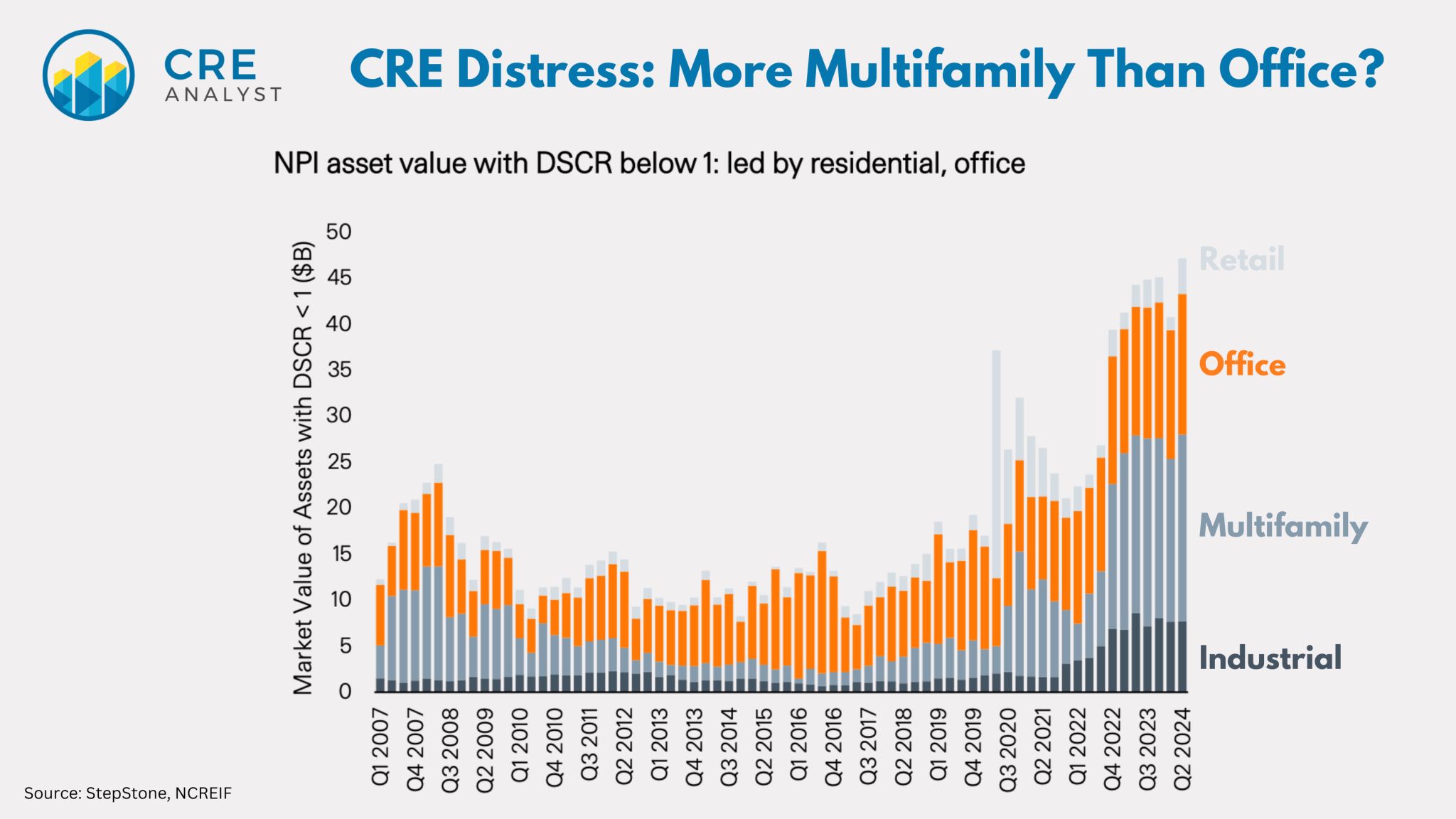

This distress indicator suggests: 1) more pain to come, 2) no one is immune, and 3) more multifamily problems than any other sector.

---- What triggers loan defaults? ----

Commercial mortgage defaults generally occur (i) when property values fall below the outstanding loan amount AND there's a loan maturity or (ii) when debt service exceeds property income.

In other words, challenging LTVs drive defaults at maturity, and challenging DSCRs drive defaults over loan terms.

Pundits who estimate distress often focus on LTV-based defaults because we have relatively good data on property values (at least property value estimates) and on loan maturities.

But maybe they're missing something by not focusing on DSCRs.

---- Institutional properties not covering debt service ----

The NCREIF Property Index is one of the most frequently tracked industry indicators because it reflects institutional properties and goes back 40+ years, providing a unique historical perspective.

On balance, these institutional properties are 90%+ leased and 42% leveraged. On the LTV side of the NPI, office leads distress (as measured by underwater loans), but on the DSCR side, multifamily leads the industry.

i.e., institutions have more multifamily properties that can't cover debt service than any other property type, including office.

StepStone recently highlighted: "Coverage ratios are also deteriorating. Multifamily represents the greatest share. Unlike post GFC era, declining rates are not likely to solve the problem..."

This brings up a few important questions:

1) If institutions with 40% LTV properties aren't covering, what does this say about more levered owners who borrowed at 60-75%?

2) How long are they willing to feed these properties before selling them or giving them back to lenders?

TLDR, don't sleep on the magnitude of multifamily challenges that could emerge.

COMMENTS