A new world: 10 stats defining the U.S. housing market

---- Delayed ownership ----

1. First-time homebuyer age today: 38

2. First-time homebuyer age 40 years ago: 29

[Today's buyers spend 82% longer renting as adults after turning 18.]

---- Changing households ----

3. "Nuclear family" households (parents + kids): 30%

4. Households consisting of individuals living alone: 20%

---- Longer lives, more housing needs ----

5. Life expectancy for a 20-year-old today: about 80

6. Life expectancy for a 20-year-old 40 years ago: about 73

[That’s roughly 50% more years spent as an empty nester if downsizing occurs at age 60.]

---- Homes as a piggy bank: Then vs. now ----

7. Profit from buying a home 10 years ago: approximately $192K (4.8x original equity)

8. Projected profit if you buy today (and hold for the next 10 years): about $177K (1.7x original equity)

---- Affordability shifts ----

9. Typical downpayment 10 years ago: $33K

10. Typical downpayment today: $65K

The housing market isn't monolithic. It's complex and differentiated.

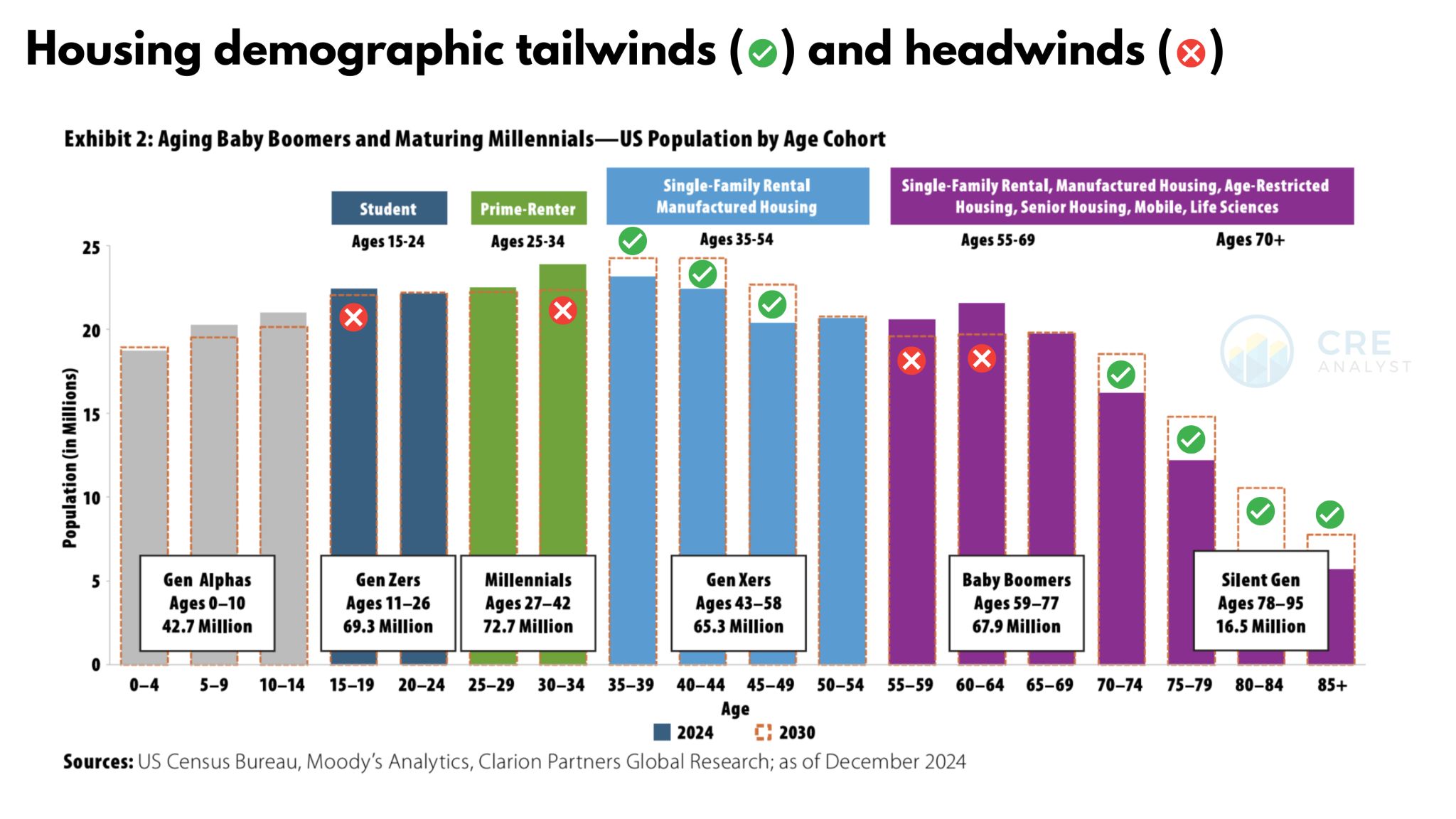

The most critical factor shaping the market today (and tomorrow) is demand.

[How many people will need, and be able to afford, specific housing types?]

That’s why Clarion's recent analysis in the PREA Quarterly is so meaningful.

Investors back new supply attempting to anticipate future demand. For example, look at projected demand for single-family rentals and senior housing versus today's levels.

Bottom line: Demographics aren't just statistics; they’re your roadmap to understanding tomorrow’s housing market.

COMMENTS