10 capital markets observations from a discussion with Eastdil's President

1) Great news for borrowers:

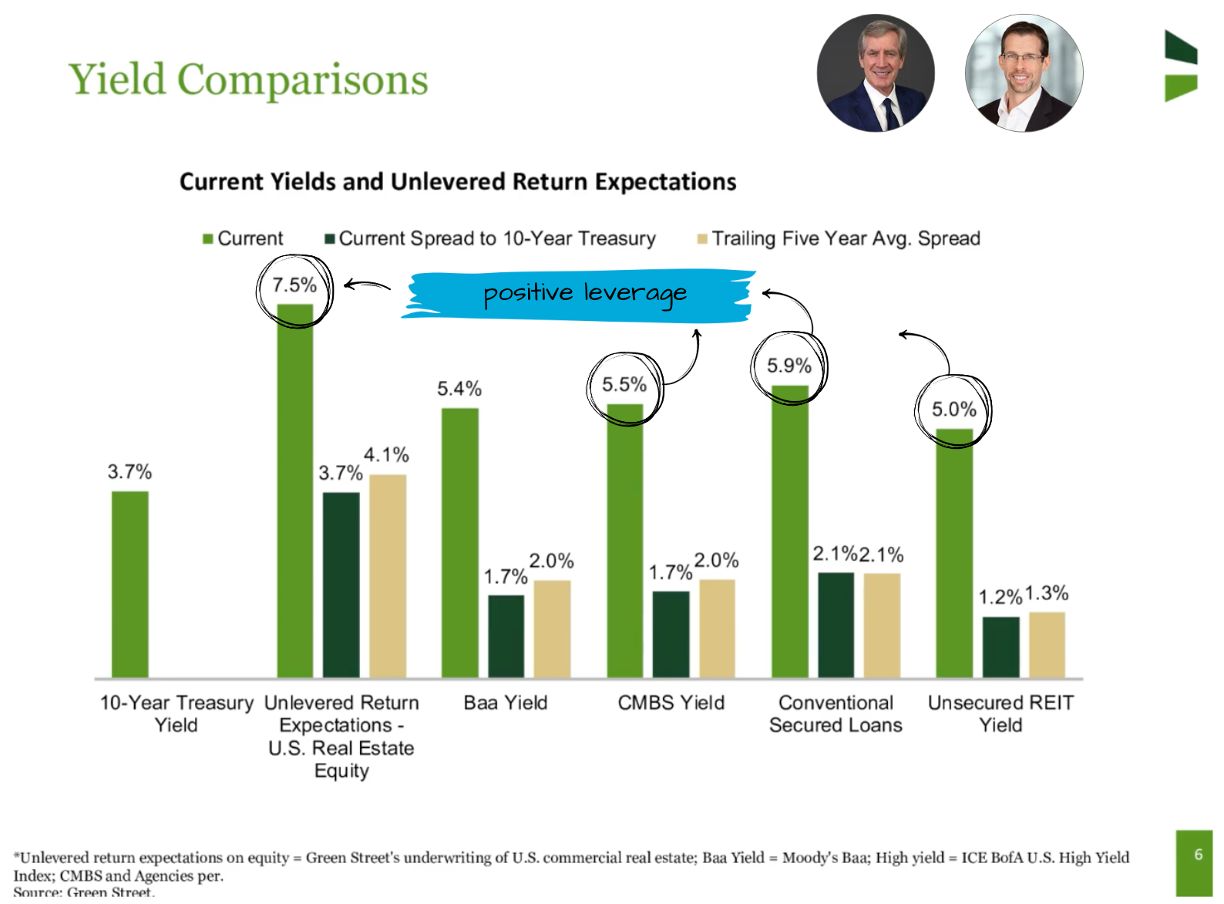

Borrowing rates are down 175 bps from 6.75% to 5-5.25%, driven by big drops in base rates and spreads.

2) Debt liquidity up across the board:

CMBS was just opening up a year ago but is “extremely liquid” now, pushing all other lenders on proceeds and spread. Even the CLO markets (which finance lenders) are back up and moving.

3) Banks:

Largest 25 banks are quoting, but smaller banks are pinched with low-yielding assets and portfolio challenges (e.g., office exposure.) Lower short rates will drop deposit yields and spur MBS payoffs, which should lead to more small banks getting back into the market over the next year.

4) Construction loans:

Still priced at nearly 8% (mostly debt funds), but could see coupons come down to 6.5% over the next year as banks (especially large banks) continue to get back into the market.

5) Office:

Still very little debt but REIT bonds and CMBS are charting a path. E.g., 5% coupon for mid 30s LTV, CMBS pricing 6.5-7% coupons at 10-11% debt yields. Balance sheet lenders remain on the sidelines, but liquidity is gradually coming back.

6) Distress:

“Rapidly accelerating distress cycle” driven by office lenders in short sell situations. Buyers are non-institutional, but appetite is growing with some values down 75% from the recent peak.

7) Multifamily:

Strong liquidity with all major lender types actively quoting. Cap rates have moved from mid-3s to 4.5% on best assets with significant support overall between 4.75% and 5.25%.

8) Transaction volumes and valuations:

Bottomed in 1Q24 and steadily accelerating. Lot of activity in 2025 and even more in 2026. Public markets typically lead private markets, and recent REIT performance “screams asset values are going to go up.”

9) Buyer pools:

Primarily driven by offshore investors, pension funds, REITs, and PE-owned insurance companies with big annuity businesses. Significant dry powder with closed-end funds looking for higher-yielding opportunities.

10) Fundraising:

Very challenging environment over the last 18 months. Many funds haven’t hit their targets. LPs want to see sales, and ODCE valuation questions have weighed down the overall market. Investors have plenty of liquidity; they’re concerned about relative value. Transaction activity picking up will give appraisers more data points which will help with valuation questions and lead to net inflows into closed-end and open-end funds next year.

Special thanks to Green Street, Cedrik Lachance, and D. Michael Van Konynenburg for continuing this annual series. Your ability to pack meaningful takeaways into a 30-minute discussion is unmatched.

PS - Link to the full discussion in the comments.

COMMENTS