Case study: Diving into a $1 billion real estate portfolio

Total pension size: $11.3 billion

Source of funds: Pensions of San Diego city employees

Real estate portfolio:

-- $1.1 billion

-- 70% core equity

-- 18% non-core equity

-- 8% core debt

-- 4% non-core debt

Long-term returns:

-- 6.6% vs. 6.0% benchmark

-- Core portfolio: 6%

-- Non-core portfolio: 8.6%

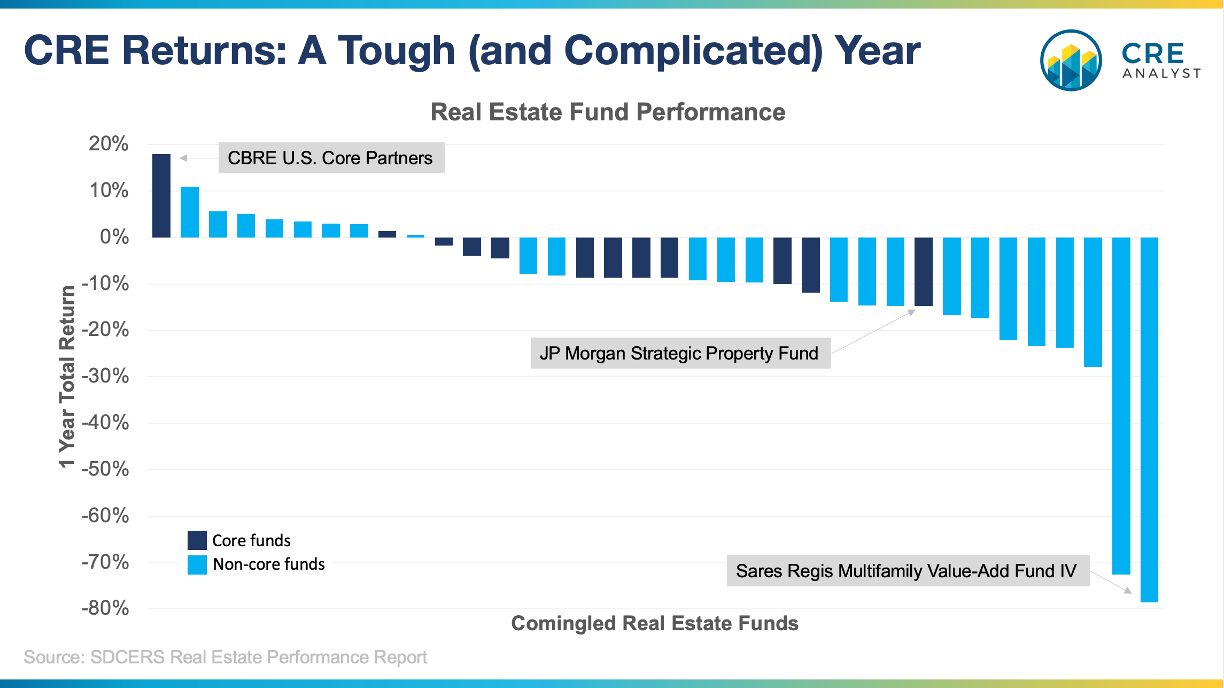

Returns over the last year:

-- Core portfolio: 9.5% across all core funds

-- Core range: -14.8% (JPM) to +17.9% (CBRE)

-- Non-core portfolio: -15.1% across all non-core funds

-- Non-core range: -78.5% (Sares IV) to +10.9% (LaSalle Asia V)

COMMENTS