Crickets…

Portfolio manager: “Our lender wants a $100M paydown on a 60% LTV loan?!”

Asset manager: “They’re saying we’ll need to rebalance the loan if we want to exercise next month’s extension.”

Portfolio manager: “That’s not possible.”

Asset manager: “Then we’ll need to sell.”

Portfolio manager: “At what pricing?”

Asset manager: “20% below our carrying values.”

Portfolio manager: “But that will evaporate our promote.”

[crickets]

Shifting roles…

Who were the CRE villains of the last few years?

Open-end private funds like BREIT. Many of them continue to block investors from leaving. Institutional core and core plus funds are in a similar position. …on their heels until carrying values fall in line with spot market values.

Who were the heroes?

Closed-end funds and their dry powder, which many people expect will come off the sidelines, spurring transaction activity and renewed value growth.

A new reality emerging...

Properties in those open-end vehicles are generally in good shape. They're 90%+ leased and low levered. Values are down because interest rates spiked, but declines have stalled.

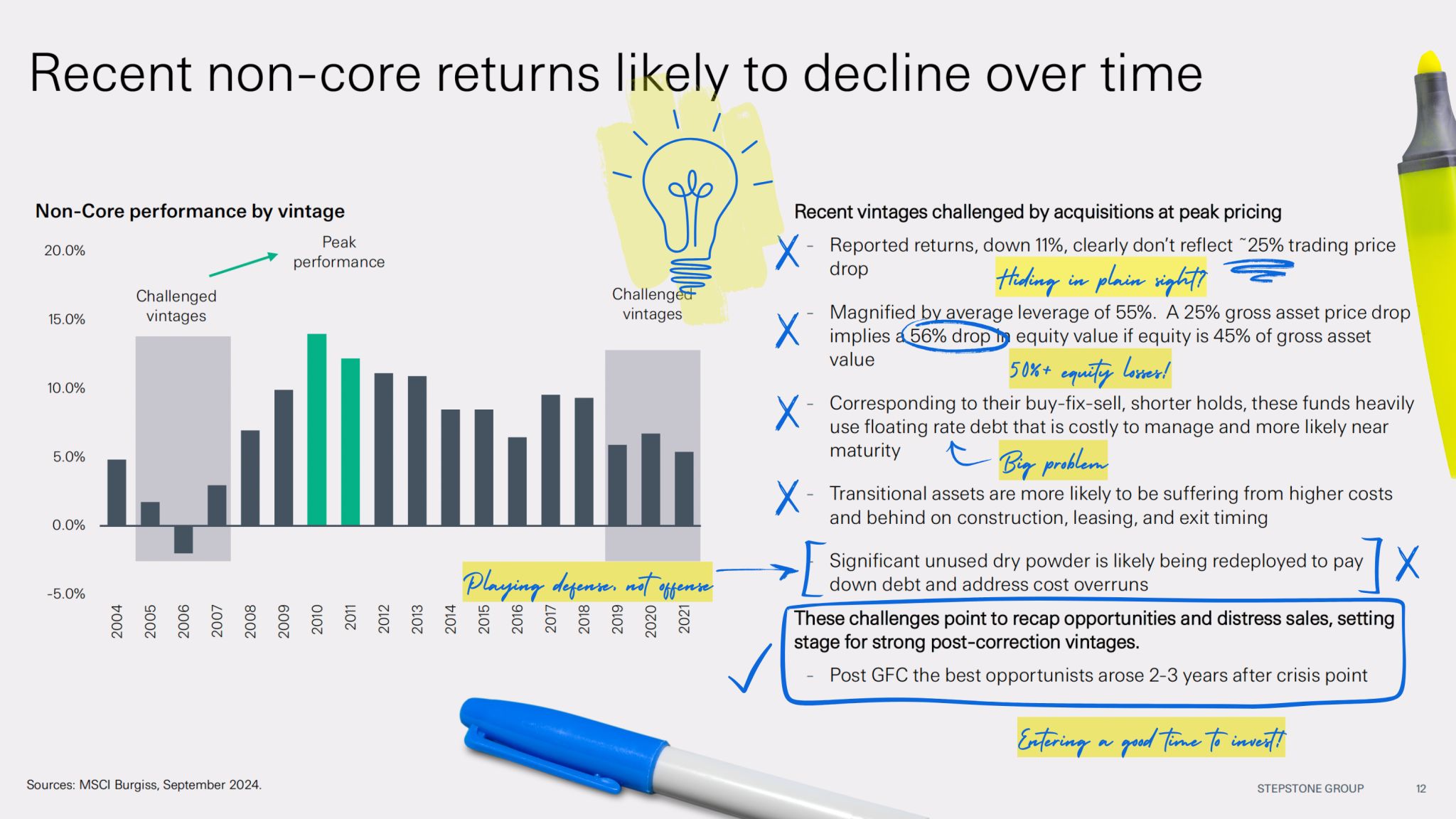

But rather than coming to save the day, closed-end funds may be shielding problems, and all of that dry powder could be needed for plugging holes instead of opportunistic investing.

There may be so many holes to plug--transitional properties, apartments purchased at 3% cap rates, and floating rate debt--that anyone with steady access to capital may soon face some of the best investment vintages in decades.

Kudos to StepStone Group for more insightful analysis.

COMMENTS