Cash is ____.

Last forty years: "overrated."

From now on: "king."

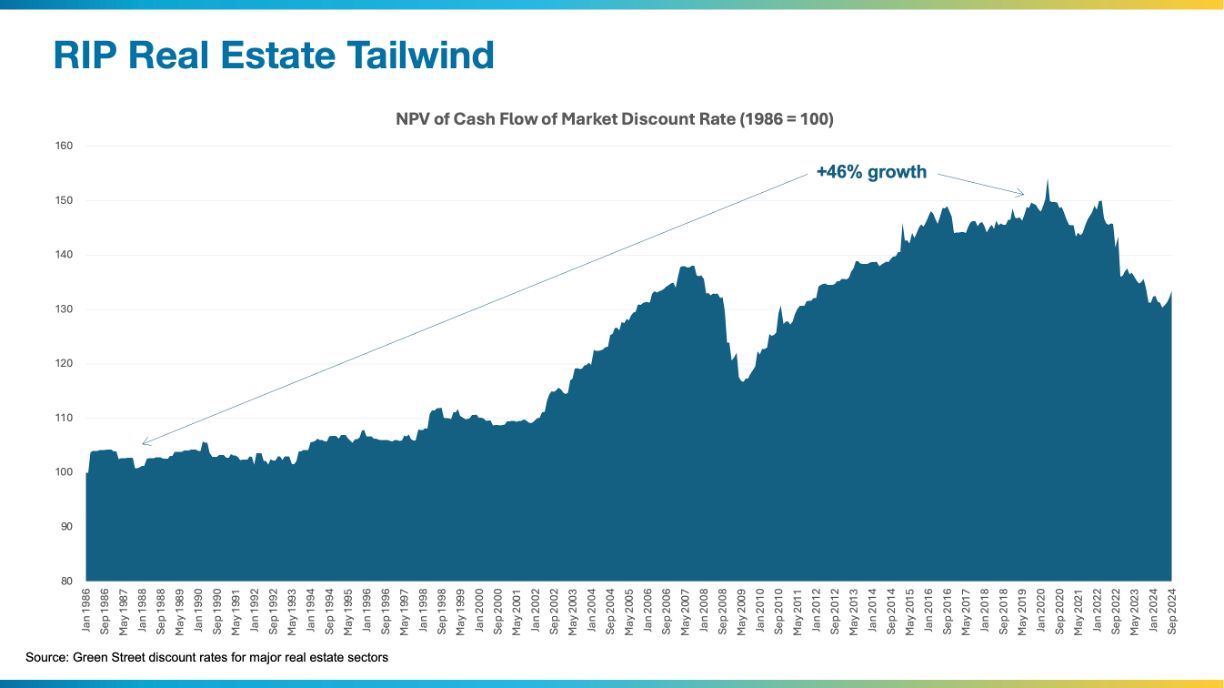

The value of real estate cash flow over time...

If you bought a stabilized real estate cash flow in 1986, you likely would have discounted that cash flow by an 11% discount rate (the market discount rate back then per Green Street).

Similarly, if you sold that same cash flow at the market's peak in 2022, you likely would have sold it to a buyer discounting the cash flow by 5.6%.

In other words, by simply maintaining that originally anticipated cash flow, i.e., without creating any incremental income or value, the value of the property would have increased by 46%.

This tailwind (driven by cheap and plentiful debt and increasing allocations to commercial real estate) was a major contributor to real estate's incredible forty-year run.

But the tailwind is gone.

What next?

Here's the nominal change you would have seen in value by entry year, compared to the 2022 peak...

1986: 45%

1987: 46%

1988: 46%

1989: 44%

1990: 44%

1991: 46%

1992: 46%

1993: 46%

1994: 41%

1995: 41%

1996: 41%

1997: 41%

1998: 36%

1999: 36%

2000: 37%

2001: 37%

2002: 33%

2003: 27%

2004: 21%

2005: 16%

2006: 12%

2007: 9%

2008: 14%

2009: 26%

2010: 19%

2011: 15%

2012: 11%

2013: 9%

2014: 8%

2015: 4%

2016: 2%

2017: 3%

2018: 3%

2019: 1%

2020: 0%

2021: 3%

2022: -3%

2023: -10%

2024: -12%

COMMENTS