Extend and pretend vs. accelerate and liquidate

---- Federal Reserve's take ----

"...banks 'extended-and-pretended' their impaired CRE mortgages in the post-pandemic period to avoid writing off their capital, leading to credit misallocation and a buildup of financial fragility."

---- Question for the Fed ----

Question for authors Matteo Crosignani and Saketh Prazad:

You concluded that "banks have extended the maturity of their distressed CRE mortgages coming due and pretended that such credit provision was not as risky to avoid further depleting their capital."

Is it possible that "pretending" (as you defined it) actually mitigates losses in this environment?

---- Here's a realistic scenario ----

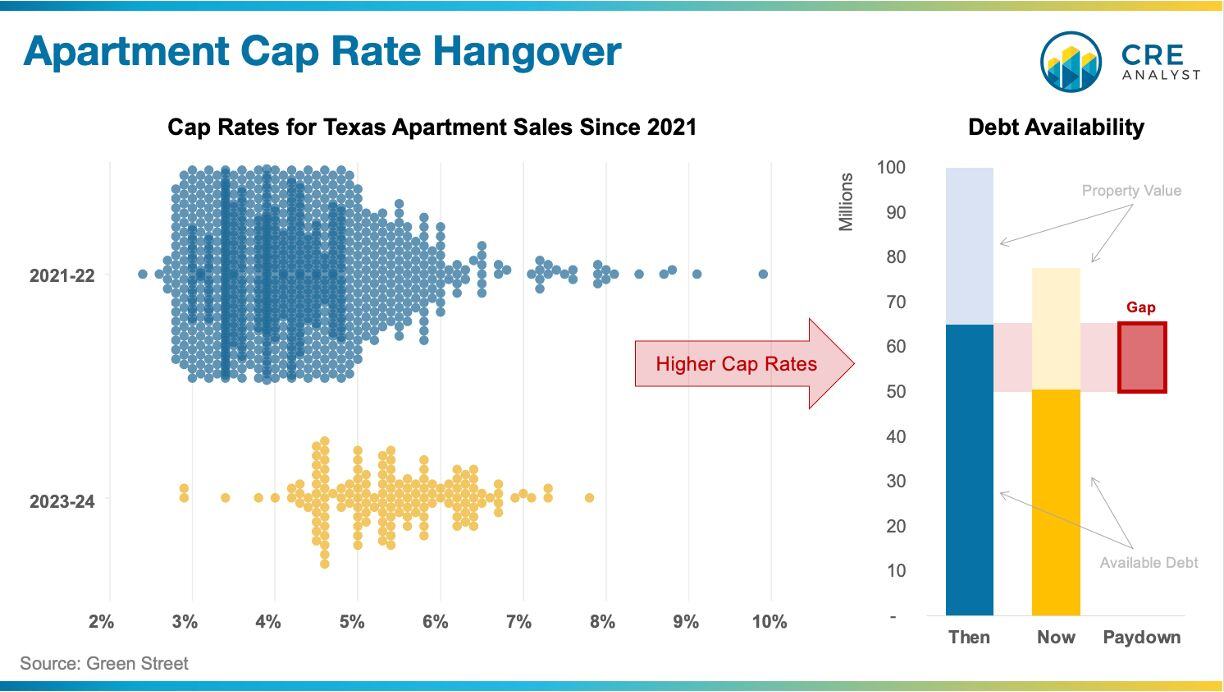

The Texas apartment market over the last four years...

In 2021 and 2022:

-- $300B+ of annual transaction volumes

-- Low 4% cap rates

-- 65% LTV financing, floating, short-term maturities

Since 2023:

-- $100-200B of annual transaction volumes

-- Mid 5% cap rates

-- 65% LTV available on revised values

Scenario:

-- You bought a $100M property with $65M debt.

-- That property is now worth $78M due to higher cap rates.

-- You've lost $22M on paper and have $13M in remaining equity.

-- Lenders will only finance $51M.

-- So at maturity, you must come up with $14M or face foreclosure.

Your loan is about to mature, and the bank is playing hardball.

Do you come up with the $14M to save $13M?

Where do you get the additional $14M?

[Sidenote: If 50+ years of lending is indicative, there's a decent chance the bank would be unfavorably surprised if they foreclosed on the property and tried to sell it. i.e., LGDs are rarely less than 0%.]

Or, instead of big paydown, the bank could just extend the maturity. The Fed calls this calls this strategy 'extending and pretending.' But the alternative would be to have a maturity wall today on a struggling property with a borrower who wouldn't presumably walk away unless you forced a major paydown.

Notably, most loans have built-in extension provisions, but these usually come with tripwires (e.g., interest rate caps, max LTVs, etc.) As long as borrowers invest in their properties, wouldn't an extension mitigate potential losses by preserving full recovery scenarios?

This is a hypothetical situation, but it's being felt all over the country, especially in sunbelt markets where capital was the frothiest. Apartment fundamentals are recovering, but we may still be in the early innings of the balance sheet reckoning.

COMMENTS