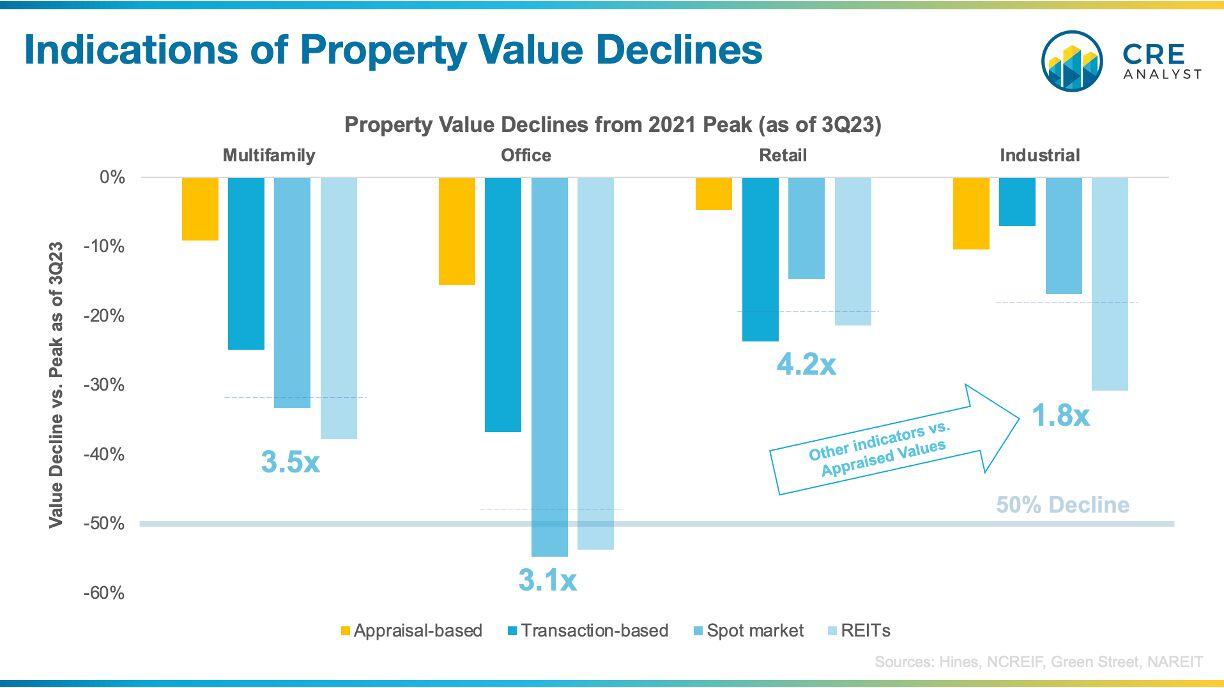

Pop quiz: How far have office values fallen since the peak?

A. 54%

B. 55%

C. 37%

D. 16%

Correct answer: Depends on whom you ask.

REIT investors say A.

Green Street's CPPI says B.

NCREIF transactions say C.

Institutional appraisers say D.

Appraised values (at least for core institutions) are significantly lower than other indications of value. Across all property types, values are down 2-4x more than appraised values.

What's the problem?

Since carrying values are materially higher than other indications of value, open-end vehicles like BREIT, JP Morgan's Strategic Property Fund, etc. have backlogs of investors heading for the exits. Even worse, this backlog continues to build (as of 3Q23).

Blackstone's Jon Gray recently called a bottom, but it will be interesting to see (as more info trickles out over the next month) if updated values and exit queues reflect a trough.

What's next?

We see two potential paths to recovery:

---- Path 1: Slow Degradation ----

-- Appraised values come down fast

-- Exit queues abate

-- Core vehicles reenter the market

-- Transaction activity rebounds

How long could this path take?

During the early 1990s, commercial property values fell for 4-5 years until debt markets and space demand recovered from the crash. Assuming we're two years into a similar path, we could be stuck with falling values and minimal transaction activity for another 2-3 years.

---- Path 2: Rescue Capital Steps In ----

-- Appraised values stay elevated

-- Exit queues continue to grow

-- Core buyers remain on the sidelines

-- Distressed trades define the market, pushing values down

-- Transaction activity remains stalled

-- Value-add/opportunistic capital comes into the core space

How long could this path take?

This would likely be a much quicker path. In the GFC, property values fell for about 18 months. We're about two years into this downturn, and extrapolating from how long it took capital to return post-GFC, we could be a year or two away from recovery. In this path, transaction activity likely wouldn't be as depressed, and well-capitalized funds/REITs would have 12+ months to recapitalize peers and/or acquire good properties at attractive pricing (as sellers dump their most liquid assets to fulfill redemption requests, pay off loans, etc.)

---- Disclaimer ----

This thought experiment is based on a series of guesses. Hopefully, they're somewhat educated guesses but guesses nonetheless. Take all of this with a big grain of salt, and understand that we don't offer legal or investment advice.

Instead, our goal is to pull together market observations from publicly available info (through the lens of the frameworks and fundamentals we cover in our classes) to facilitate engaging discussions among real estate professionals.

COMMENTS