What's better than dry powder?

Cheap equity.

Cheap, plentiful, and consistent debt.

And sidelined competitors.

---- REITs rising ----

Pubicly-traded REITs haven't been big buyers since the GFC.

They couldn't compete with heavily levered private equity with 0% ish debt.

But the tables have turned.

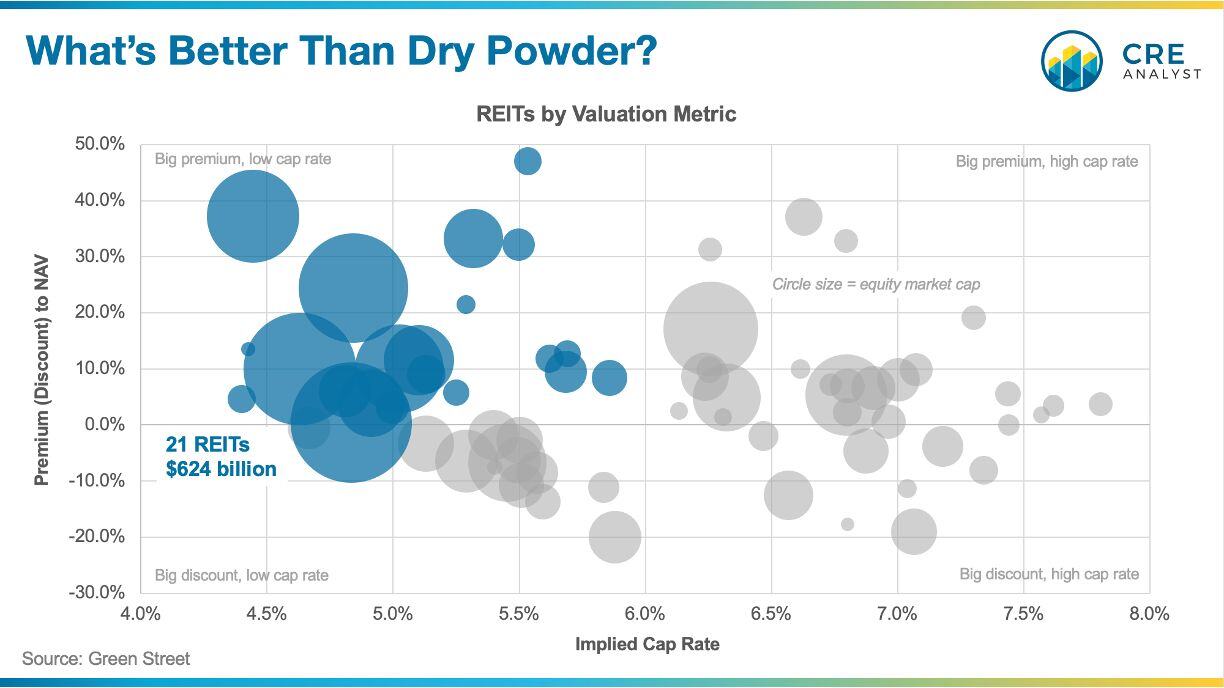

---- Not all REITs ----

NAREIT says there are about 225 publicly traded REITs.

Of these, there are 100 or so legit REITs listed on major exchanges.

And of these, 21 seem to be in a position to go on the acquisition offensive.

These 21 REITs represent about $625 billion of equity market capitalization.

Assuming they grow by 10% in the next few years and leverage their equity 1/1, that's about $125 billion of acquisitions, which is needle-moving in a $300-400 billion-a-year market.

Two big questions...

1. Which REITs will lead the charge?

2. Will transaction activity be driven by M&A or one-off?

COMMENTS