Brokers, debt, and short sellers...

Approaching a bottom?

You'd think large brokerages might be easy to pick on these days. Values are down, rents are down, activity is down, etc. Most are in cost-cutting mode.

But commercial real estate brokerage (selling/leasing/managing) is a pretty efficient business.

The 5-6 big CRE brokerages all have their lanes. They're generally really good at what they do, attract top talent, and bring in a steady flow of clients (even in challenging times).

Conditions are challenging, but it seems that the stock market may be saying there's a fair amount of downside already priced into brokers' stock prices.

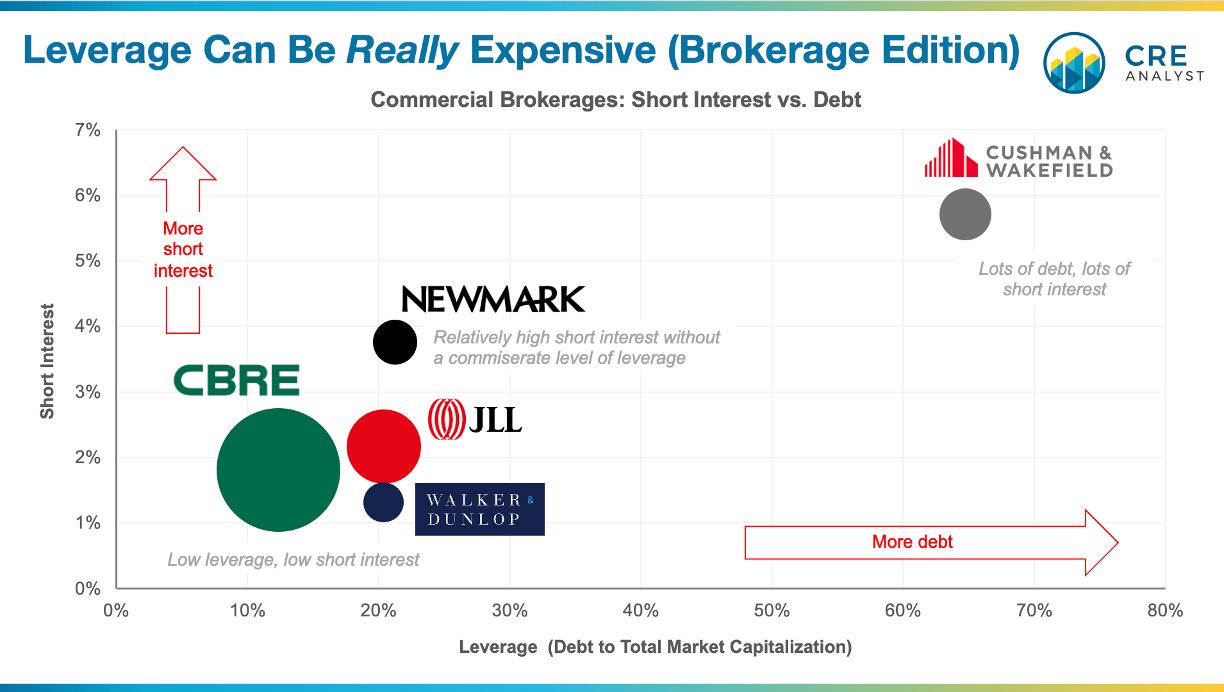

Only 1-2% of the shares of CBRE, JLL, and Walker & Dunlop are held short.

Key questions...

On the other hand, two brokers--Newmark and Cushman--are more shorted than their peers.

There's a lot of short-term noise in the brokerage business. Some good (e.g., Newmark's hyperactive loan sale business) and some bad (e.g., short-term depression in multifamily activity at Walker & Dunlop).

...but over time, wouldn't you expect brokerage value to run with a firm's ability to demonstrate strong income growth and relative edge vs. peers (from lower risk, a fortified business, and/or something else that generates a stronger multiple)?

If so, perhaps the most important questions brokerage executives need to answer with their long-term actions are:

1. What do you do with free cash (i.e., people/business acquisition)?

2. How much and how do you borrow?

These questions frame our pre-earnings thoughts...

A few questions to keep an eye on as the large brokers report 4Q23 earnings over the next two weeks...

GLOBAL:

-- Recovery expectations keep getting pushed back, which has meant more cost-cutting. Cutting to the bone? Worried about competitiveness?

-- Haves vs. have nots: CBRE and JLL seem to be pulling away from the pack. Will this sector mirror investment management, where a few firms dominate or will they feed off each other (re: talent)? Operational separation seems more difficult than balance sheet separation.

COMPANY-SPECIFIC:

CBRE:

-- Cash cow but missing a golden opportunity?

-- Doubling down on facilities management via J&J acquisition makes sense but needle moving? The $1B price could've bought a lot of brokerage talent or seeded significant fees in the principal businesses.

C&W:

-- How do you dig out from an outsized debt load?

-- Is it possible to cost-cut your way to success?

-- One year (ish) into new CEO: milestones vs. reality?

Newmark:

-- Big team acquisitions over the last few years. Betting the house on gaining market share in a recovery?

COMMENTS