Worried about your bonus disappearing? You're not alone. Here's the basic math that has every sponsor (including Blackstone) in a bad mood:

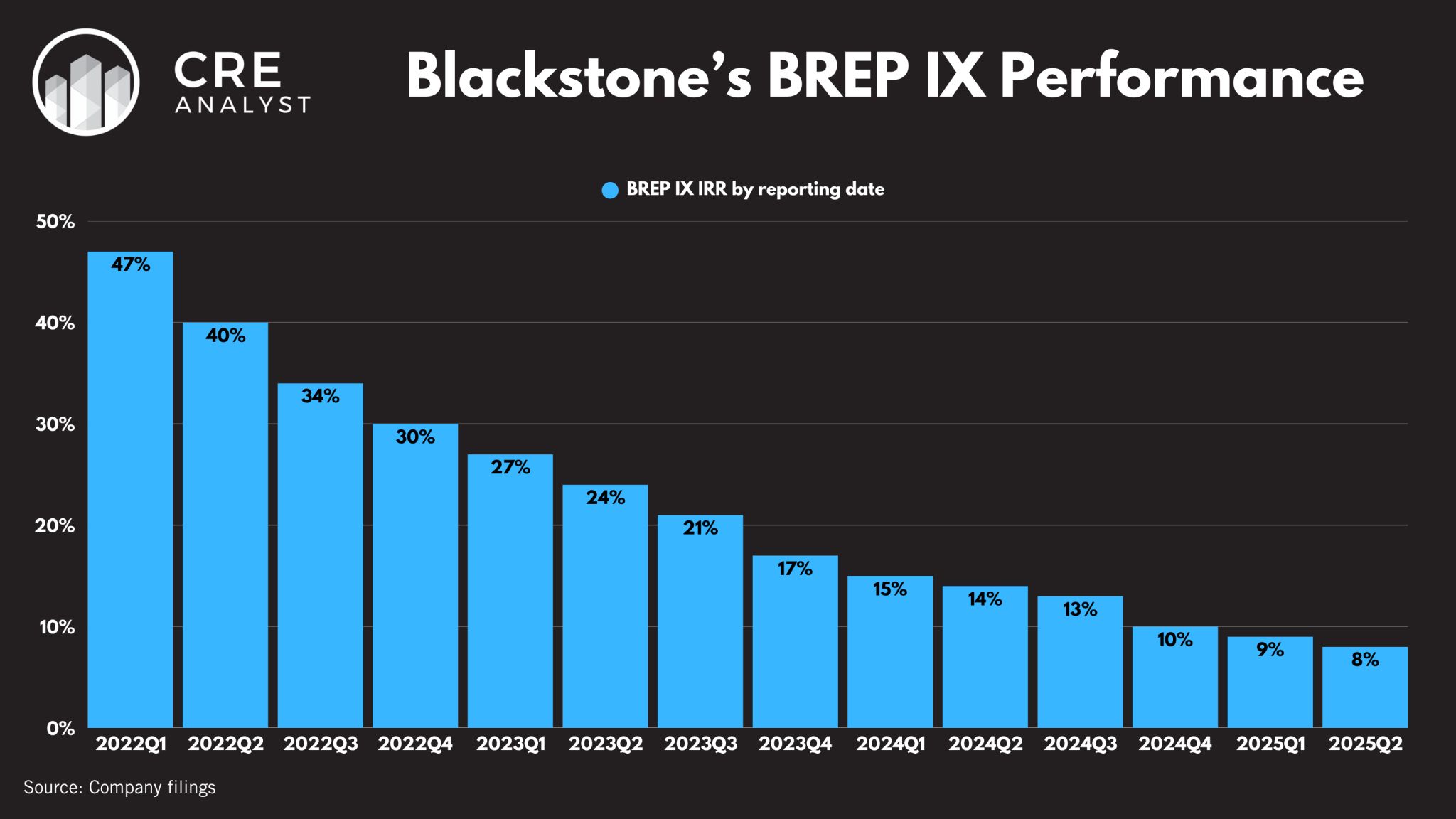

Blackstone just reported their flagship real estate fund dropped from 47% to 8% IRR. Well below the typical 9% promote threshold.

As our back-of-the-envelope math below shows, the difference between 47% to 8% is huge in dollars, but the difference between 15% to 8% (the fall over the last year) is even greater emotionally.

---- Best case scenario ----

BREP IX raised $21.3B of commitments in 2019, and the early reads on performance were incredibly positive, peaking at 47% IRR.

Had BX been able to keep up that pace, it would've generated life-changing profits for Blackstone and BREP's fund managers.

Fund IRR: 47%

Final proceeds: $311B

Less: $38B pref/equity

Net distributions: $273B

25% promote: $68B

Managers' share: $34B (~50%)

Quick explanation: A 47% return over 7 years would turn the $21B into $311B. Assuming a 9% hurdle (21*1.09^7), the team would have to return the original investment plus $17B of pref. So profit sharing would kick in after the fund generated more than $38B.

(Fund manager: "Holy sh*t honey, our team's profit share would be $34B if the fund ended today.")

Life-changing money, to say the least.

---- More realistic scenario ----

But, let's be real, there was no way anyone could have maintained the post-Covid frenzy for 7 years.

So what if BREP IX just performed like the average BREP fund?

Fund IRR: 15%

Final proceeds: $56B

Less: $38B pref/equity

Net distributions: $17B

GP carry (with catch-up): $4B

Managers' share: $2B

Still a life-changing amount of money for the fund managers, and a needle-mover for BX.

---- Today's reality ----

As BX reported earlier this morning, BREP IX's performance continues to fall, and the fund is on track to generate an 8% IRR.

Fund IRR: 8%

Final proceeds: $36B

Less: $38B pref/equity

Net distributions: $0

25% promote: $0

Managers' share: $0

Imagine you're on the BREP management team. In just three years, you've gone from calculating $34B to $4B to $0.

And that's in a seat within the largest platform, with the largest closed-end funds, and a very strong track record.

To be clear, the numbers above are educated guesses, but the weight is real.

Longer-than-expected hold periods.

Sinking returns.

Dwindling carried interest.

...these new realities are casting a long shadow over an industry that, not-so-long ago was defined by optimism and excitement.

How could we not be steaming toward a major industry shakeup?

PS -- If you're navigating this new reality and looking to level up, DM us about our upcoming FastTrack cohort.

COMMENTS