What makes landlords implode?

The CRE bankruptcy trifecta.

REIT bankruptcies are incredibly rare.

In 40+ years, only four equity REITs have filed Chapter 11:

-- General Growth Properties (2009 – ill-timed maturities)

-- CBL (2020 – B malls)

-- Pennsylvania REIT (2020 and 2023 – B malls)

-- Washington Prime (2021 – B malls)

Why don’t more REITs tip over?

-- Constant investor scrutiny on leverage and asset quality.

-- Unencumbered asset bases (secured debt is less common).

-- Unsecured bond markets often serve as lifelines.

What about office REITs?

Values are down sharply, leasing fundamentals are weak, and capital is cautious, but most public office REITs remain relatively stable.

No bankruptcies this cycle (yet).

...but distress is a long game.

Don't go to sleep on this corner of the market.

What to watch...

The REIT bankruptcy trifecta:

1. Inferior product

2. High leverage

3. Near-term maturities

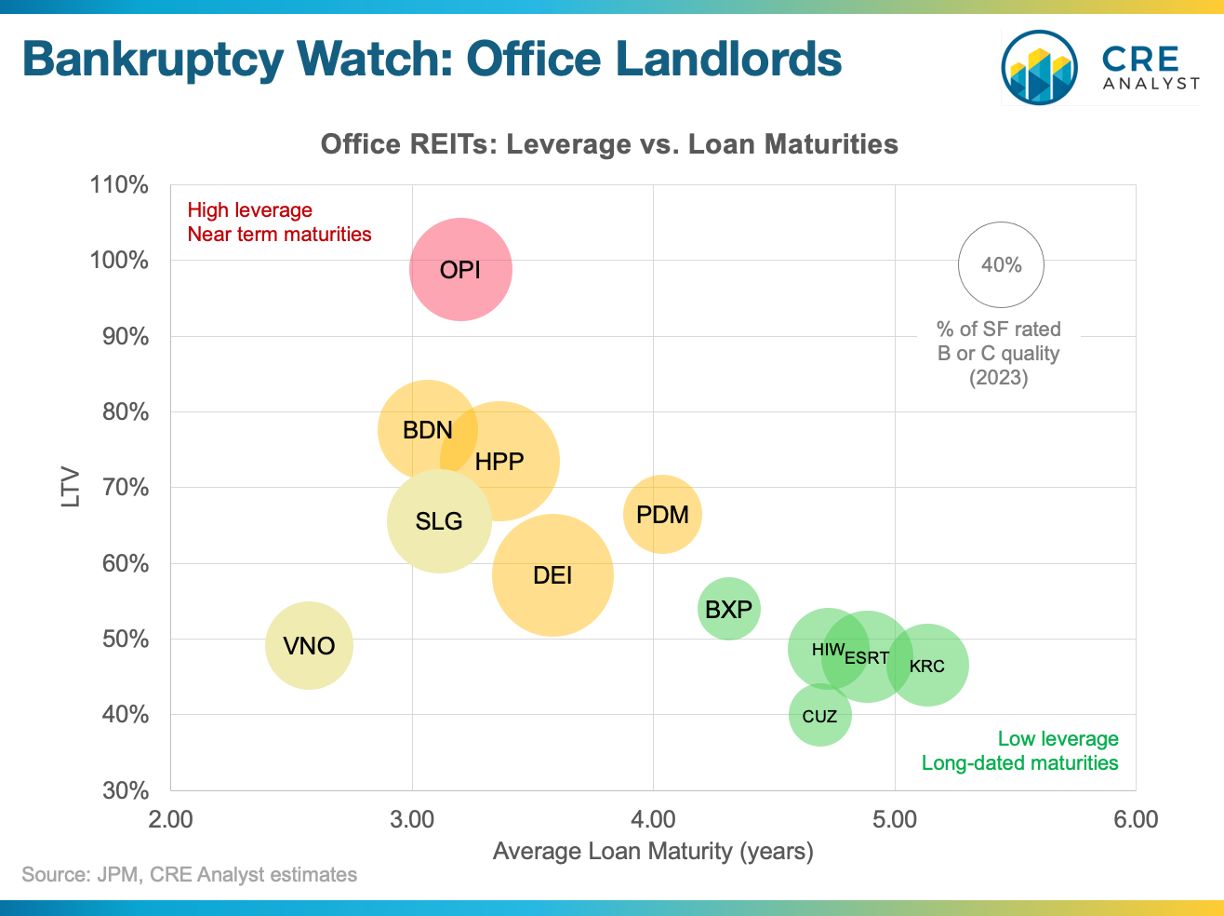

Which office REITs are most exposed?

The CRE bankruptcy trifecta.

REIT bankruptcies are incredibly rare.

In 40+ years, only four equity REITs have filed Chapter 11:

-- General Growth Properties (2009 – ill-timed maturities)

-- CBL (2020 – B malls)

-- Pennsylvania REIT (2020 and 2023 – B malls)

-- Washington Prime (2021 – B malls)

Why don’t more REITs tip over?

-- Constant investor scrutiny on leverage and asset quality.

-- Unencumbered asset bases (secured debt is less common).

-- Unsecured bond markets often serve as lifelines.

What about office REITs?

Values are down sharply, leasing fundamentals are weak, and capital is cautious, but most public office REITs remain relatively stable.

No bankruptcies this cycle (yet).

...but distress is a long game.

Don't go to sleep on this corner of the market.

What to watch...

The REIT bankruptcy trifecta:

1. Inferior product

2. High leverage

3. Near-term maturities

Which office REITs are most exposed?

COMMENTS