Blackstone vs. Brookfield: A defining difference?

---- On the surface ----

Brookfield and Blackstone both reported earnings over the last week and, from 30,000 feet, they sound similar...

"Great quarter"

"Great year"

"Great fundraising"

"Dry powder"

Bloomberg's take:

"Brookfield was a voracious buyer of real estate in the last decade’s era of rock-bottom interest rates, snapping up companies such as GGP Inc., the second-largest US mall owner, and office developer Forest City Realty Trust."

"It was the No. 1 acquirer of retail properties, thanks largely to the GGP deal, and the fourth-biggest purchaser of offices globally in the last 10 years, according to MSCI Real Assets. Real estate research firm Green Street places Brookfield Property Partners as the second biggest office owner in the US, behind Hines."

"The company and Blackstone were the unequivocal winners of the shifting fortunes in private equity real estate after the 2008 financial crisis, with platforms from previous powerhouses like Goldman Sachs Group Inc. and Morgan Stanley struggling to raise new capital. By contrast, Blackstone and Brookfield continued to raise ever-bigger funds, widening the gap between themselves and the rest."

---- A very different strategic approach ----

But the firms' pitch decks ignore a very different subsurface strategy...

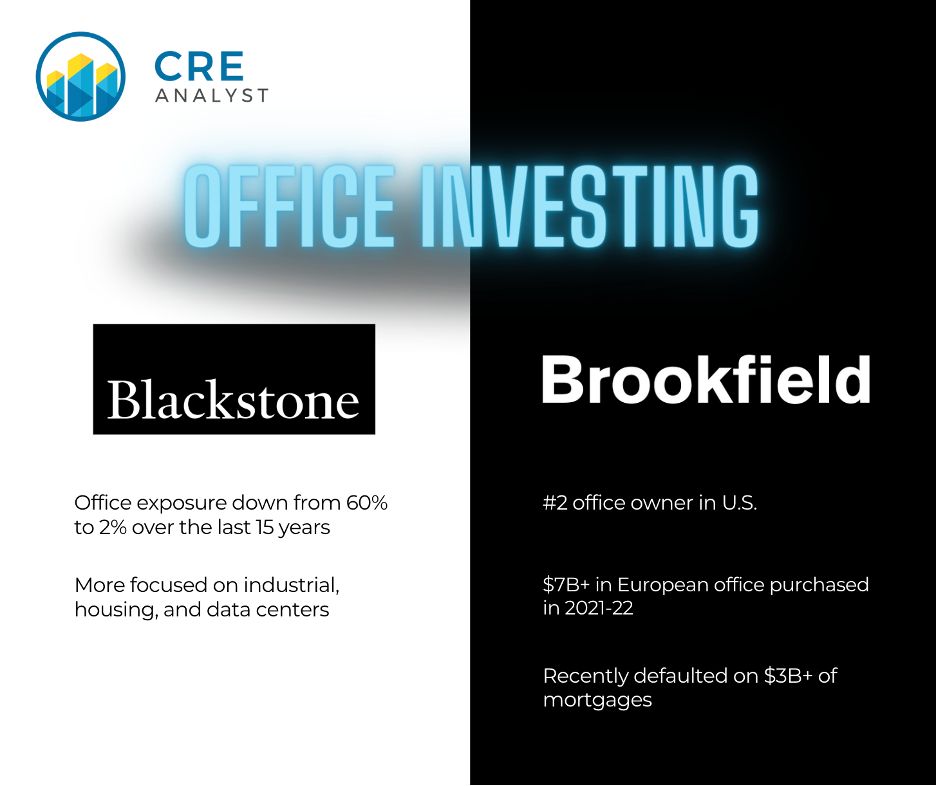

Blackstone has gotten almost entirely out of office, while Brookfield recently doubled down on office (much like it did with malls in recent years).

Here's what Brookfield had to say this morning in their investor letter about office...

"In early December, we sold our majority interest in 150 Champs Elysees, a landmark mixed-use asset in Paris, for a sales price of approximately $1 billion and an excellent return. Also in December, we disposed of an office asset in São Paulo, Brazil for a sale price of $300 million, representing a 17% IRR. These transactions highlight our belief that high quality office and retail in great locations continue to see significant demand and, while transaction volumes have been reduced, values remain strong."

In other words, "everything's fine."

---- Next steps ----

Over the last 10+ years, it was easy for these two investment management giants to generate outsized returns. The tailwinds of low-interest rates, plentiful debt, falling cap rates, and strong employment growth led to wins across the board.

But those tailwinds have turned to headwinds, and it's hard to see a future scenario where such incongruent strategies (big bets on office and retail vs. big bets on industrial and housing) could both win.

Which strategy do you believe will generate better returns?

COMMENTS