Diving into mortgage REITs and debt funds...

---- CRE debt providers ----

-- Banks

-- Insurance companies

-- CMBS

-- Agencies

-- Debt funds / MREITs

Debt funds and mortgage REITs have the smallest market share of the CRE debt space, but they have grown the fastest and dominate the market for higher-yielding real estate credit.

i.e., debt funds and mortgage REITs often provide debt secured by projects that other lenders don't want to touch.

---- A pretty simple business ----

Despite lots of acronyms and financing schemes, mortgage REITs/debt funds are pretty simple businesses:

-- Gather equity from investors (HY fund investors, REIT investors, etc.)

-- Borrow money from banks and bond investors

-- Lend that capital to property owners

Four key decisions made by debt fund/MREIT sponsors...

1. Leverage: How much do you borrow vs. finance with equity?

As long as there's a spread between your cost of debt and the net yield on your debt investments, more leverage will increase returns to your investors. But there can be a lot of fluctuation on both sides.

2. Maturities: How do you manage the maturities on your loan investments vs. the maturities on the debt you borrowed to finance those investments?

There are several ways you can finance loan investments. Revolving lines, warehouse lines, corporate bonds, CRE-CLO executions, loan on loan financing. Each has a different maturity profile. Mismatches cause big problems.

3. Fixed or floating?

Since the spread between investments' unleveraged returns and the cost of debt defines net returns (or lack of) to investors, you'll want to make sure you don't get upside down. ...which is harder in practice than it may sound.

It'd be easy if borrowers only wanted fixed-rate loans and there was steady fixed-rate financing for those loans, but financing markets are volatile, which can make this balancing act a challenge.

4. How much risk do you take in lending?

If you thought you were lending at S+800 but ended up getting a net S+300 on your loan portfolio because of a few costly defaults, your positive loan spread likely just turned negative, which means all the debt you borrowed to finance your loan portfolio made unattractive returns even more unattractive. Your equity investors will run and your lenders will want to be paid off.

On the other hand, if you accurately estimated your net returns to be S+700 and borrowed 75% at S+400, your equity investors will make extremely outsized returns.

---- Mortgage REITs: Tip of the spear ----

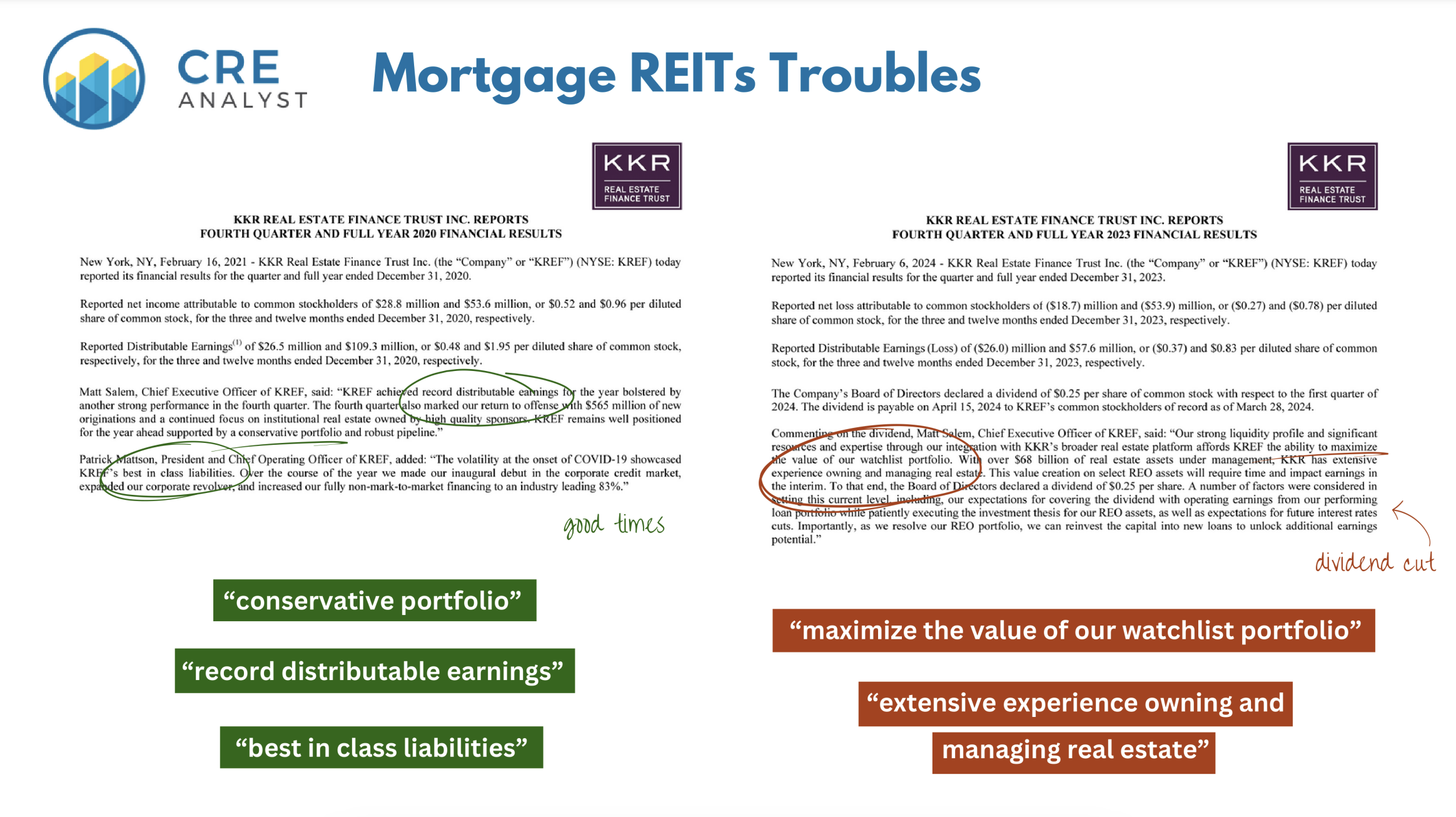

Recent interest rate hikes, and the market's responses to these hikes, have created some big challenges for mortgage REITs.

-- Equity is more expensive

-- Borrowing costs are higher

-- Proceed levels are lower

-- Property values are down

-- Property incomes are down

-- Defaults are trending higher

You can see some of the effects these challenges are having on mortgage REITs in these slides.

COMMENTS