Imagine being a fly on the wall in a fund platform's ownership meeting...

Investment managers talk a lot about investments and fundraising but (almost) never talk about the business of investment management.

Most of their conversations are behind closed doors, but here are some comments from a recent presentation by Sun Life, which owns 56% of BentallGreenOak, the fast-growing real estate fund platform.

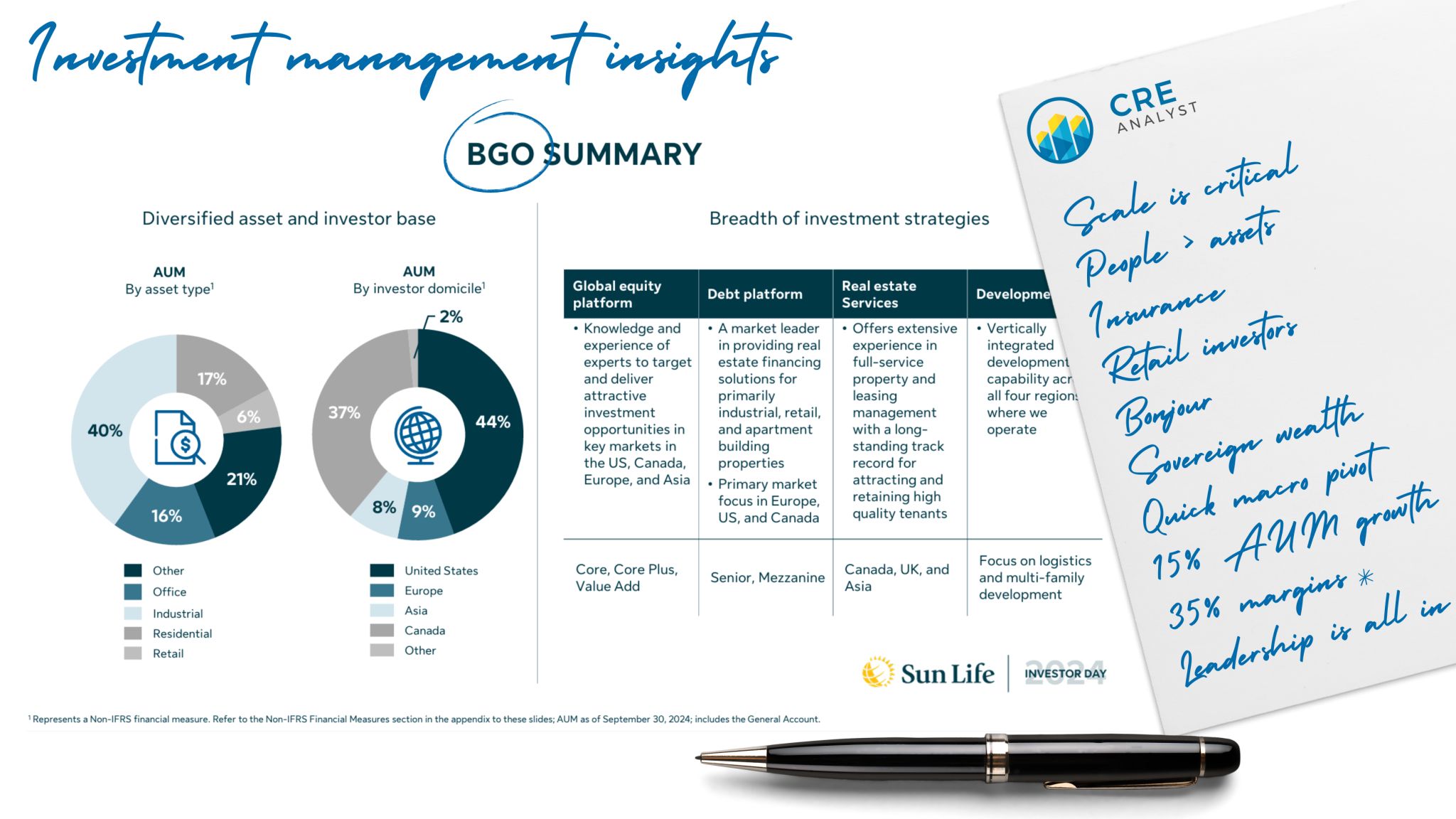

Takeaways from Sonny Kalsi's (CEO of Sun Life Capital) investor day presentation about BentallGreenOak (BGO):

1. Scale is Critical: In a world of haves and have-nots, Kalsi emphasized that scale is essential in asset management. BGO, nearing $300 billion in AUM, competes favorably with industry leaders like Ares and Blue Owl, positioning itself as a preferred manager for clients seeking to consolidate relationships.

2. Acquisitions are People-Centric: Growth through acquisition has been challenging but successful for BGO. Kalsi stressed that asset management is more about managing people than assets, highlighting the importance of culture, incentives, and leadership alignment.

3. Insurance as a Growth Lever: Being affiliated with Sun Life, a leading insurance company, gives BGO a significant advantage. This partnership provides direct access to capital, expertise in the insurance sector, and the ability to cater to insurance clients effectively.

4. Focus on Retail Wealth: BGO sees retail wealth as a major growth area, with partnerships like Scotia and Sun Life’s wealth channels serving as key platforms for expansion.

5. Geographic Expansion: BGO is targeting growth in the Middle East and Canada. It raised $1 billion from Middle Eastern investors in 2023 alone and sees untapped potential in Canada’s concentrated pension community.

6. Strategic Partnerships: BGO is prioritizing partnerships with sovereign wealth funds by offering cross-strategy solutions and fee breaks. “One-stop solution” is a strong pitch.

7. Capitalizing on Headwinds: Despite challenging conditions for real estate over the past four years, BGO is optimistic about improving market dynamics.

8. Organic Growth Goals: BGO aims for 15%+ third-party AUM growth and 20%+ FRE growth, underpinned by operational improvements, strategic execution, and existing assets.

9. Efficiency and Margins: With a focus on improving FRE margins (targeting 35%+), BGO is confident in achieving efficiencies as the platform integrates and scales further.

10. Leadership Commitment: Kalsi highlighted his personal commitment by transferring his ownership in BGO to SLC Management, signaling alignment with Sun Life’s broader vision and ensuring long-term focus on delivering results.

We could see ownership discussions like this pouring more into public over the next few years, particularly at smaller managers as the difference between winners and losers continues to grow. Doubtful that other managers are as upbeat as BGO.

COMMENTS