A microcosm of banks' CRE challenges?

This exchange came up in M&T Bank's recent earnings call...

-------------------------

Question from Analyst

-------------------------

I know you've had 10 questions already on commercial real estate. But if we look at this deep dive you did covering 60% of all commercial real estate loans, one, what are you learning?

I don't know if you're talking to building owners as you work through that process, but as these come due, you have $1 billion or so in criticized. What are you expecting?

And then when you called out the 4.4% office reserve, is that a general reserve on the office portfolio? Are those specific credits coming due where you're anticipating losses?

--------------------

M&T's Response

--------------------

Yes. I mean the $4.4 million is really a general amount. There could be a little bit of specific embedded in that. But the bulk of it is more of a general reserve from what we're seeing from that perspective.

We are seeing our clients, our sponsors really step up and really support these credits. We think that charge-offs that we had this past year were really more financial and institutional oriented. But our sponsors because they're long-term real estate owners of the property, I mean they basically own properties where they want to own them in a certain block and city of where they have it. So it's really long-term oriented. They tend to have really low tax basis in these properties, and they're going to support these credits over time. So that's really what we're seeing there.

When we go through and look at whether we should grade it as criticized or not, you're seeing some pressure on the debt service coverage ratio. Once it falls under 1.1, it goes into a criticized camp. But the vast majority of what we have in criticized is between 1 and 1.1. Yes, we had 1s under 1 in that level, but the vast majority we have there.

So over time, I think those will cure and won't result in loss for the most part. We did raise losses up a little bit for 2024. Some of that was really normalization on the consumer portfolio. And then, some of it is maybe working out a few more credits off. But for the most part, what we have in criticized is not materializing into losses.

---------------

Takeaways?

---------------

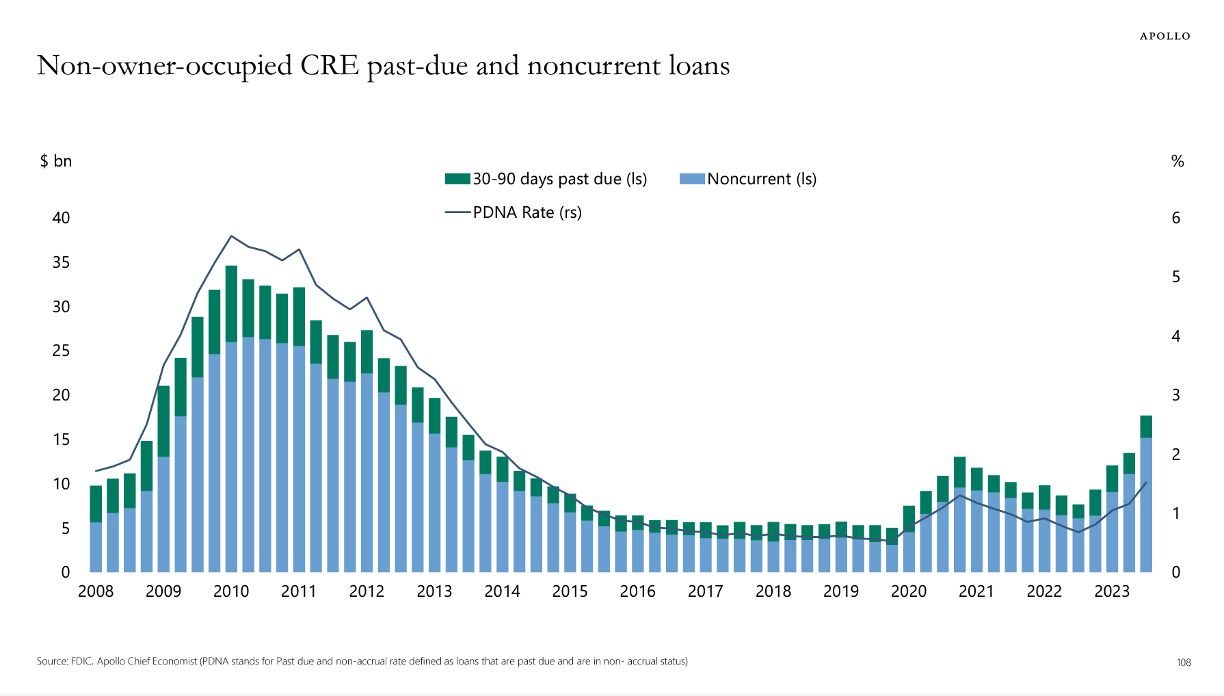

Delinquencies and bank problem loans are escalating, but there seems to be an abundance of banker confidence related to future losses.

Are you buying their confidence or are banks underestimating future challenges?

COMMENTS