What's the most important change to the real estate capital markets over the last 25 years? Our vote...

...institutional capital shifted its collective allocation to real estate from 2% to 10%.

This mattered for two reasons...

1. It's a lot of money. Call it $10 trillion of inflows.

2. Perhaps more importantly, these investors have been largely focused on the safest perceived assets, pushing down discount rates and cap rates for core assets and creating follow-on opportunities for the entire industry.

But cracks are forming. What happens when institutions start questioning their real estate exposure?

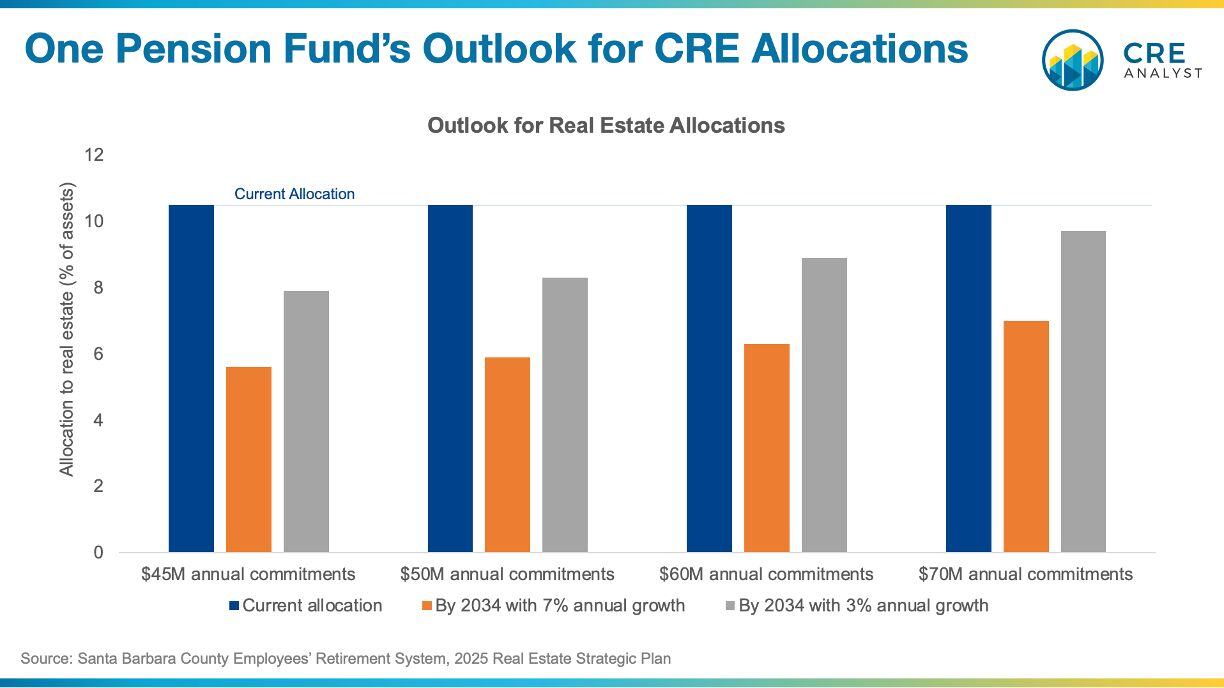

This is only one relatively small pension fund--Santa Barbara County's $4 billion in total assets ($700M or so of real estate equity). However, their challenges jump off the page. If real estate generates high single digit/low double digit returns, it'll have a home in the portfolio into the foreseeable future, but it's role seems to be on track to wane over time.

The party isn’t over, but the guest list may be shrinking.

COMMENTS