Think your year is off to a rough start? Could be worse: Some investment manager is about to be fired due to the lure of a sub-5% IRR.

LA County's employment pension fund ("LACERA") met last week and approved moving $2 billion from separate accounts into core funds ($1.5 billion) and non-core funds ($500M/year) in 2025.

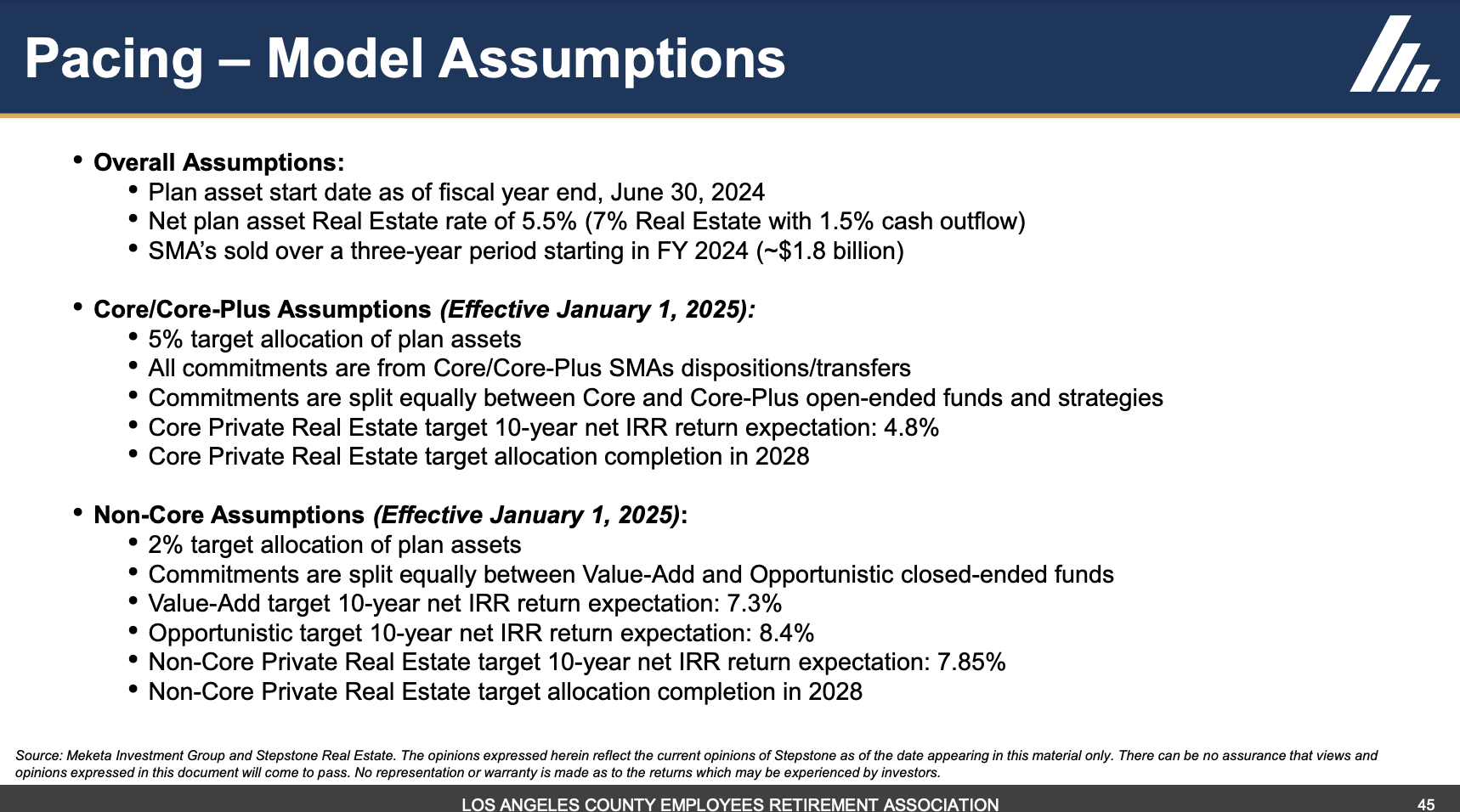

On slide 132 are the targeted returns:

"Core Private Real Estate target 10-year net IRR return expectation: 4.8%"

"Value-Add target 10-year net IRR return expectation: 7.3%"

"Opportunistic target 10-year net IRR return expectation: 8.4%"

Granted, these are net of fees. So call core 6%, value add 9.5%, and opportunistic 10.5%.

What's a comparable 10-year net IRR on a real estate credit fund?

To be fair, LACERA has been moving out of SMAs and into more comingled funds over the last several years, and this move was relatively well choreographed.

Other takeaways...

1. Core since 2022: More risk, less return?

The LACERA deck included a description of real estate risk profiles. Core, core plus, value add, etc. which raises this question about relative performance.

2. Scraps and secondaries

The approval included a new sleeve for secondaries and co-investments, focused on bid-ask gaps for funds and partnership interests being carried at above-market values.

3. Hunting for emerging managers

LACERA also included a new sleeve for emerging managers at an average investment of $50M, each in managed accounts or fund-of-one style investments with less discretion. Lacera is hoping to graduate emerging managers into the portfolio over the next 7 years.

PS - $1.5 billion moving into core funds could make a meaningful splash. LACERA has said in prior presentations that negotiating power with fees is a meaningful driver. Will be interesting to see if LACERA sticks with down-the-middle managers or expands into others, perhaps one with relatively large exit queues.

Read the full report here.

COMMENTS