From the newsroom...

A: "Traffic’s down on my real estate pieces. I need a hook. Any tips?"

B: "Remember how blindsided everyone was in the GFC? This time could be worse."

A: "Worse than the GFC? Come on, that was a once-in-a-lifetime shock."

B: "Exactly! That’s what we thought last time too, right? But now we’ve got high interest rates clobbering property values. Investors are waking up to the fact that they bought high, and now they’re stuck. And don’t get me started on the maturity wall."

A: "Maturity wall? Sounds ominous."

B: "It’s real, Alex. Debt’s maturing, and lenders are 'extending and pretending'—keeping loans alive as if the market’s going to bounce back. But how long can they kick the can? At some point, they’re out of road."

A: "So, you’re saying rates push down values, owners are stuck, and lenders are just hoping this’ll blow over?"

B: "Yep, but hope isn’t a strategy. Higher rates mean lower valuations, and when those loans come due… It's ugly. And that’s exactly what readers need to know. 'Is Your Building the Next to Tank?' or 'Commercial Real Estate’s Ticking Time Bomb.' This isn’t just hype; people need to know this.

A: "So, we’re actually doing them a favor—giving them a heads-up before they’re blindsided like in ’08."

B: "Exactly! If you saw a train coming, wouldn’t you want to yell? This is their chance to get ready before the lenders come knocking."

A: "Alright. Let’s give them the real story."

----------------

This wasn't an actual conversation heard in a newsroom, but how else could we consistently get headlines like:

'The Bill Is Coming Due on a Record Amount of Commercial Real Estate Debt' (WSJ, 1/16/24) and

'The $1 trillion ‘wall of worry’ for commercial real estate that spirals through 2027' (MarketWatch, 7/24/23).

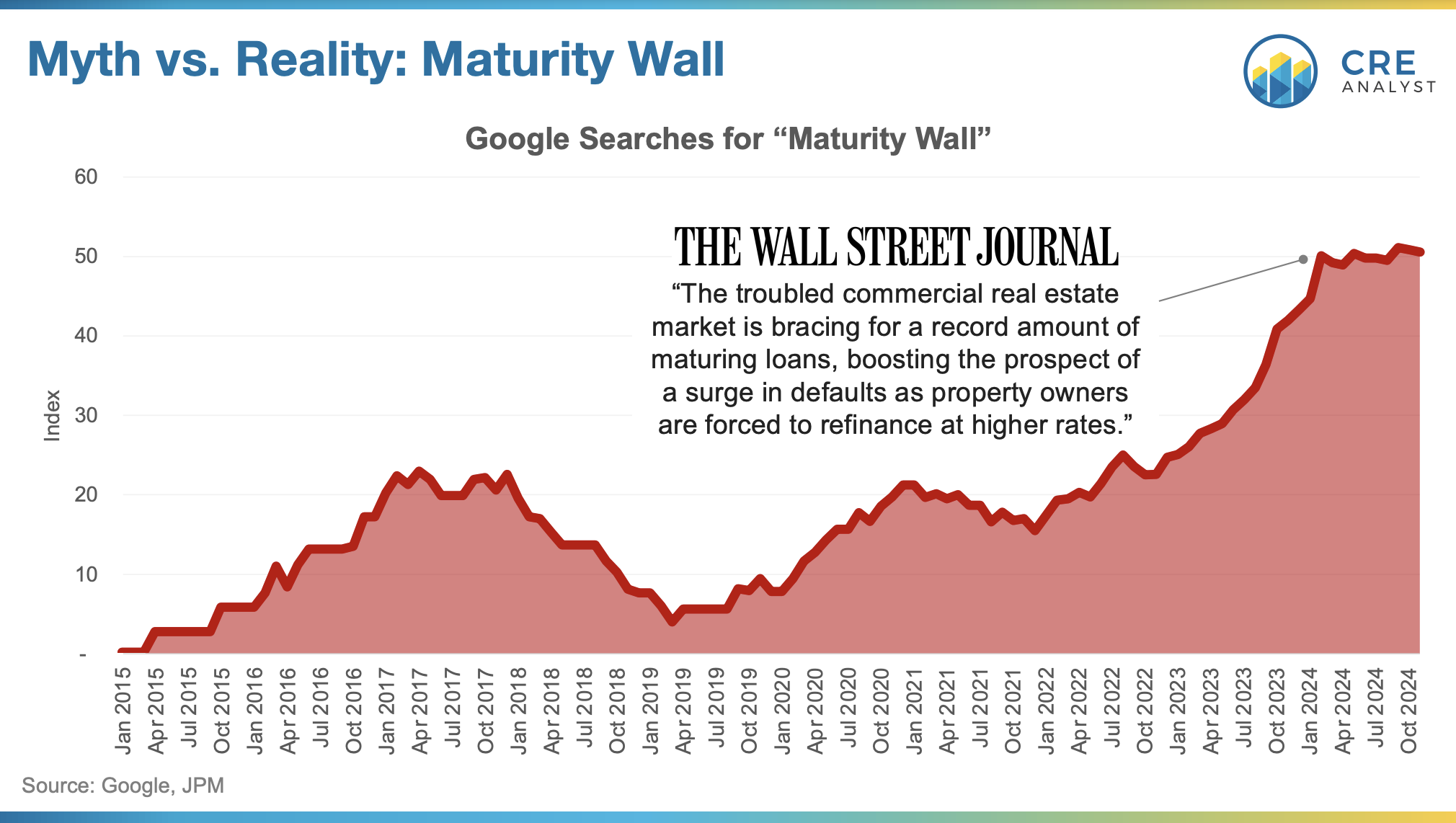

Doomsday reports of commercial mortgage maturities have dominated headlines for the last two years. ...closely following Google searches for "maturity wall."

But details matter.

Yes, maturities were scheduled to peak in 2024 and 2025. But those were original maturities. Floating-rate loans, in particular, almost always come with extension options. When you account for these realities, near-term maturities are 50% lower.

----- Takeaways -----

-- Delinquencies and defaults: Problem loan rates have increased over the last 18 months, and more problems are on the horizon. But bank delinquencies are around 2%, compared to 10% in the GFC and 17% in the early 1990s. Perspective is important.

-- Extend and pretend: Is extending a loan per the loan docs "pretending"? Isn't it smart to "kick the can" on a performing loan to allow income and value growth, rather than forcing losses?

-- Avoid echo chambers: It's easy to be drawn into doomsday narratives, but real estate markets are complicated. Navigating them requires having accurate reads on how these markets shift over time, which is antithetical to black/white thinking.

Read the full report here.

COMMENTS