Sea change...

"What inning are we in?"

"Is inflation transitory?"

"What are the odds of a recession?"

"How long will the yield curve stay inverted?"

"Will the Fed finally cut short-term rates?"

"Green shoots?"

The themes that dominated discussions over the last few years all have a familiar thread: Risk on, risk off

i.e., All good. All bad. All good again. Carry on.

But what if this way of looking at the world is totally disconnected from reality? What if our benchmark paradigm gives us more comfort than insight? What if there's something much larger going on that won't be broadly appreciated without the benefit of hindsight?

---- Our working hypothesis ----

The "risk on, risk off" paradigm no longer applies.

The tailwind of falling interest rates over the last 40 years masked nuances that will be much more evident, far-reaching, and performance-defining going forward.

---- An intoxicating 40 years ----

Between 1982 and 2020, the 10 Year Treasury fell 65% of the time (on an annual basis) by an average of 80+ bps. This is like batting 0.650 and averaging a double every time you get a hit.

In about a third of the years following 1982, rates increased by an average of 51 bps YoY.

So not only were falling rates 2x more likely, they were also 60% more powerful.

The natural bias that this tailwind has instilled is almost impossible to overstate.

How could a generation of risk takers NOT overestimate their skill when they batted 0.650 and consistently hit doubles for 40 years? How could they not believe that their hard work and insight will lead to favorable results?

---- This time is different ----

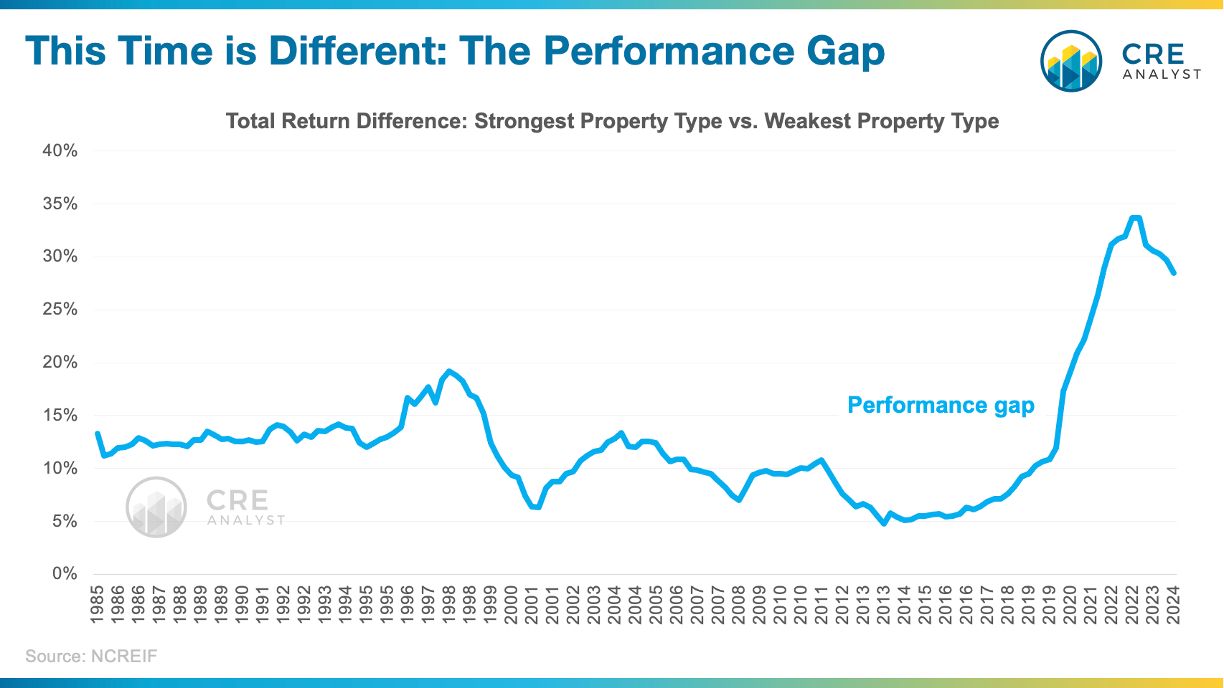

This chart could be anecdotal evidence of how "risk on, risk off" is dead.

For 40 years, the annual difference between the strongest real estate asset class and the weakest real estate asset class hovered around 1000 basis points of total return. Since 2021, this performance gap has averaged 3000 bps.

Will this gap stay at all-time wides? Unlikely. There's probably not another office sector waiting to implode. However, the underperformers won't likely be masked by falling interest rates and cap rates.

Appreciation accounted for only 20% of total returns in the 40 years leading up to 2010. Since 2010, appreciation accounted for 50% of total returns.

...hard to not be intoxicated by the falling rate tailwinds, especially when those tailwinds accelerated after the GFC.

But this is more than a hangover or a correction. ...more than a new cycle.

We are in an entirely different world vs. the last 40 years.

We'll continue to flesh out how this new paradigm will create risks and opportunities for investors and real estate professionals in future posts and on our website.

If you value this content, please like/share/comment!

COMMENTS