Peeling back layers related to higher interest rate effects on real estate returns...

FOR INCOME-ORIENTED INVESTORS

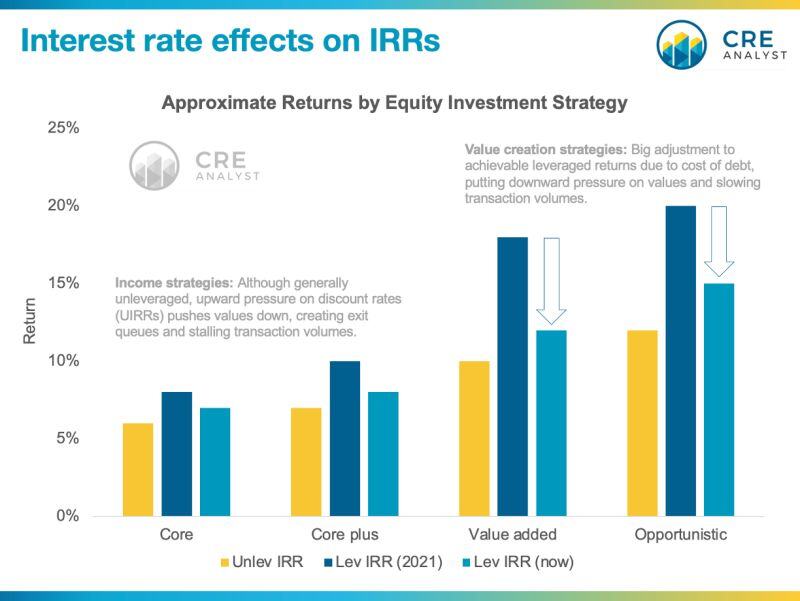

The cost of debt hovered around 3-4% for the last few years but is now 6-7%. If investors can get 6-7% by lending, why would they invest in the safest equity investments (core) at 6-7% return targets? Many of them won't. If they don't pile into debt, they'll at least go to the sidelines, which helps to explain mounting exit queues and the significant slowdown in transactions of core assets. Core buyers are on the sidelines.

FOR VALUE CREATION-ORIENTED INVESTORS

Investors in value creation strategies were consistently achieving 18%+ leveraged IRRs by investing in assets with 10% ish unleveraged IRRs and leveraging them up with very favorable financing structures (e.g., 65% LTV at 3.5%). Now that borrowing rates are much closer to the estimated unleveraged IRRs of these assets, it's impossible to achieve high teens leveraged returns. Why would investors take significantly more risk associated with value creation strategies to only get a few hundred basis points of additional return over income oriented strategies? This tension helps to explain the significant slowdown in deal activity, as sponsors are realizing they will likely struggle to hit return expectations.

UNLEVERAGED IRRS ("DISCOUNT RATES")

If unleveraged IRRs are so important, why are they rarely discussed (especially in value creation strategies)?

Unleveraged IRRs are very useful for two things: 1) assessing risk relative to alternatives across the risk spectrum, and 2) assessing positive vs. negative leverage. Since risk-oriented sponsors are typically purely focused on hitting return requirements imposed by their investors, i.e., "we need to get 18% gross returns," they don't typically flex between risk profiles. If they need an 18%, they're going to be very focused on the higher end of the spectrum and don't care much about the relative value of a lower returning opportunity since it fails to satisfy their hurdle rate. Additionally, the effects of leverage have been incredibly positive for decades, so investors haven't had to assess the possibility that leverage effects could be neutral or negative. ...until now.

CONTEXT FOR CURRENT FASTTRACK STUDENTS

We spend a lot of time in class working through the mechanics of DCF valuation, but it's critically important to understand and appreciate discount rates (the extent of which future cash flows are adjusted downward to get to a present value that compensates you for risk), how discount rates are chosen (based on risk; pretty safe to assume that most real estate investments' UIRRs fall between 6-12%), and how discount rates relate to cost of capital (your discount rate/UIRR needs to be higher than your cost of capital to create value).

COMMENTS