Finally, signs of a thaw? Core capital is starting to move again.

Pension fund IC meetings are usually uneventful, but something quietly significant happened in a Hartford conference room last week...

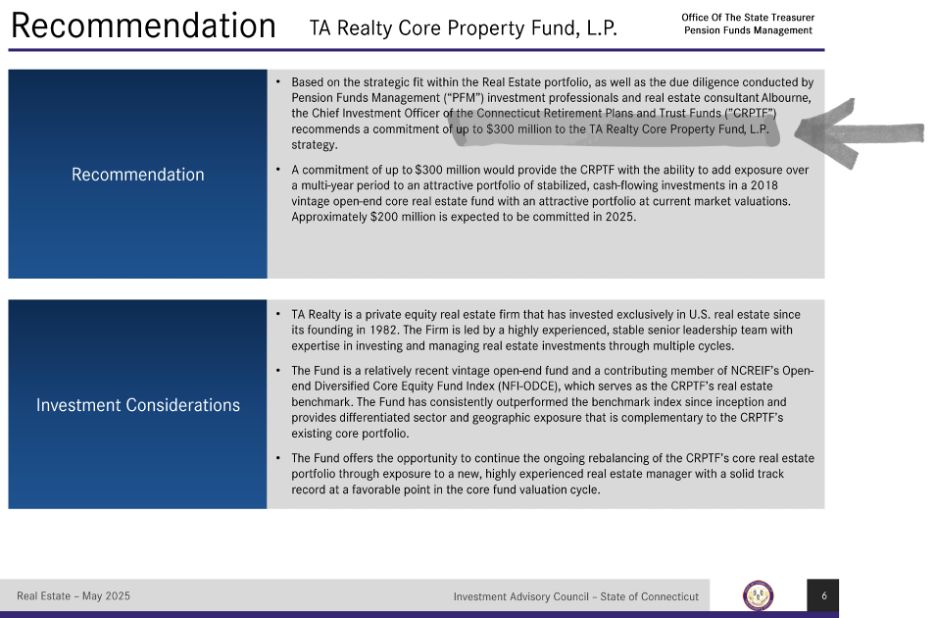

The State of Connecticut approved a consultant recommendation to invest up to $300 million into TA Realty’s core fund.

---- Why does this matter? ----

The absence of core capital has been a big driver of falling values.

Core funds in NCREIF's ODCE index, generally designed to produce income-oriented 7–8% returns, have underperformed both riskier strategies and safer credit plays in recent years.

Their backward-looking valuations (based on lagged appraisals) caused many investors to flee, creating long redemption queues and choking off liquidity and investment activity.

In short: the investors who typically set pricing for trophy assets sat out the last two years.

---- What does TA have that others don’t? ----

Per pension fund disclosures, TA’s core fund is heavily weighted toward industrial and multifamily in large southern metros. ...a winning strategy.

The fund has consistently delivered top-quartile performance.

While peers like JPMorgan had $6 billion in net redemptions as of mid-2024 (per Meketa), TA had an inbound queue—a rare bright spot in the space.

---- What should we take from this? ----

1. Early sign of re-entry.

As we noted late last year, more investors are getting comfortable with current valuation marks, a prerequisite for broader re-engagement.

2. Winners and losers are diverging.

Historically, performance dispersion across core funds has been narrow. But this cycle will likely be different. Poor allocation decisions and long queues cast long shadows.

3. Momentum will likely build slowly.

Income-oriented capital tends to move in years, not months. This is encouraging, but the bar is still high. Private credit remains a formidable competitor for new capital, and many funds continue to work through last cycle's challenges.

This isn’t a flood, but it might be the first meaningful trickle.

PS - If you're interested in more detail about TA's core fund, stay tuned. We'll post more details about it in a future post.

COMMENTS