Same labs, different marks

Two years ago, life science real estate was hanging on to its reputation as a belle of the real estate ball. ULI and PwC ranked it 4th out of 27 property types for investment prospects.

Reality took a sharp turn, though, thanks to falling post-COVID demand and slower biomed capital flows.

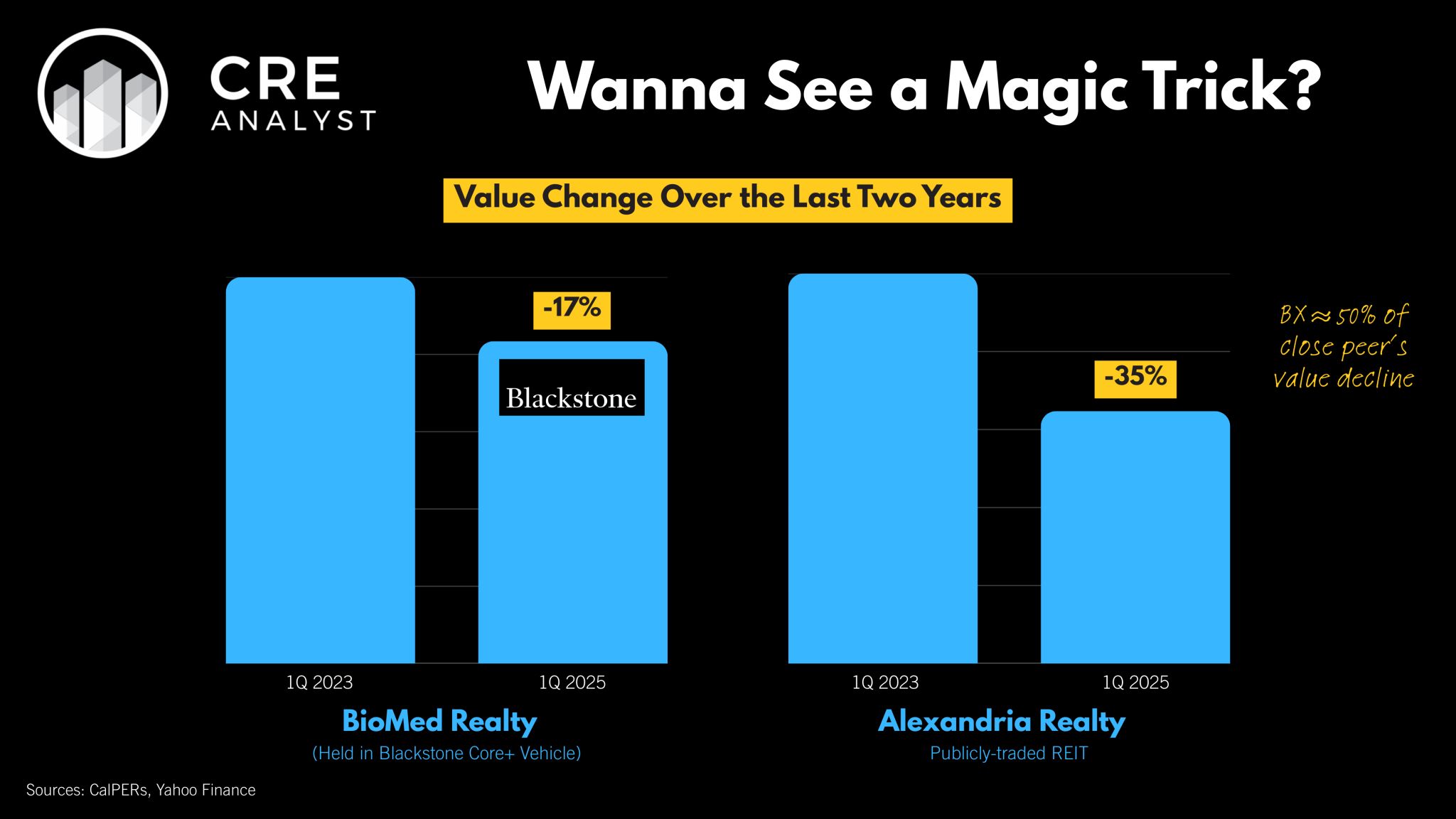

Alexandria (a $15B REIT and the industry’s bellwether) is down 35% over the last 2 years.

…down 35% over 2 years.

Now the private side.

Blackstone bought BioMed Realty in 2016 in BREP VIII, then recapitalized it in 2020 into a perpetual core-plus life sciences vehicle.

We requested, received and reviewed documents from one of the vehicle's largest LPs, which suggest that the Blackstone BioMed vehicle is down only about 17% over the last two years.

Public prices, down 35%.

Private NAVs, down 17% over the same window.

Same sector.

Similar exposure.

Same time period.

Different marking systems.

What are we missing?

COMMENTS