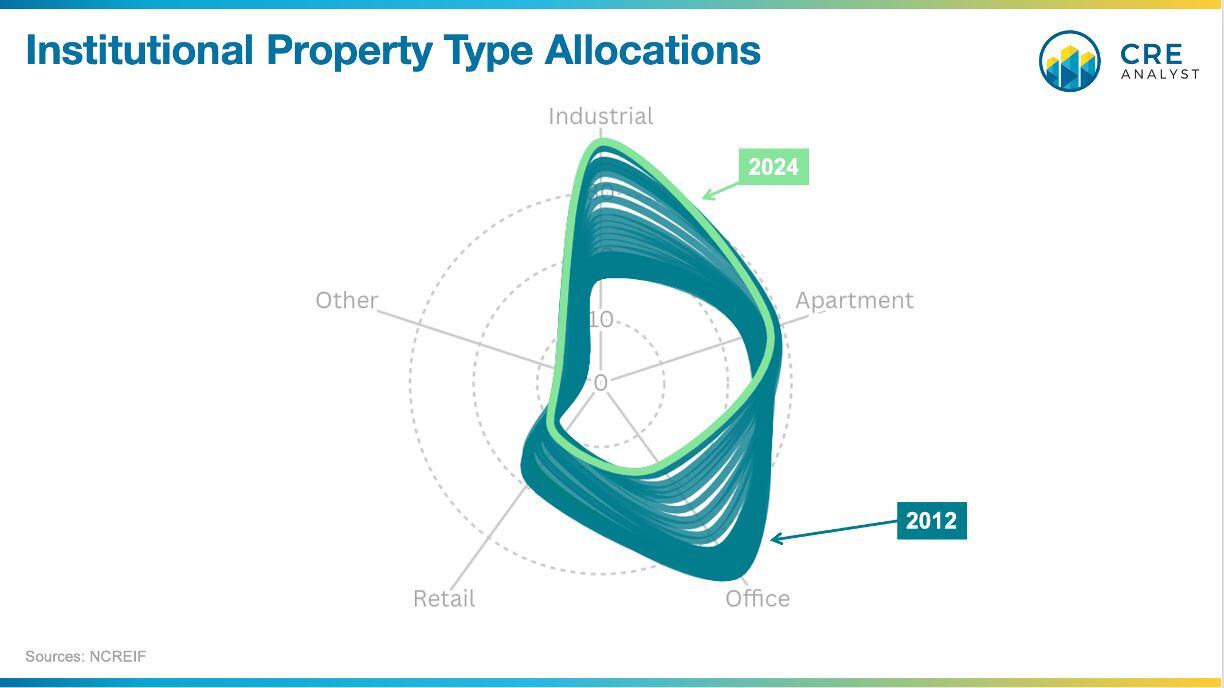

This massive shift has largely slipped through the cracks. Why? Maybe because it happened gradually over the last 12 years and/or because headlines have been dominated by once-in-a-lifetime challenges (pandemic, post-ZIRP hangover, etc.)

Nevertheless, this megatrend will likely get much more attention as transaction activity picks up, leaving some sellers pleasantly surprised and others unpleasantly surprised.

The megatrend: big shift out of office and retail and into industrial and multifamily

Institutional allocations to office and retail have fallen by 50%+ over the last 12 years, from 55% to 26%. What's filling the gap? Industrial, apartments, and "other."

Then vs. now...

Office: 37% --> 16%

Retail: 18% --> 11%

Apartments: 24% --> 28%

Industrial: 17% --> 38%

Other: 4% --> 7%

Why this matters: This $200B to $300B pot of capital has the lowest cost of equity in the industry and largely defines benchmark pricing.

Predictions...

1. Institutional values stabilize in the next few months.

2. Exit queues into core funds reverse over the next 3-6 quarters.

3. Core funds begin to deploy capital.

4. They increasingly favor industrial, housing, and niche sectors, putting downward pressure on cap rates again.

5. Out-of-favor asset class performance will be more defined by income growth (or a lack of income growth) with minimal cap rate compression.

6. Growing dispersion between "winners" and "losers"

COMMENTS