Why is industrial so popular with real estate investors?

(a) Lower cap rates

(b) Lower discount rates

(c) Stronger rent growth

(d) Less CapEx

(e) Favorable financing

Our answer:

(d) Cash is king.

---- Follow the dollars ----

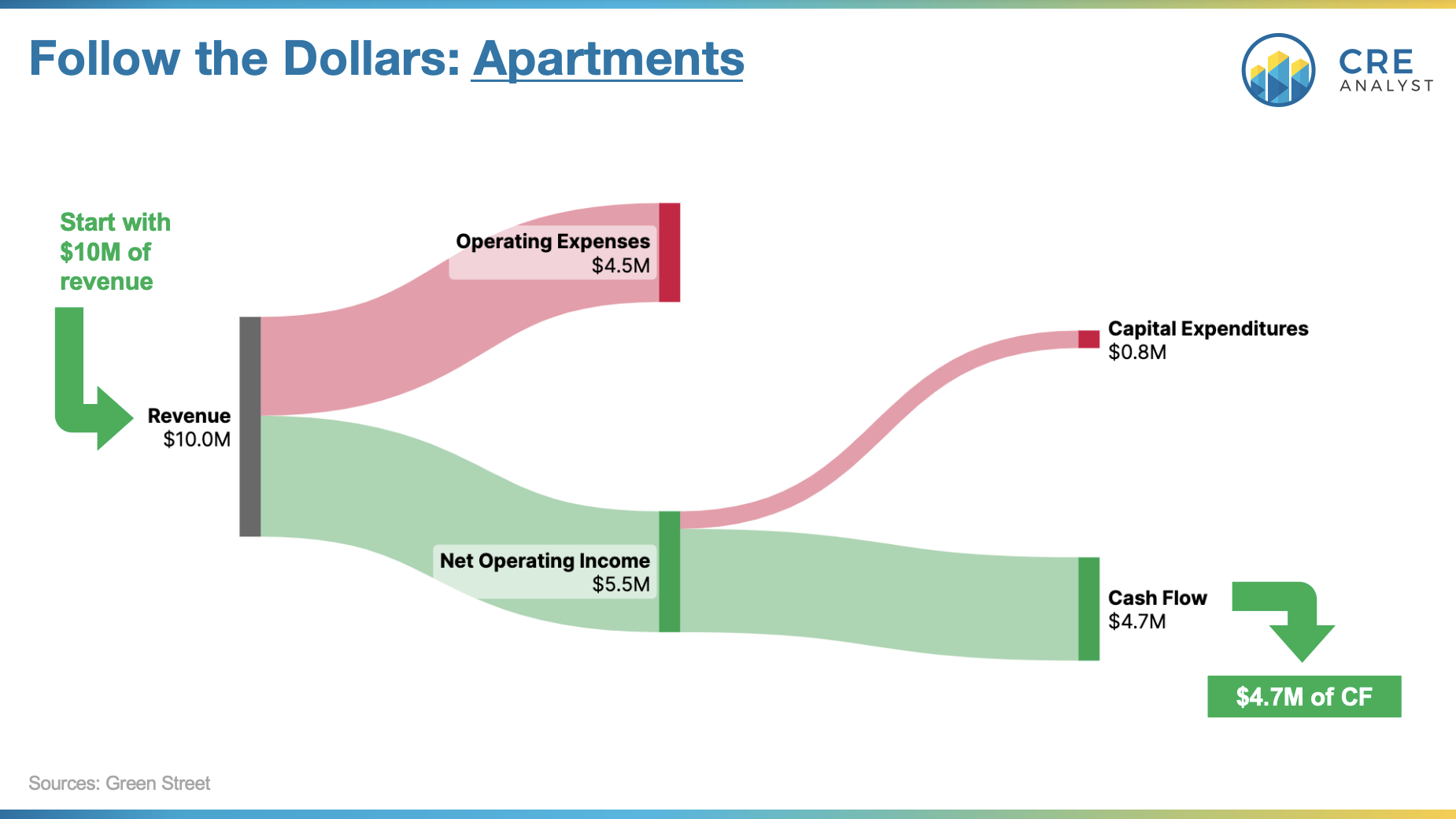

Assume you have three properties with $10M of revenue. Here's how we think cash would flow through typical assets:

-- Apartment property: $5.5M in NOI and $4.7M in CF.

-- Office property: $5.7M in NOI and $3.9M in CF.

-- Industrial property: $7.4M in NOI and $6.4M in CF.

Industrial trades at a much tighter cap rate, so those dollars are more expensive. How meaningful is this overall performance difference? See below.

---- Double whammy ----

Incremental CapEx burns in another way: In addition to affecting underwritten returns, lower operating margins also increase the volatility of returns. i.e., a 2% change in revenue leads to a 10% change in NOI at a 20% margin and a 20% change in NOI at a 10% margin.

---- If I knew then what I know now ----

Investors generally only talk about operating margins every ten years when rents stall and revenue stalls. No one wants to talk about CapEx when the market is booming. But kudos to those who have always beat the CapEx drum.

No better example than Green Street:

"We have long advocated the use of Adjusted Funds from Operations ('AFFO') as a superior measure of performance for REITs. The most important distinction between the NAREIT prescribed FFO measurement and AFFO is that AFFO attempts to include a variety of costs related to leasing and maintenance of a real estate portfolio, that, while capitalized, are conceptually more akin to current period expenses."

-- Green Street, 1996

"Sizable differences in performance across property sectors afford an opportunity for property investors – in both private and public markets – to generate outsized returns. Most attempts to do so, however, are futile endeavors, as they require foresight on variables, such as the health of the economy or the direction of interest rates, where it is arguably impossible to consistently outsmart the market."

"There is, however, one key differentiator of sector returns that has long been underappreciated by many market participants, and, as a result, appears to have been the source of consistent and predictable mis-pricing. Though we have been banging the 'cap-ex is important' drum for over two decades, property-market participants continue to understate the long-term magnitude of the expense."

-- Green Street, 2019

View our graphs on Green Street's analysis here.

COMMENTS