$40B+ of "dry powder" but stuck between a rock and a hard place...

The dynamics beneath the surface of these ten funds connect the dots between every key question facing real estate investors today. How far will values fall? Why have transactions stalled? Where's the dry powder? Are we headed into a recession?

FEWER TRANSACTIONS

Commercial property trades are down about 70% YoY. Capital flows have stalled, and there's a meaningful disconnect between buyer and seller expectations.

FALLING VALUES

According to Greenstreet, commercial property values have fallen by 13% over the last year. At some point, lower values will attract more capital, but when? To understand that, you need to understand the nature of available "dry powder."

DRY POWDER

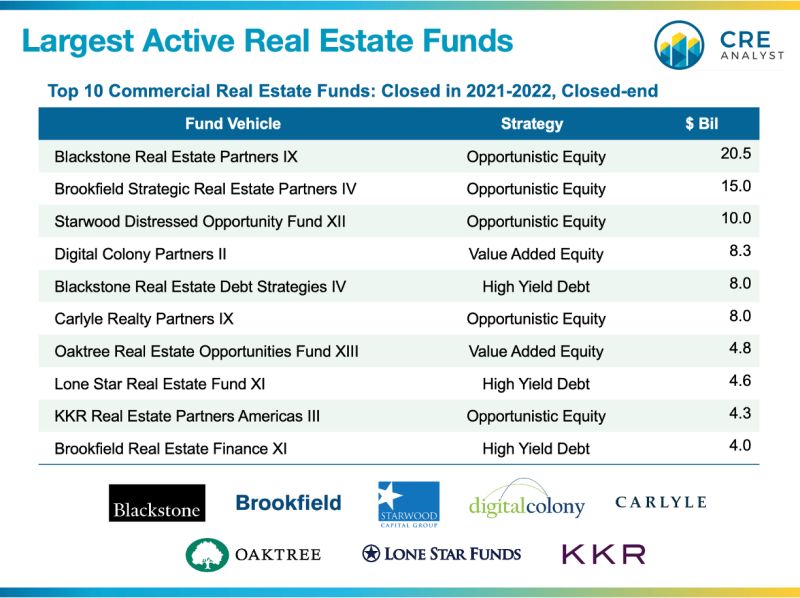

The last few years saw massive commitments come into real estate private equity funds, especially the largest funds. The top ten closed-end funds, outlined below, raised $87.5 billion. We think about 50% of that has already been deployed, which leaves $40+ billion of available capital, just from these ten funds.

RETURN EXPECTATIONS

The equity funds on this list tend to target 14-18% leveraged IRRs, which generally are not achievable in today's debt market (explains why trades have stalled). Unleveraged IRRs of 8-12% may be relatively attractive on a nominal basis, but they simply don't meet the targets these funds have set with their investors.

IMPORTANCE OF INTEREST RATES

For the last decade, borrowers could buy at 8%+ UIRRs, leverage up to 60-70% LTV with <4% cost of debt, and generate 18%+ LIRRs (call it 16% net to investors). Win, win. Investors, managers, and lenders get paid. But now those borrowing rates are 6-8%, which pushes LIRRs down to 10-14% before fees. This is half of the problem facing these funds. How do you get to mid/high teen returns when debt isn't cooperative?

IMPORTANCE OF UNDERWRITTEN CF AND APPRECIATION

The other half of the problem facing these funds, and their investors, relates to the outlook for revenue/income growth and exit cap rates. Those 8%+ UIRRs can become 4% UIRRs (or worse), quickly, if you think we're headed into a recession. Do you catch a falling knife by entering the market now or make a play now betting that market sentiment is overly bearish?

HOW DO WE GET OUT OF THIS MESS?

There are two big problems: 1) uncooperative debt via high interest rates and 2) dwindling NOI outlooks in the face of a recession. We've been in this situation before, and it won't take an entire industry to lead us out of being stuck in the mud. Pioneering investors with access to capital and a relatively bullish outlook will lead us out by discovering prices and getting the wheels spinning. But these investors will need to have relatively clear paths on interest rates/cap rates and income growth.

COMMENTS