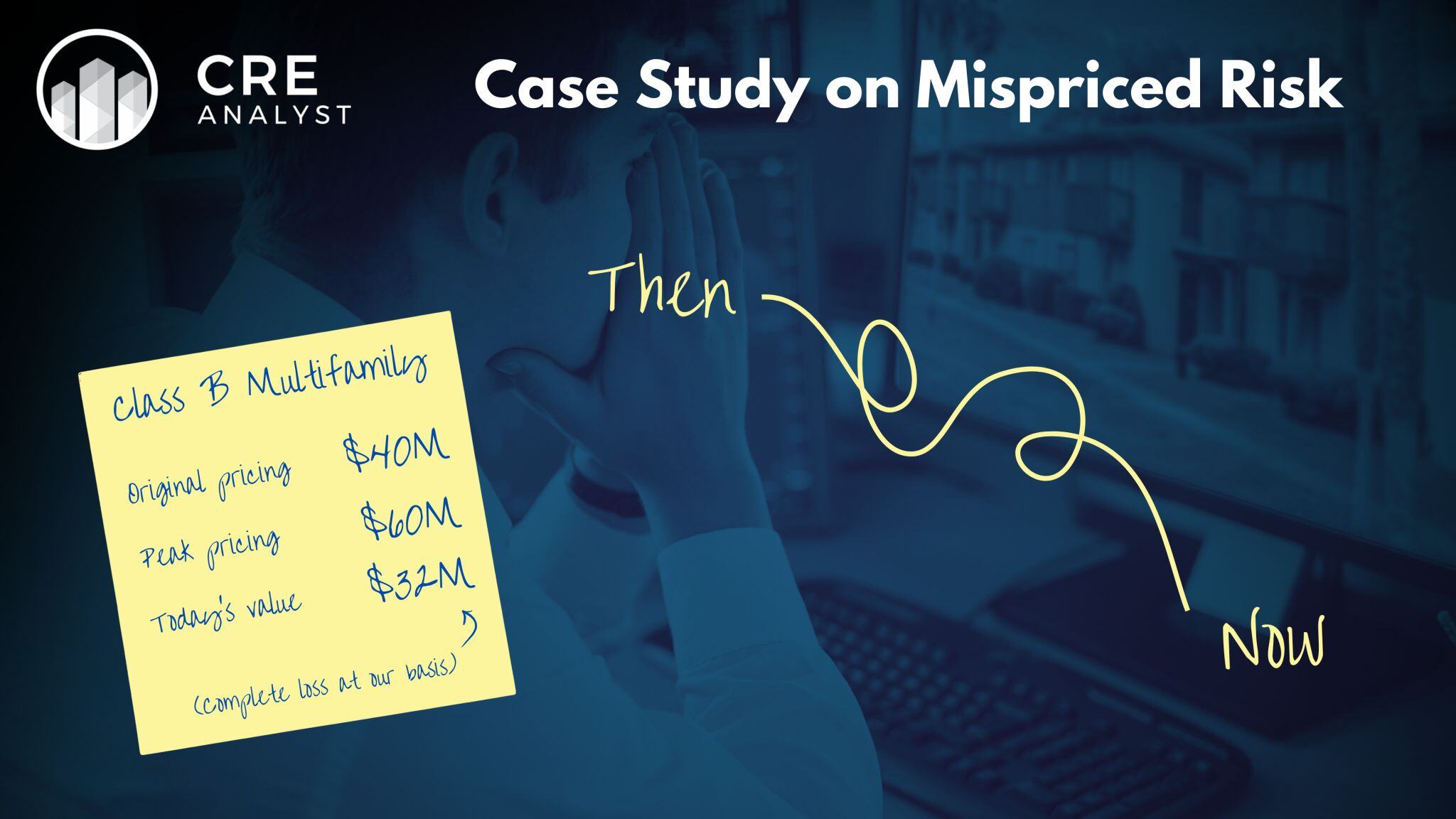

Case study: What happens when you misprice risk?

Buyers spend countless hours underwriting operating cash flow but will casually shave 100 basis points off a discount rate or cap rate.

For most of the last 30 years, this wasn’t a costly mistake.

...then that changed.

Office gets all the attention when it comes to locked up capital markets, but lower quality apartments could be experiencing a similar cycle.

Class B and C trades are non-existent, so we're left to guess about bid-ask gaps based on various underwriting assumptions.

Here's a sobering look at underwriting assumptions for a generic Class B/C asset over the 5+ years...

---- Pre-2020 ----

Rent growth: 3%

OpEx growth: 3%

Reserves: $500/unit

Going-in cap: 6%

Exit cap: 7%

Unlev IRR: 7%

Cost of debt: 4%

Levered IRR: 10%+

Implied value: $40M

For decades, B and C assets weren’t considered "core," but family offices, local investors, and individuals made solid, income-oriented returns by buying at 6-8% cap rates. Inflationary gains and mild property improvements added another 100-200 basis points, all amplified by sub-5% mortgage debt.

---- 2021-23: Fix-and-flippers ----

Rent growth: 10% from renovations

OpEx growth: 3%

Reserves: $300/unit

Going-in cap: 4%

Exit cap: 4.5%

Unlev IRR: 8%

Cost of debt: 3%

Levered IRR: 14%

Implied value: $60M

The post-pandemic market created a playbook for quick profits:

- Light renovations with big rent bumps

- Assumed tax assessments below 70%

- Minimal reserves

- High LTC floating-rate debt

- Exit before market fundamentals catch up

- For a while, it worked.

---- Today’s buyers ----

There don't seem to be many buyers of lower-quality product, so we're guessing here, but underwriting probably looks something like:

Rent growth: 0% for a few years

OpEx growth: 3%

Reserves: $1,000/unit

Going-in cap: 7.5%

Exit cap: 8%

Cost of debt: 6%

Unlev IRR: 8%

Levered IRR: 9%

Implied value: $32M

Well-capitalized buyers are back, but they’re targeting relatively new product at 4% cap rates. Very muted interest in older product due to capex, credit losses, taxes, insurance, and new supply.

Where did the fix-and-flip buyers go? If they concentrated all of their bets during the post-pandemic recovery and borrowed 65% LTV at peak prices, they’re wiped out.

---- Takeaways ----

We talk a lot in our classes about how underwriting value starts with an assessment of risk. Where does the property fall within the lifecycle of a building? Does it produce stable income or is it speculative? How does it compare to alternatives from a risk perspective?

Or as Paul Singer recently said:

“The worst trades are the trades where you misunderstand the risk. You put it into the wrong category.”

* From Nicolai Tangen’s In Good Company podcast. Although not real estate-specific, the discussion was focused on this exact topic. Worth a listen.

COMMENTS