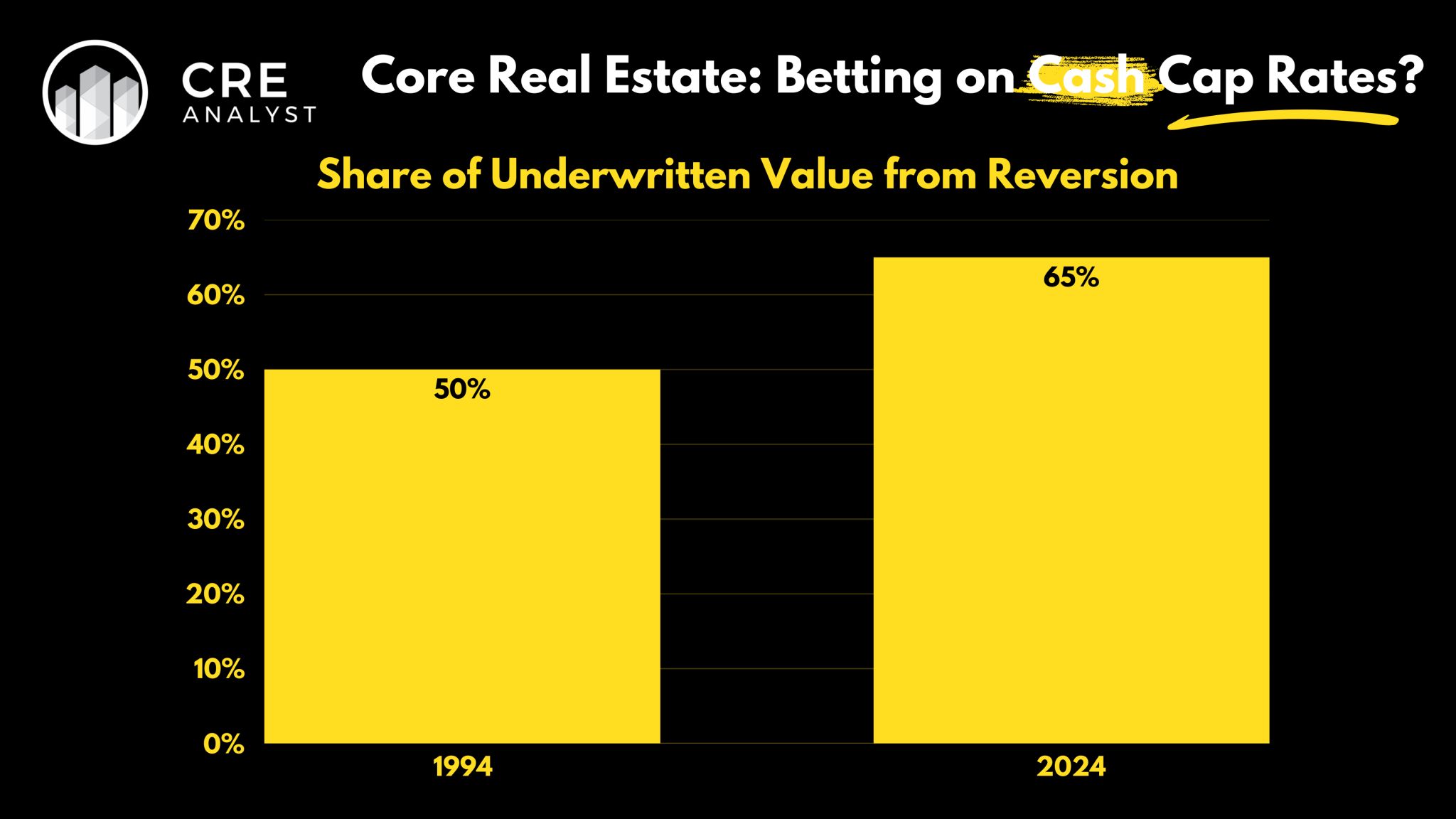

Rule of thumb from 30 years ago: "no more than 50% of your value should come from estimated reversion." Today's reality...

Three sources of real estate value:

1. Contractural income

2. Speculative income

3. Speculative resale ("reversion")

What happens when cap rates fall?

Obviously, values increase.

And what happens when values increase?

Buyers underwrite less value from income and more from speculative version. i.e., more cap rate bets.

Stop buying, you say?

Easier said than done. Income-oriented real estate investors, by definition, aren't responding to tactical opportunities. They are often liability-driven with assets that often need to be deployed/redeployed. Their vehicles are typically perpetual in nature, focused on broad market trends and allocations.

Core cap rates in 1994: 9.0%

Core cap rates in 2024: 4.7%

Silver lining?

Expected exit cap rate adjustments would presumably be a one-time shot. Once updated, will income yields could spike, leading to more stable returns?

PS - Has this shift affected how core risk/return profiles compare to non-core risk/return profiles?

COMMENTS