Help wanted: manage $2 trillion in AUM, strong starting pay but limited upside and constant public scrutiny.

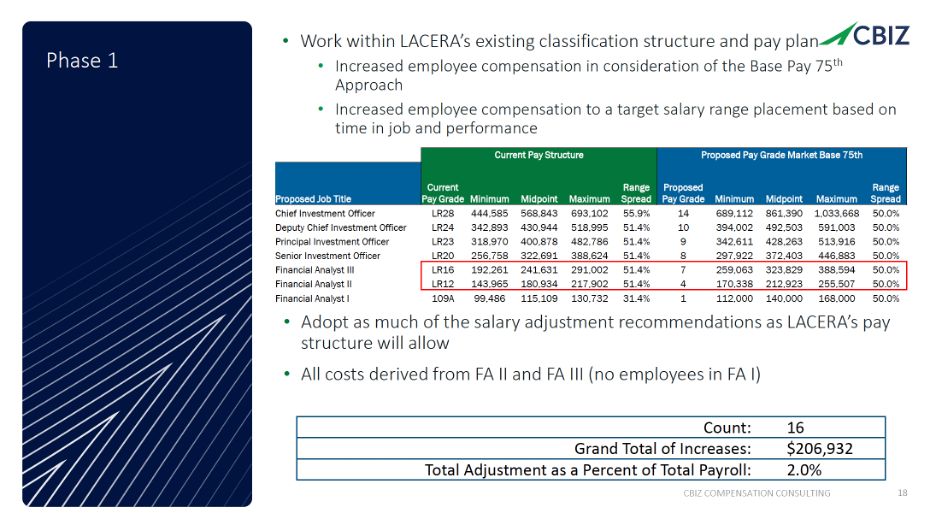

LACERA is restructuring its pay structure. Their consultant pulled compensation data from some of the largest U.S. public pensions (collectively managing more than $2T) and is recommending near- and long-term changes.

A few takeaways:

1. Pension fund managers don’t get paid that well?

Financial analysts could make $170K–$389K. Solid, even for SoCal. But under the proposed structure, the top two investment leaders would max out between $400K and $1M. Sounds big but well below market for experienced senior managers handling billions.

2. The market for talent is fierce.

Pensions don’t move fast, but this one is making moves. The consultant is pushing meaningful change, acknowledging that talent wars are real.

3. So why the cap on comp?

Straight from the consultant's memo:

-- Pros: Aligns with goals, attracts talent, rewards performance

-- Cons: “Negative member and media perception”

And there it is, the core conflict:

You need top talent to be an effective steward of retirement capital.

But public perception resists private-sector pay.

LeBron James makes $50M a year.

Overpaid? Maybe, maybe not.

But if he left the Lakers, no one’s retirement would be at risk.

Our two cents...

Pension fund investment managers have to compete in some of the most competitive markets on earth, yet they rarely make millions and never make billions. They're stewards of public capital. Pay them what they’re worth.

If you're in a public pension fund and want the same real estate training that the biggest firms in real estate get, DM us.

COMMENTS