Why shut down a $6 billion real estate fund platform? [Ameriprise/Lionstone]

A doomed marriage?

Ameriprise bought Lionstone back in 2017, saying: “Real estate is an important asset class for institutional and retail clients, and we are enthusiastic about the opportunity to further our capabilities in this growing asset class.”

Why was Lionstone attractive to Ameriprise?

"We already have a nice property business in the UK and it’s been a great complement and we leverage through distribution what we do there. We weren’t in that space in the U.S. and Lionstone gives us a beachhead. We can help them expand. They have good capability to launch other products that we thought would be interesting in the retail space, which they’re not in today."

Estimated acquisition economics...

Although the acquisition price was never disclosed, we think Ameriprise probably bought the firm for a low AUM multiple. Nothing like Legg Mason's similarly-timed acquisition of Clarion for about $600M. Wild guess: call it $50M, plus a pledge to invest $150M or so in funds/JVs and maintain about $30M of annual G&A (per pension fund and SEC disclosures). ...in exchange for about $6 billion in assets.

A concentrated investor...

We think Lionstone's biggest investor (by far) was the State of Oregon. Two years ago, Oregon listed Lionstone as its fourth largest manager with $800M, but it fell to $483M earlier this year.

Lionstone's approach: AI, office, and development...

Lionstone overinvested in office, but the firm has always tried to differentiate itself by its "data-driven" approach and investments in AI:

"Lionstone analyzes diverse data sets and uses a proprietary algorithm-based approach to translate information into a detailed understanding of location and physical space. Lionstone’s advanced analytics isolate submarkets and specific locations where the greatest demand for space exists relative to supply."

This week's news...

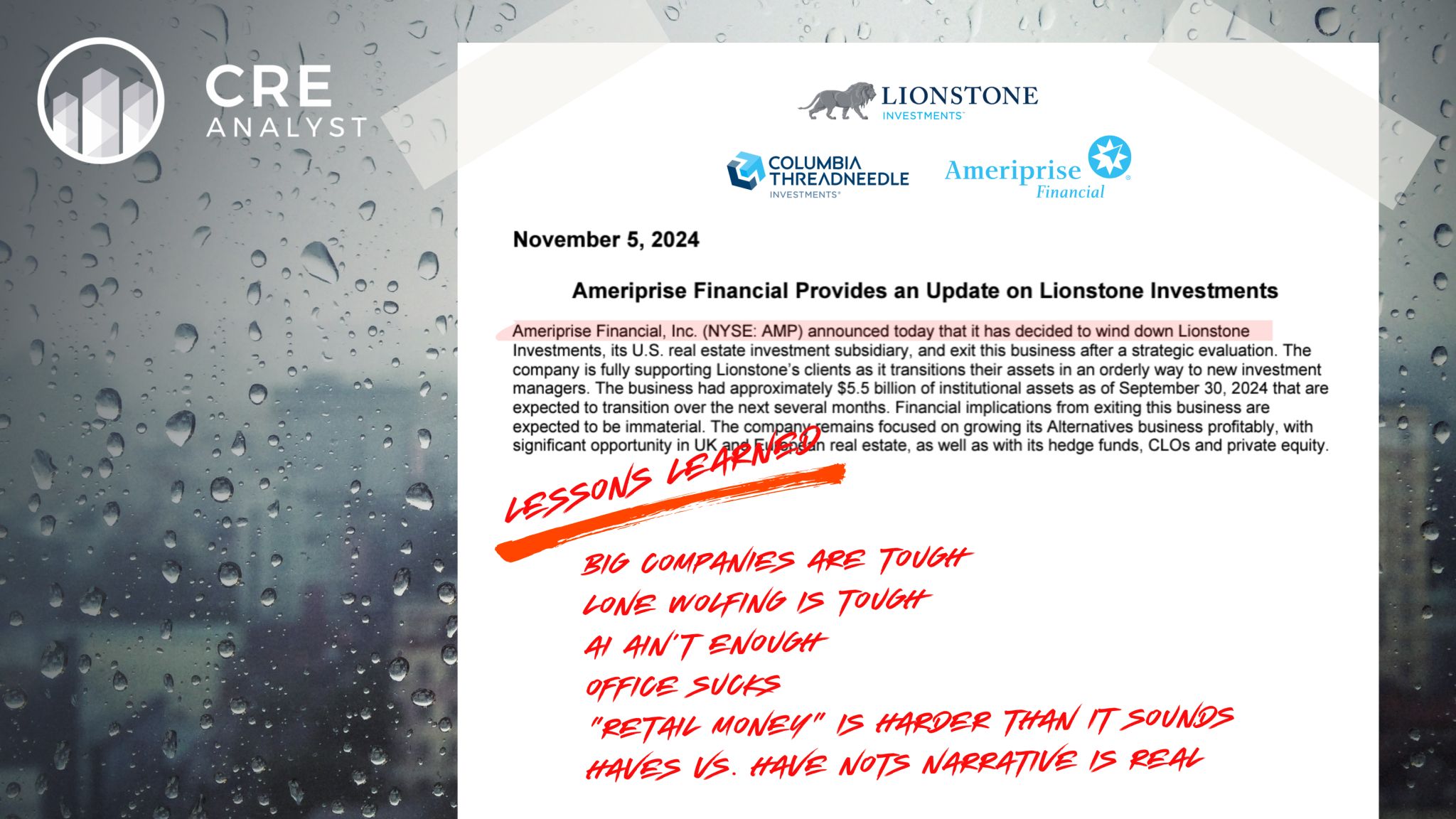

"Ameriprise Financial, Inc. announced today that it has decided to wind down Lionstone Investments, its U.S. real estate investment subsidiary, and exit this business after a strategic evaluation."

---- Our takeaways ----

1) $6B of AUM sounds meaningful, but it wasn't diverse, discretionary, or promote-earning (on balance).

2) Key Lionstone staff departed in recent years.

3) The retail channel never materialized.

4) Lionstone's average deal size was $30M pre-acquisition but swelled to $100M pre-Covid. Very competitive space.

5) Blackstone and Brookfield boast that investment management mandates are consolidating with the largest firms. This may be a consequence.

6) Ameriprise's business is skewed away from private assets and U.S. real estate.

How many other investment managers are facing similar pressures?

Is Lionstone's shutdown a one-off event or a sign of more pressure to come?

Affected by Lionstone's wind down? DM us if we can help with training or job leads.

COMMENTS