Blackstone to buy $4B strip center REIT. Quick takes...

Blackstone announced earlier today that it agreed to take a $3 billion strip center REIT Retail Opportunity Investments Corp (ROIC) private for $4 billion. ROIC primarily owns strip centers in the Western United States.

Quick takes...

1. "Retail apocalypse" is officially in institutional capital's rear-view mirror.

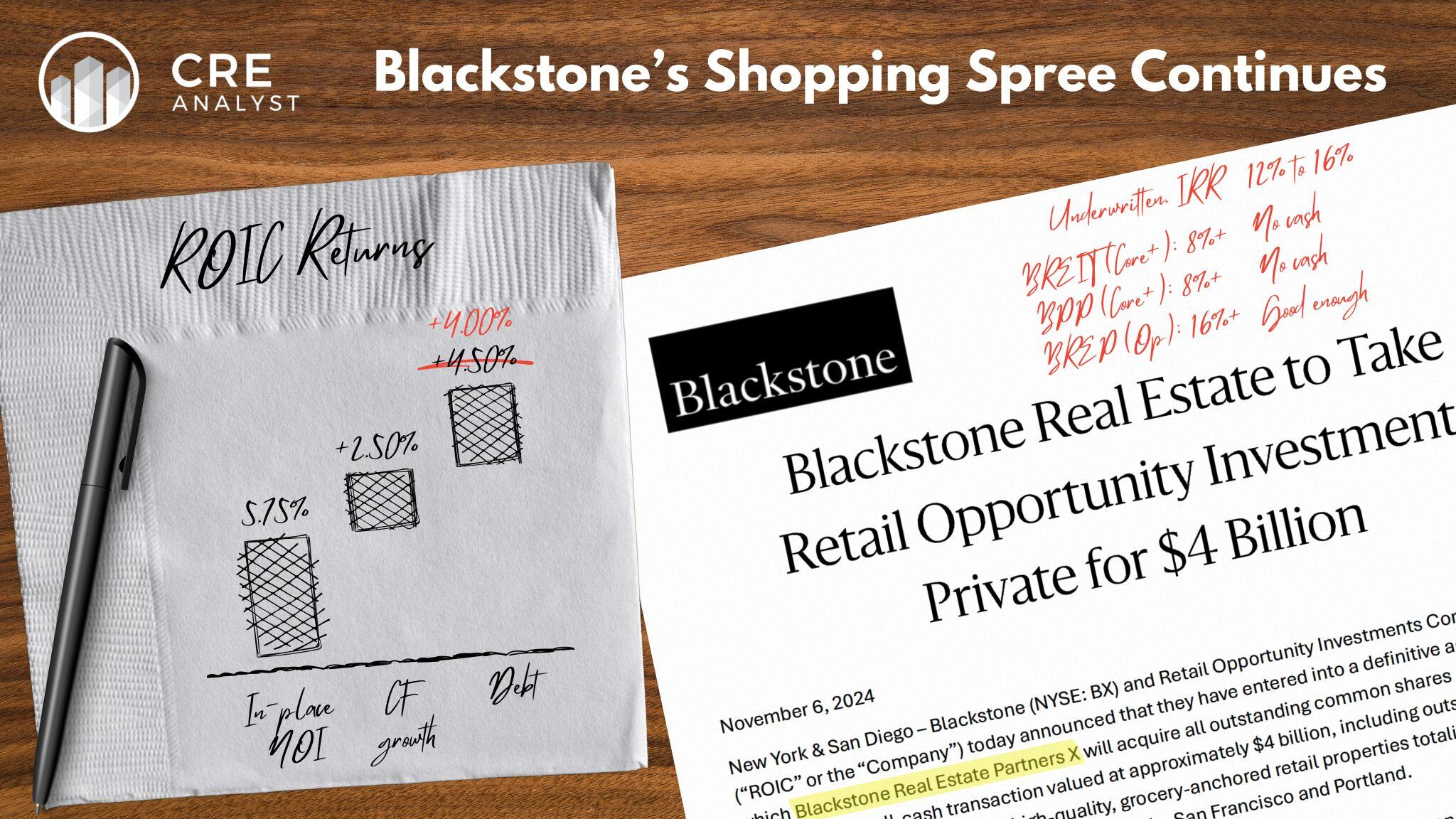

2. Blackstone is buying the REIT at about a 5.75% cap rate, which--with relatively optimistic CF growth--could generate a 9% UIRR. BX will almost certainly leverage up the portfolio, leading to a 12%+ underwritten LIRR.

3. The increase in Treasurys could make incremental debt more expensive (quick estimate: 50 bps lower LIRR vs. early Aug), but BX could offset with SASB floaters as with previous take privates (eg AIRC).

4. Is it surprising that ROIC is going to BREP X, Blackstone's opportunistic fund, which tends to target 16%+ returns?

5. If Blackstone is betting that retail cap rates are heading back to the mid-5s, this might not be the last strip center REIT privatization. Strip center REITs currently trade in the low 6s. InvenTrust ($2.3B), Kite Realty ($6B), and Site Centers (<$1B) all trade at or below NAV. More to come?

COMMENTS