One data point is not a trend but this is a trend...

Blackstone bought Tricon (SFR) for $7.5 billion in January.

Blackstone bought AIRC (multifamily) for $9.5 billion in April.

KKR bought Quarterra (multifamily) for $2.1 billion in June.

And Blackstone just announced it will buy ROIC (retail) for $4.0 billion.

All of these deals were priced at substantial premiums to publicly traded real estate values, despite private appraisals continuing to lag REIT share prices (until the last few months). Why?

1. Private equity sponsors: no pension funds or insurance companies. These firms aren't looking to lay up. They're not afraid to underwrite aggressively and act on conviction when they have...

2. Dry powder: the vehicles that purchased these deals all had fresh funds in hand. e.g., Blackstone's BREP X and KKR's insurance subsidiary.

3. Glass-half-full underwriting: the way these deals priced surprised more people than the fact they got done at all. 4-5% cap rates for resi and sub 6% caps for retail would have been almost unthinkable a year ago, unless you gave credit to future income growth. Pretty easy to get to the strike prices otherwise.

4. Favorable debt: the three larger deals came with favorable debt, and Blackstone upsized their leverage profiles with cheap SASB financing. Good example of why it's important to understand the difference between negative leverage (UIRR < cost of debt) and "negative leverage" (cap rate < cost of debt); Blackstone will likely look like a hero with positive leverage despite a broad chorus of professionals who proclaimed negative leverage was killing deal activity.

5. Insurance company backing: KKR's deal seems like an outlier. We estimated KKR's pricing corresponded to a 5% cap rate, but they said on a recent earnings call that it was actually a low 4%. And they bought it all cash. How? An insurance company affiliate. The big PE shops (e.g., KKR, Blackstone, Apollo) have amassed very large insurance affiliates, which they insist will lead to more real estate capital.

Notably missing from these defining traits:

-- HNW/retail capital is all the rage but is still on the sidelines.

-- Favored asset classes; no contrarians.

-- The big buyers were all mega investment managers (big get bigger?)

-- Brookfield hasn't re-joined the party.

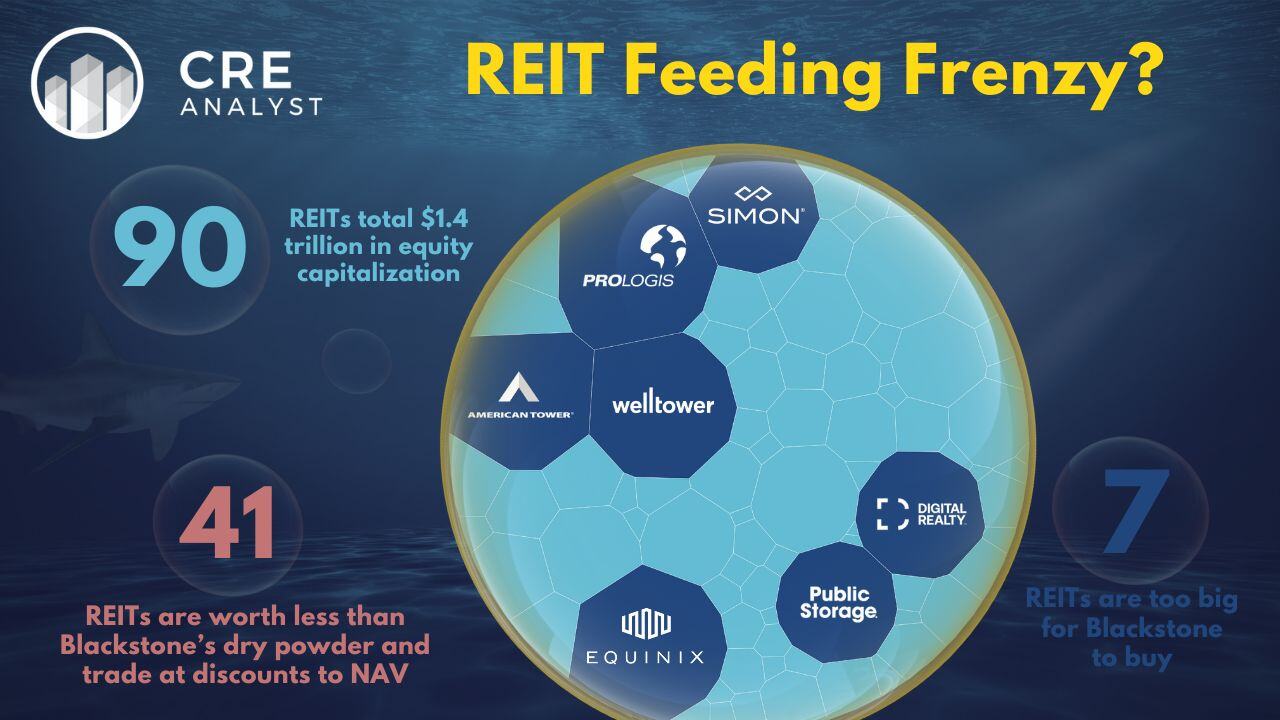

We're starting to see more pundits calling for increased REIT privatizations. There are 40+ REITs currently trading below NAV, that Blackstone could buy with its $55 billion of real estate dry powder. And, notably, BX's dry powder is only down by 16% after doing the deals that have already closed this year.

Now that there's a clear privatization trend, will we see more? Will Blackstone continue to dominate or will others join? Will they stretch beyond the favored asset classes?

COMMENTS