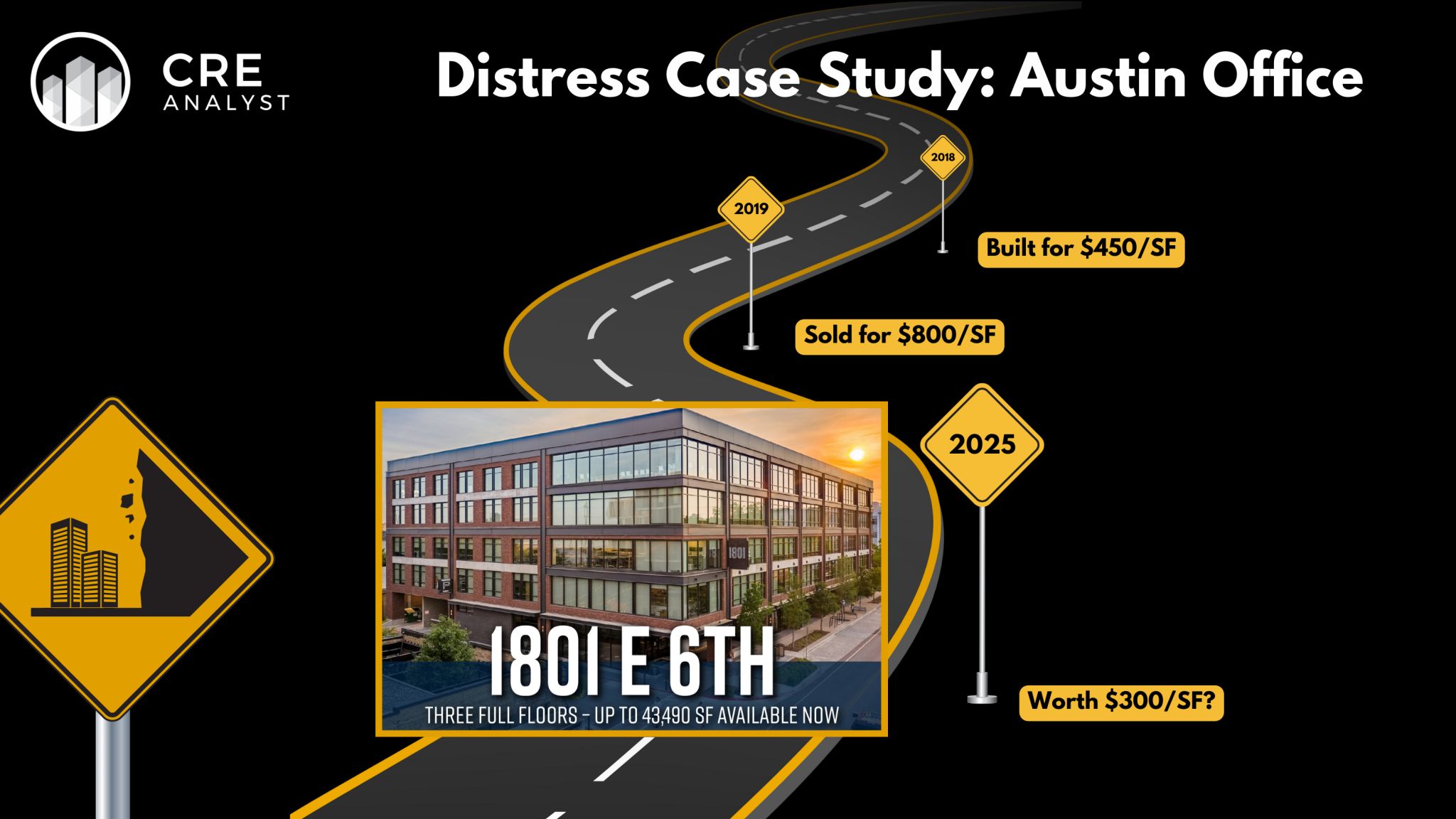

Road map: from $800/SF to $300/SF in 5 years

Brand new building in 'top market'

Phase 1: Get to $800/SF

1. Pick a market with explosive growth, preferably with an emerging tech scene and 'cool factor' (Austin).

2. Find a piece of dirt in an up-and-coming area (East Austin).

3. Develop a building that could get the highest possible rents (office).

4. Don't worry about credit tenants. They don't like up-and-coming areas. Just lease it up to 95% so it looks solid.

5. Find a core fund that is on the outside looking in on the "number 1 market to watch" in the ULI/PWC Emerging Trends survey.

6. Sell the building for approximately $800/SF when core investors price rollover, capital, rent growth, and exit cap rates to perfection. 5% is a nice round number.

Phase 2: Get really unlucky

7. Have every single worker in the entire office market go home for a year.

8. Watch the amount of money chasing the same number of investments increase by trillions, creating a capital frenzy for everything except office buildings.

9. Then watch that money spigot get turned off suddenly when inflation increases, causing an interest rate spike that kills asset values (along with the unicorn-chasing tech startups that made your area up-and-coming).

10. See interest rates, cap rates, and discount rates expand by 300+ bps, effectively pulling all new investment dollars out of the market.

11. Have most of your tenants put their space on the sublease market since they don't need the space anymore, all but guaranteeing downward pressure on rents.

Related posts:

-- Core funds grapple with redemption queues (2024)

-- The bottom for office (2025)

-- Investors making a fortune in office (2026)

COMMENTS