Reality is a lot more complicated than headlines would suggest...

"Real-Estate Doom Loop Threatens America’s Banks" (WSJ)

"Bank Crisis Could Cast Pall Over Commercial Real Estate Market" (NYT)

"Commercial Real Estate Crash Sparks Bank Collapse Fears" (Newsweek)

"Banks Still Fear a Run on Assets, Expert Says" (Globe Street)

---- Poll: How bad are bank loan portfolios? ----

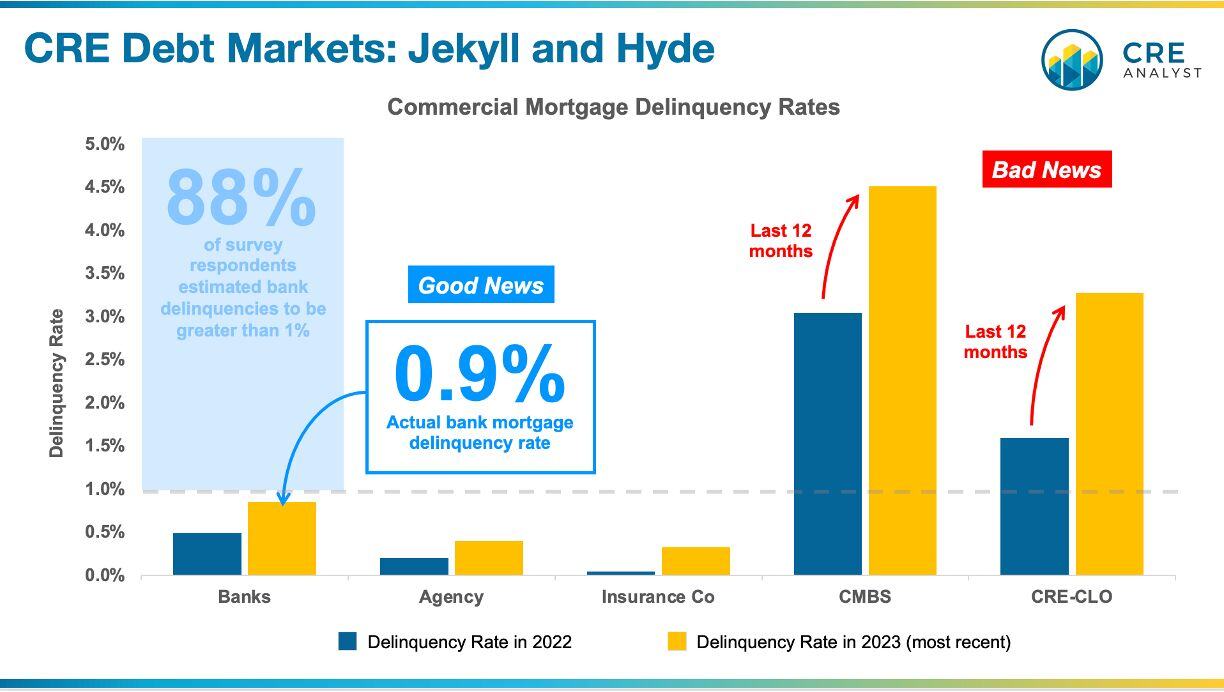

We polled our LinkedIn audience last week:

"What is the delinquency rate for commercial mortgages held by banks?"

We received 1,400 responses:

-- 21% said greater than 5%

-- 32% said 3% to 5%

-- 35% said 1% to 3%

-- Only 12% said less than 1%

---- Good news ----

The banking situation doesn't seem as bad as many expected. 80% expected delinquencies to be greater than 1%, and only 12% correctly estimated current delinquencies below 1%.

Delinquencies are up in every lender category, but there's no way to make 1% sound catastrophic. Nearly a year after some of the largest bank failures in history occurred and two years into a historically significant rate-hiking cycle, bank delinquencies remain under 1%. It could be a lot worse.

This is especially important because banks hold about $3 trillion in commercial and multifamily mortgages, which is 50% of the real estate debt markets. ...by far the largest lender profile.

---- Bad news ----

Securitized real estate debt (i.e., CMBS and CRE-CLO) only accounts for about 10% of the real estate debt markets, with about $600 billion outstanding.

...but one enduring lesson from the GFC is that a relatively small portion of the market can send shockwaves through the financial and real estate markets.

CMBS delinquencies (S&P):

-- Increased marginally overall in late 2023

-- Retail 6.0%

-- Office 5.5%

-- Lodging 4.2%

CRE-CLO delinquencies (DBRS):

-- Significantly bigger uptick in late 2023

-- Office up from 0.62% to 4.83%

-- Retail up from 1.52% to 3.3%

-- Multifamily up from 0.28% to 2.11%

This sliver of the market only amounts to about $100 billion and--to be clear--it is very different from its similarly-sounding prehistoric cousin the CRE CDO.

We've reviewed the CLO deals that were floated over the last few years (and related collateral), and there's definitely a lot of risk hiding in this little sliver.

We'll be diving into CRE-CLOs more in upcoming posts (including the largest sponsors who could be sitting on meaningful problems).

Stay tuned...

COMMENTS