A winning playbook: Why hug the index when you can outperform, raise capital, and invest when your peers are sidelined? How TA Realty outperformed by 500 bps without chasing risk...

Core real estate funds usually play it safe. Pension fund investors restrict these managers to stabilized and low-leverage properties with very little operational complexity.

Size matters:

TA's core fund hovers just below $6B in NAV, which is significant. Why? Because at about 1% management fees, its hard to generate significant profit for the investment management platform below $5B. But above $5B, stable fees generate substantial profits due to lean management.

Sticky capital:

As long as core fund managers avoid allocation blow ups, their investors tend to hang around for long periods of time. Consequently, the bigger managers get, the safer they play the allocation game. Welcome to index hugging 101.

Adding value via allocation:

In this relatively low-risk, allocation-driven world, differentiation comes down to a handful of strategic bets. TA Realty nailed it over the last five years with this path...

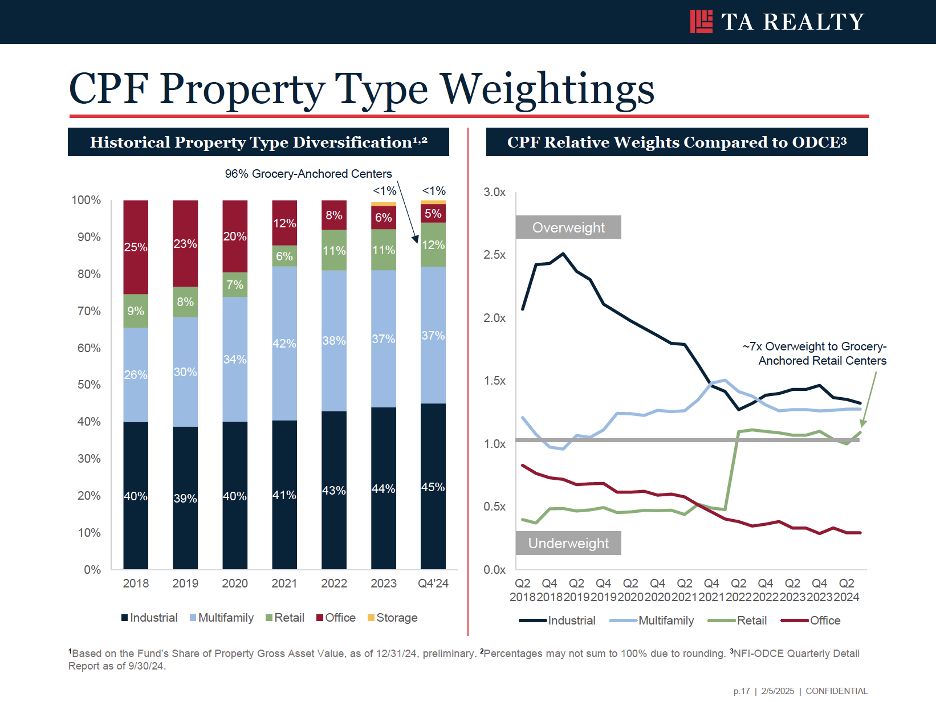

1. Big overweight: Industrial

2. Big underweight: Office

3. Big overweight: Grocery-anchored retail

4. Moderate overweight: Multifamily

5. Returns: 10.6% for TA investors vs. 5.6% for index (5Y)

That's 500 bps of outperformance amid one of ODCE’s toughest periods on record.

Why this matters:

TA Realty now stands out, actively investing capital while competitors grapple with exit queues.

The hard part:

Allocators rarely get consecutive cycles right. Many outperform, attract capital, then stumble during the next cycle.

TA’s challenge:

Can they sustain the advantage? Only one way to find out...

PS -- with the core fund index turning positive in late 2025, this is step two in the core capital recovery. Core funds have the cheapest cost of capital, and funds like TA (with capital to deploy) will likely lead the market, redefining pricing for the safest assets and establishing guideposts for the rest of the market.

COMMENTS