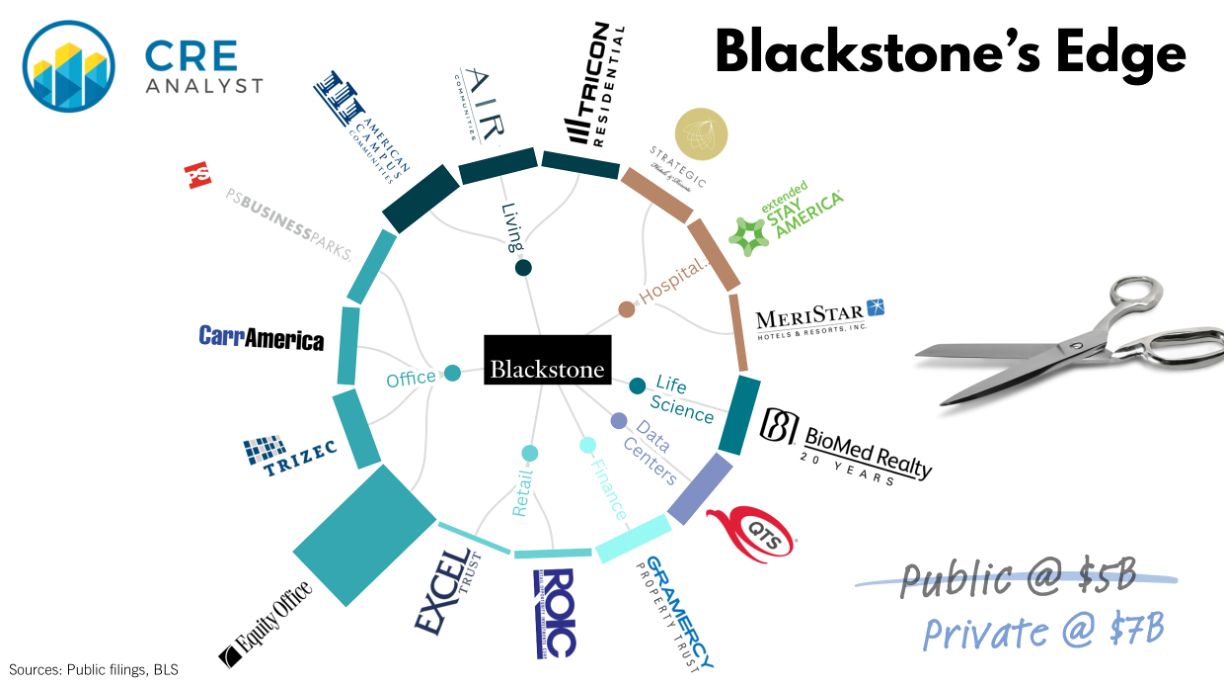

How did Blackstone become such a dominant force in real estate? By buying mispriced platforms hiding in plain sight.

No firm has done more to exploit the disconnect between public and private real estate markets than Blackstone:

– 15 REIT privatizations totaling nearly $180B

– More than 2x the next most prolific buyer (Brookfield)

– Most others haven’t managed more than one or two

But it’s not just the volume. It’s the variation.

Each deal required a different thesis.

A few quick examples:

---- EOP (2007) ----

Blackstone bought the largest office REIT at a 5% cap and 90% leverage. They quickly flipped 60 million square feet (about two-thirds of the portfolio) leaving them with 30 million square feet of prime office at a 7% cap rate and 60% leverage. The public price was high. The private bid was higher. The challenge was executing the flip. i.e., buying wholesale and selling retail.

---- ACC (2022) ----

COVID overhang and enrollment fears kept public market sentiment weak. Blackstone saw through it and secured the largest student housing operator with development capabilities. Now BREIT controls an irreplaceable platform.

---- QTS (2021) ----

More data has been created since this acquisition than in all prior human history. Blackstone didn’t just buy assets; they bought a platform built to scale and underwrote income growth more accurately than the market did, giving BREIT control of another irreplaceable platform.

---- Tricon (2024) ----

This wasn’t about current yield or near-term growth. It was about origination. Blackstone needed a machine to produce SFR cash flows for its growing base of insurance clients. Tricon now stands as one of the only SFR operators still acquiring because it has the lowest cost of capital.

Not every deal is perfect...

---- Biomed (2015) ----

Acquired through BREP VII, then later recapitalized into a long-dated core+ vehicle. Since then, its closest public comp (Alexandria) is down over 50%. In a private structure, valuation policies dictate marks instead of daily trades, which can shield a fund from volatility but creates real pressure in vehicles like BREIT, where redemption demand and valuation opacity collide.

---- Takeaways ----

Valuation isn’t just a model. It’s a worldview.

A key driver of Blackstone's ability to outperform and outgrow is locked in the firm's ability to find value, at scale, in public real estate markets.

What separates BX isn't access or information. Based on its track record, it's about conviction, valuation clarity, and an ability to price risk rather than avoid it.

EOP is the best example. BX didn’t just bet on a public discount; they underwrote the private premium and pre-wired the flips. That’s not sandbagging. That’s execution. Then, rather than "rinsing and repeating," BX came up with and evolved its playbook for finding value in other real estate platforms.

The trillion dollar question: What's next?

COMMENTS