The case for CRE debt

1. Lenders' paradise: Lenders are in the driver’s seat. Broken capital structures and tighter borrowing conditions correspond to the need for more debt.

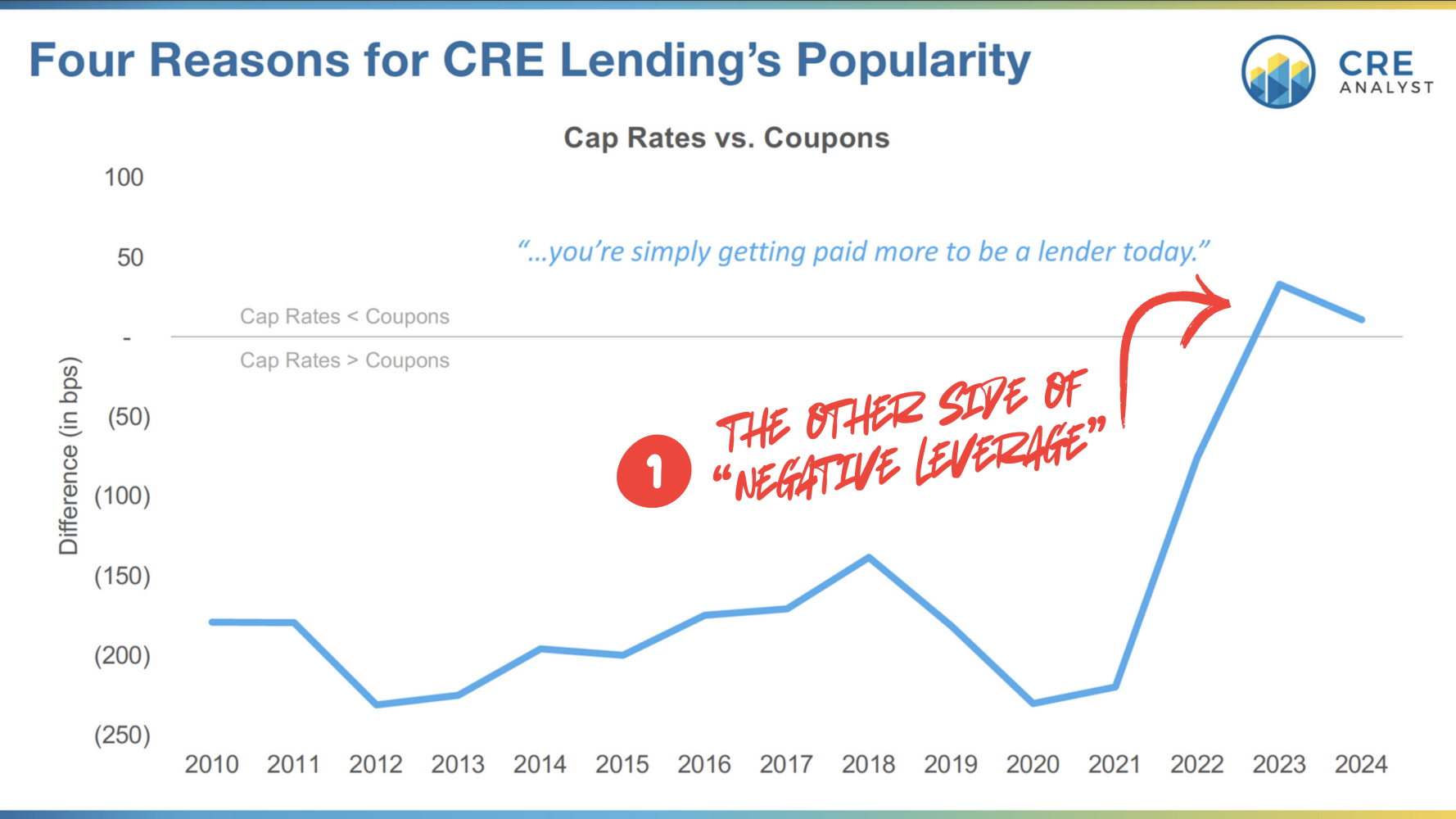

2. More yield: Lenders are getting paid much more today for taking (at worst) the same risks as before.

3. More cushion: Property values and LTVs have dropped, which means lender positions are even safer than before.

4. Juicy relative value: Real estate borrowing rates have diverged from corporate bond yields, offering more spread than over the last 10+ years. This is a rare disconnect.

5. Banks on their heels: Banks account for 40%+ of real estate credit markets and are stepping back in a big way.

6. A refinancing tsunami: Over $2 trillion in commercial real estate debt needs refinancing by 2026, much of it from deals made when rates were near zero. Those borrowers need new money, fast.

7. Private lenders are the answer: Insurers and CMBS markets can only do so much. Private credit funds have the flexibility and the appetite to meet the demand.

8. Policy tailwinds: The economy is shifting toward a more reflationary environment, which means higher borrowing costs are likely here to stay.

9. Go big or go home: The players who can scale up and stay picky about their deals are the ones who’ll clean up in this market.

10. A long runway: Real estate markets aren’t bouncing back overnight. But for lenders who step in now, the combination of strong demand and limited supply could mean years of solid returns.

TPG recently outlined a four-point explanation of "why we like opportunistic real estate credit," summarized in the attached deck and linked in comments.

You joining the debt party?

Stay tuned for the other side of this argument...

See our insights here.

COMMENTS