"Here comes the sun"

The CMBS market is pretty convoluted, but it's perhaps the best place to get real-time reads on capital providers' interest in real estate debt.

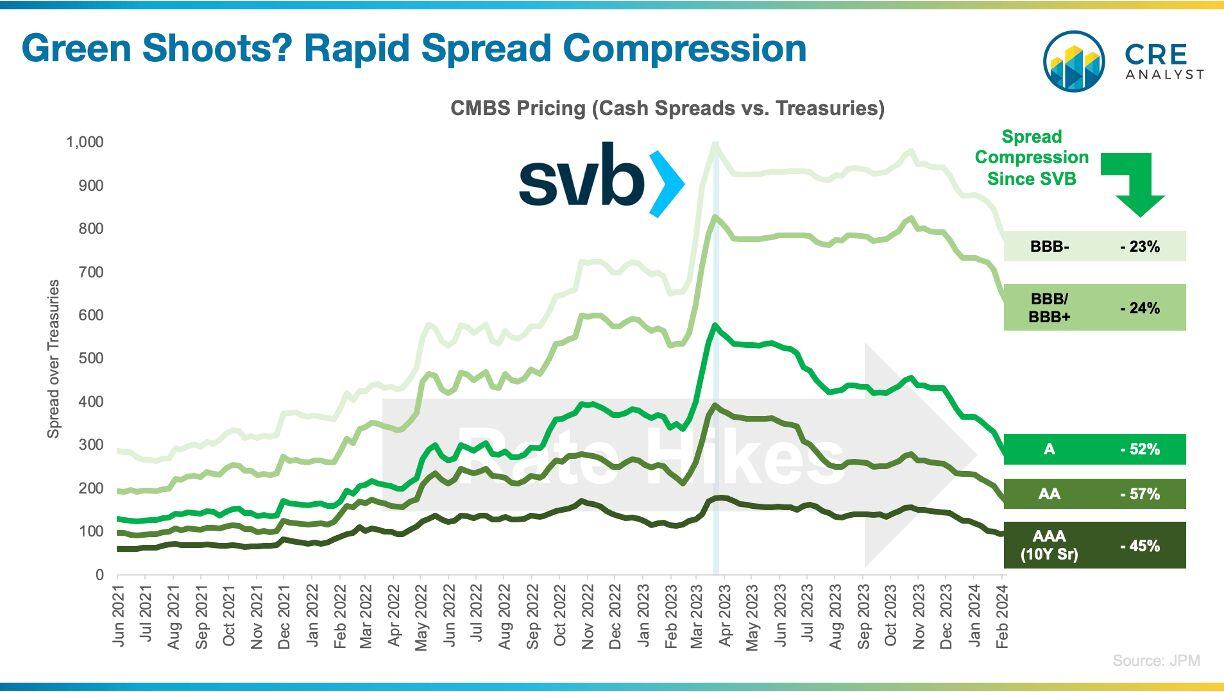

And, for the first time in years, it may be flashing green lights...

------------------------------

Quick CMBS background

------------------------------

1. Investment banks originate and pool a bunch of commercial mortgages.

2. Rating agencies differentiate the pool by setting subordination levels between CMBS classes. Senior classes (first payments) get higher ratings, and junior classes (first losses) get lower ratings.

3. Bond investors set pricing/yields by purchasing classes of the pool from the investment bank, which clears its inventory (except for "risk retention" requirements).

The CMBS market may be a deflated shadow of its 2005-07 self, but securitization is a critical part of the real estate capital markets because:

-- It regularly provides $100+ billion of loan proceeds for borrowers, and;

-- By turning commercial mortgages into credit-worthy bonds, securitization pulls dollars from the $11 trillion corporate bond market.

i.e., securitization is a portal that pulls bond investors into the real estate lending market.

-----------------------

Back to today

-----------------------

Rate hikes, bank failures, and real estate "doom loops."

To say that commercial mortgage lenders have been on the sidelines over the last few years is a bit of an understatement.

But this happens every ten years or so.

What brings lenders back into the market? Spreads gap out relative to perceived risk and uncertainty, and yield-focused investors follow the opportunity.

"Why invest in equity if you can get similar returns by investing in debt," they say.

Sound familiar?

Lenders might've "taken the rest of the year off" last November/December, but they may be getting some cold water in their faces to kick off 2024...

-- Lenders focused on AAA mortgages (call it 50% LTV or lower) thought they'd be getting T+175 but are around T+100 bps.

-- Lenders focused on A/AA mortgages (call it 60% LTV) thought they'd be getting 350-550 bps over Treasuries but are having to settle with 175-275 bps spreads.

-- Higher leverage lenders (BBB or 65%+ LTV) benchmarked to 900+ bps spreads but are facing 7 handles.

Is this data perfect? Definitely not. CMBS markets are volatile, and we're benchmarking to off-the-run secondary sales.

However, these observations suggest that commercial real estate debt may be coming off the sidelines.

...which is good news for borrowers and good news for overall stability.

COMMENTS