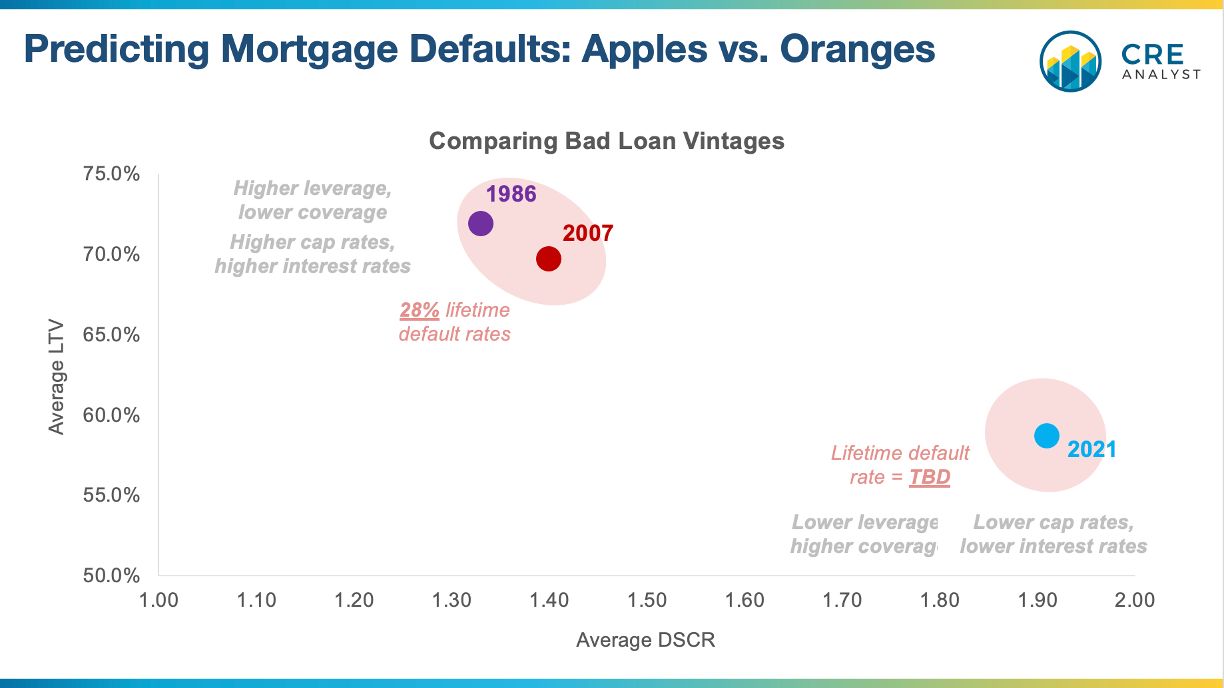

Nearly 30% of loans originated in 1986 and 2007 defaulted. Are we in for a replay or is this time different? Pick your argument...

---- This time is different ----

Lenders were a lot more disciplined this time. 70% LTV was the norm in the mid-1980s and early/mid-2000s. But pushing past 60% for the last 5+ years has been hard.

Okay so cap rates were really low and have expanded, but loans don't default just because property values fall. They default when there's not enough income to cover debt service, and today's loans benefit from much stronger coverage ratios. Also, fundamentals are generally still healthy.

Worst case, lenders may just have to accept rates that look bad compared to what they could get today to facilitate kicking the can.

---- Here we go again ----

This environment is very unlike the 1980s and early 2000s, but loan stress is loan stress, and problems are brewing.

The Fed saved the day in those downturns by keeping rates low, but that's not as much of an option today. QE seems done for good, and eventually, these borrowers will have to refinance their overleveraged loans.

There are big gaps between where lenders are willing to lend (up to 55-60%) and where borrowers need them to lend (80-85%) to prevent having to make massive capital contributions.

Expect lots of forced sales and downward valuation pressure, worsening the problem.

What's your call?

COMMENTS