Will Blackstone spark a real estate recovery?

Bad news: A real estate recovery depends on conditions that haven't been met.

Good news: Blackstone is positioned to inject capital, which could spark a quick climb out of a deep hole.

---- Prereq 1: Debt market rebound ----

Some positive signs:

-- Benchmark yields are down.

-- Agencies and insurance companies are relatively active.

-- Decent CMBS issuance.

-- Debt funds are quoting.

-- Credit losses remain low (for now).

-- Lots of money being raised for debt strategies.

On the other hand:

-- Banks (largest lender segment) continue to pull back.

-- Delinquencies are moving in the wrong direction.

-- Spreads remain elevated.

-- Virtually no debt available for certain asset classes (office).

Overall:

Better than a year ago but not out of the woods. Hard to see a strong rebound in debt production in the near term.

---- Prereq 2: Return of core buyers ----

Why is core capital so important?

Without core buyers, trades will be dominated by higher-cost investors, who can only generate targeted returns by buying at distressed pricing. Volumes will stay low because sellers don't want to sell to bottom fishers.

What has to happen for core capital to come back?

Exit queues need to abate. Investors must believe that current values reflect the effects of higher interest rates.

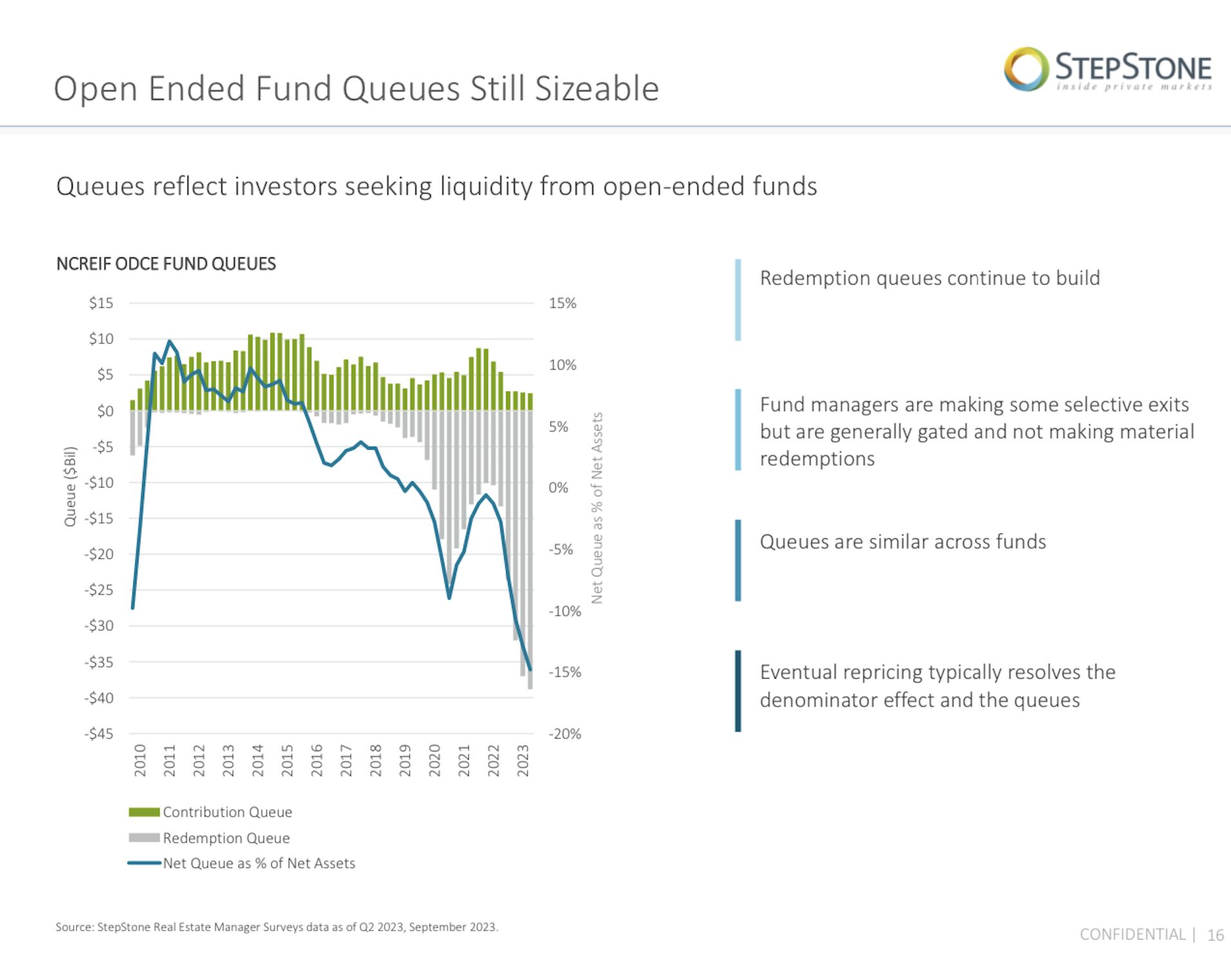

Although open-end funds were slow to price in the effects of higher interest rates, they've made progress lately. Still, redemption queues continued to build as of late 2023.

Until balance is restored (as measured by redemption queues), it's hard to see a strong rebound in transaction activity.

---- Silver lining: Big capital infusions ----

It's easy to think a rebound needs to be symmetrical. i.e., since it took a few years to get into this mess, it'll take a few years to get out of it. But we don't think this is the most likely path forward.

Blackstone's recently announced acquisition of Tricon suggests Blackstone may be back in the business of recapitalizing core and core-oriented operators with short-term challenges. We think BX's pro forma IRR was likely around 15%, which would generate 12% ish to investors. ...below their Funds' historical benchmarks, but core plus returns for a core investment don't sound bad.

Interesting quote from this StepStone presentation: "Queues are similar across funds." In other words, this isn't about a single fund. This problem is about a broad lack of confidence in values, fundamentals, and relative yields.

Another big infusion of capital could change the landscape.

COMMENTS