Mind the gap...

CBRE Investment Management in Jan 2020:

"A value-add investment strategy includes multiple drivers of returns, thereby seeking to reduce the risk of poor performance arising from any single source."

"Alpha is a key driver of return in value-add investing. A manager’s ability to increase NOI across a portfolio of properties can represent a material component of total return."

"NOI growth involves property-specific business plans and represents idiosyncratic risk-return in a portfolio context."

"Movement in cap rates (income divided by property value) can affect total returns. Contracting cap rates contribute to returns; expanding cap rates detract from returns."

"To be prudent, managers should underwrite stable cap rates or cap rate expansion, even in a continued low interest rate environment."

"We believe value-add investing can be a compelling strategy at this stage in the cycle given its continued ability to deliver both income and capital gains. Additionally, differences in regional growth dynamics have metros at different points in their cycle of supply-demand balance. This provides astute managers with an opportunity to exploit asynchronous growth cycles to identify mispriced assets."

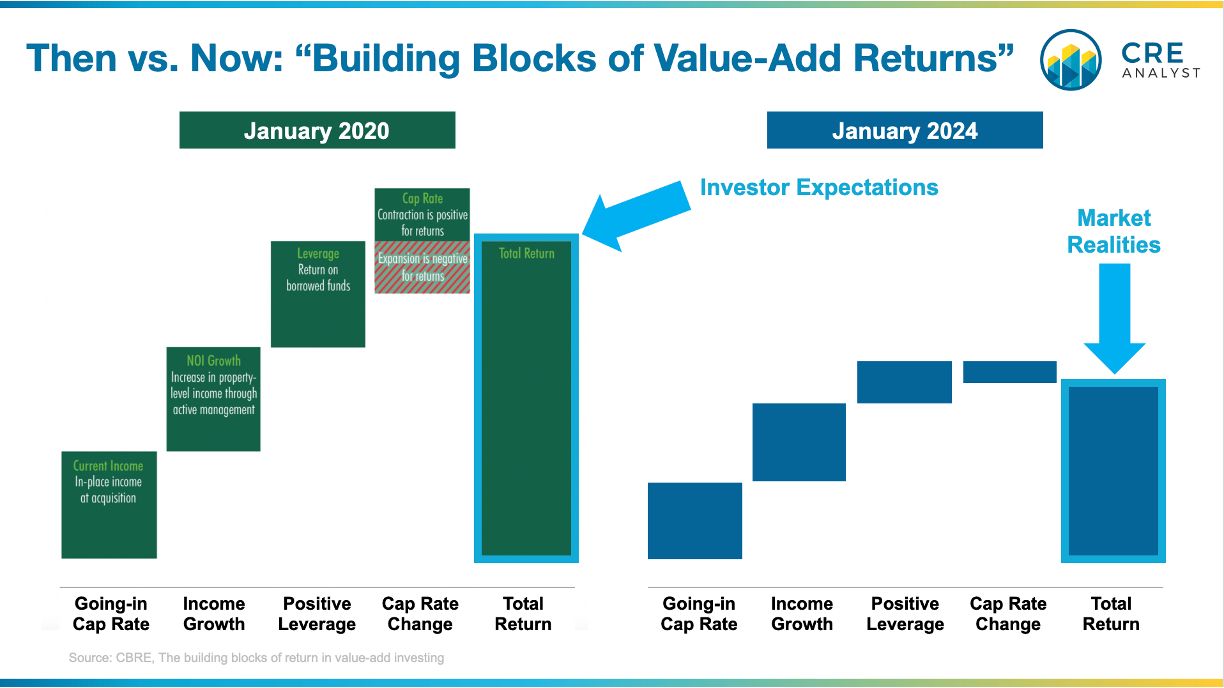

---- vs. Current Market Realities ----

1. In-place income is lower due to zero interest rates in 2020-22.

2. Income growth is lower due to slower fundamentals.

3. Leverage is slightly positive (at best) due to higher interest rates.

4. Cap rates are up as investors price in higher interest rates.

5. Therefore, total returns are significantly lower.

---- Mind the Gap ----

The only way to close the gap between yesterday's total returns and today's, in the short run, is for prices to decline. This downward pressure is what has stalled transaction activity.

But over the longer run, here's what can/will get the market back into equilibrium...

1. Falling prices could increase going-in yields (very likely)

2. NOI growth could pick up (maybe, maybe not)

3. Borrowing rates could decline improving the effects of leverage (very likely)

4. Cap rate expansion could be less than expected (likely)

COMMENTS